Information Background

XRP prolonged its rally on August 23 as institutional buying and selling volumes spiked above averages, reinforcing bullish sentiment after weeks of consolidation. The transfer coincided with dovish remarks from Fed Chair Jerome Powell at Jackson Gap, which strengthened expectations of September fee cuts and triggered rotation into threat property, together with cryptocurrencies.

Regulatory readability following Ripple’s litigation consequence continues to help institutional flows, whereas analysts now level to bold $5–$8 targets ought to XRP break decisively above near-term resistance.

Value Motion Abstract

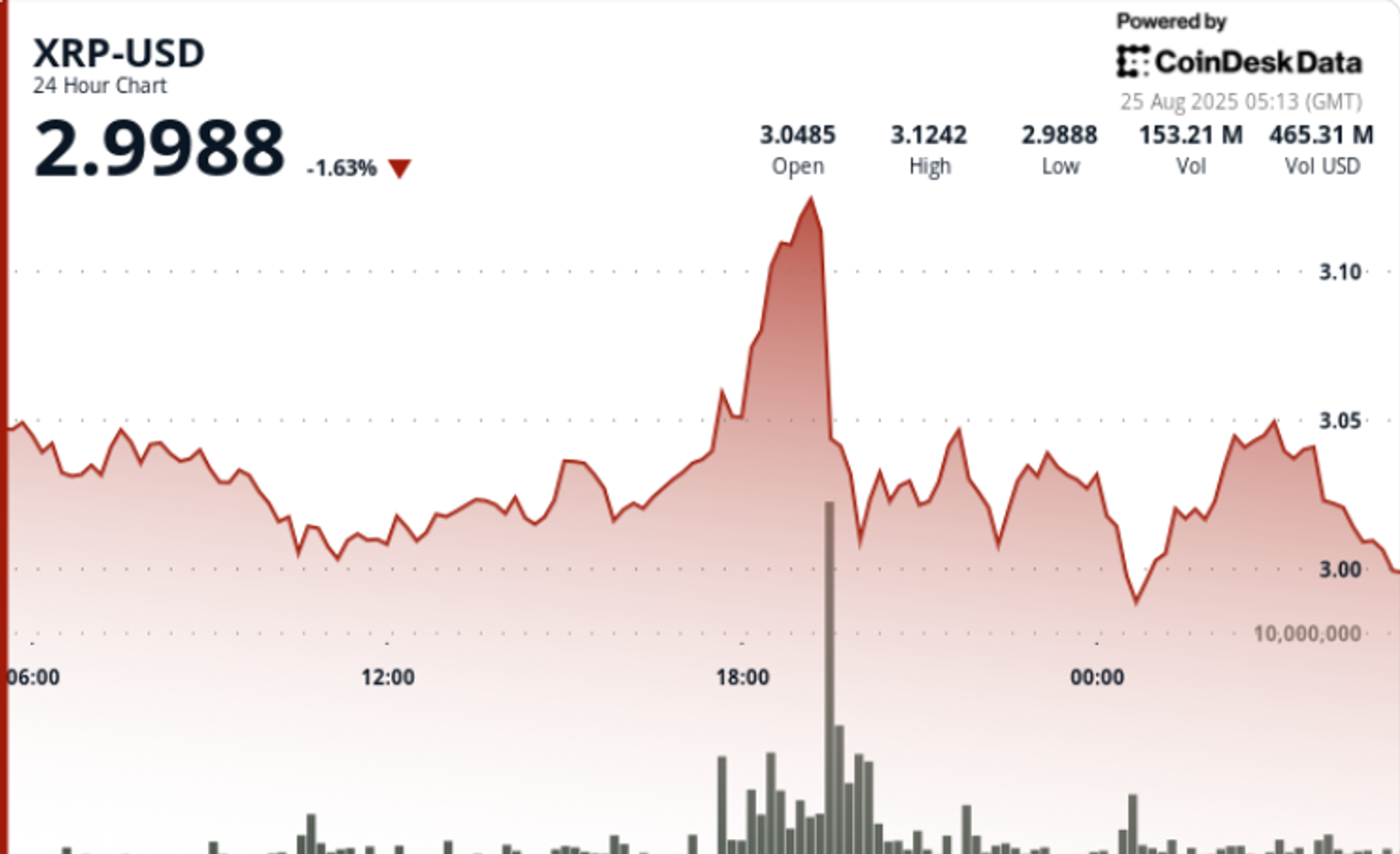

• XRP climbed 3% through the 24-hour interval from August 23 at 15:00 to August 24 at 14:00, rising from $3.02 to $3.09 earlier than consolidating again at $3.02.

• The token traded in a $0.09 band, peaking at $3.09 on elevated 58.8 million quantity—properly above the 24-hour common of 33.2 million.

• Assist fashioned close to $3.00 through the 11:00 candle on 46.6 million turnover, validating demand on the psychological degree.

• XRP ended the session close to $3.02, suggesting renewed momentum whereas consolidating beneath resistance.

Technical Evaluation

• Resistance stays agency at $3.08–$3.09, outlined by high-volume rejection through the midnight rally.

• Assist solidified round $3.00 after a number of bounces with above-average participation.

• Quantity spikes affirm institutional flows, with $27 million value of XRP reported transacted in a single minute by fiatleak.

• Chart buildings resemble double-bottom and symmetrical triangle patterns, which analysts recommend might prolong positive aspects towards $3.30 and, if breached, open a path to $5–$8.

What Merchants Are Watching

• Whether or not $3.00 holds as a sturdy flooring throughout profit-taking phases.

• A decisive breakout above $3.30 resistance because the set off for higher-range targets.

• Fed coverage trajectory forward of September—fee reduce affirmation would doubtless maintain flows into threat property.

• Whale pockets accumulation and on-chain settlement volumes, which spiked 500% to 844 million earlier within the week.

• Broader correlation with equities, as decrease yields proceed to push crossover inflows into digital property.