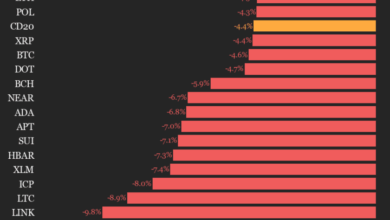

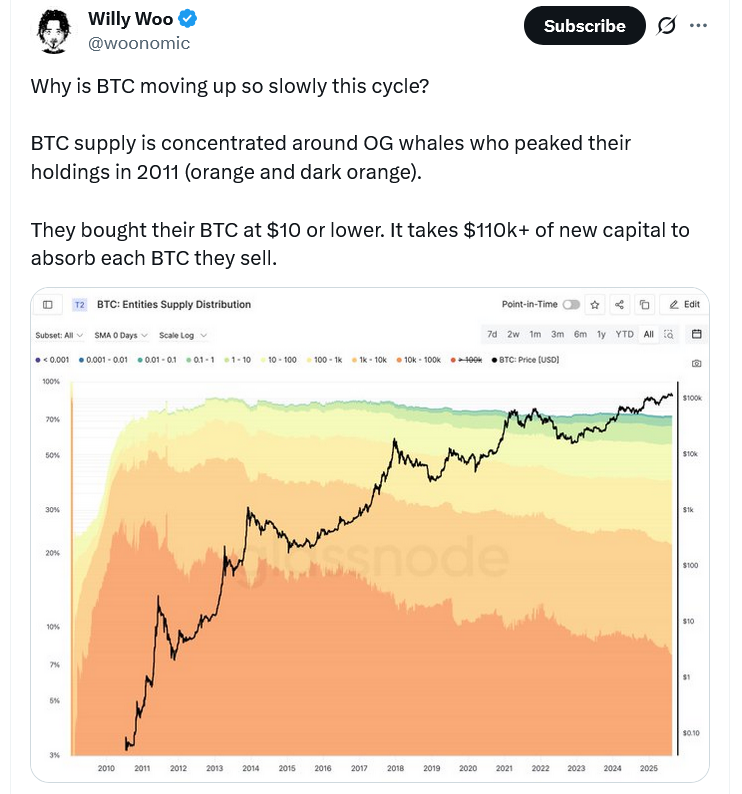

Bitcoin’s oldest whales might be responsible for Bitcoin’s gradual worth motion this cycle, in response to Bitcoiner Willy Woo, mentioning that it now takes greater than $110,000 of recent capital to soak up each Bitcoin they promote.

“BTC provide is concentrated round OG whales who peaked their holdings in 2011,” Woo stated in an X put up on Sunday. “They purchased their BTC at $10 or decrease.”

“This differential in price foundation, the availability they maintain and their charge of promoting has profound impacts on how a lot new capital that should are available to carry worth,” the OG Bitcoiner stated.

Whale blamed for Bitcoin flash crash to $112K

It comes because the crypto group pointed to an OG Bitcoin whale’s rotation out of BTC for ETH to elucidate Bitcoin’s $45 billion market cap plunge on Sunday.

The whale is known to have rotated over $2 billion value of Bitcoin into Ether during the last week, triggering a cascade of promote orders throughout the market.

The flash crash noticed Bitcoin (BTC) fall almost 2.2% from $114,666 at 7:31 pm UTC to $112,546 in 9 minutes earlier than bottoming out at $112,174 at 8:16 pm UTC, CoinGecko information reveals.

ETH additionally fell a pointy 4% from $4,937 to $4,738 over the identical time-frame. Each cryptocurrencies, nonetheless, recovered roughly half of the losses incurred from the flash crash.

Many on X have pointed to a crypto whale that started transferring Bitcoin to the decentralized crypto perpetuals platform Hyperliquid on Aug. 16, sending 24,000 BTC ($2.7 billion) throughout six transfers during the last 9 days, Blockchain.com information reveals.

Of that, 18,142 BTC value $2 billion has already been offered, with virtually all of it being rotated into 416,598 ETH, in response to crypto analyst MLM, who believes the whale is behind one other set of pockets addresses shifting Bitcoin to Hyperliquid for added ETH purchases.

A complete of 275,500 ETH, value round $1.3 billion, has been staked, suggesting the whale’s pivot to ETH could also be a part of a long-term technique.

Whale’s worthwhile buying and selling technique contributed to the crash

The whale additionally longed 135,263 ETH on Hyperliquid for a complete publicity of 551,861 ETH — value over $2.6 billion — strategically positioning the trades to frontrun different fast-moving market individuals and netting a $185 million revenue on the ETH/BTC commerce, MLM stated.

These lengthy ETH positions elevated in worth as merchants reacted positively to the whale’s earlier spot purchases.

Associated: Custodia Financial institution CEO warns of TradFi corporations going through first crypto winter

However because the whale began closing the longs, the market realized the whale’s buying and selling technique — prompting merchants to reverse their positions with a cascade of promote orders, MLM famous on Telegram.

“He successfully frontran the individuals who have been attempting to frontrun him.”

Extra Bitcoin might be offloaded

The founding father of TimechainIndex.com, often called Sani on X, additionally famous that the Bitcoin whale nonetheless holds 152,874 Bitcoin throughout a number of different pockets addresses.

The funds initially got here from crypto alternate HTX (previously Huobi) about six years in the past and had remained inactive till Aug. 16, Sani added.

One other whale transformed BTC into ETH final week

In the meantime, one other Bitcoin whale offered $670 Bitcoin value $76 million to open an extended place in ETH final Thursday — reflecting the rising pattern of crypto whales promoting BTC for ETH.

ETH is up 220% since bottoming out at $1,471 on April 9, making up misplaced floor on the likes of Bitcoin and Solana (SOL), which led the early phases of the present bull cycle.

Journal: Bitcoin’s long-term safety funds drawback: Impending disaster or FUD?