Good Morning, Asia. This is what’s making information within the markets:

Welcome to Asia Morning Briefing, a day by day abstract of prime tales throughout U.S. hours and an summary of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

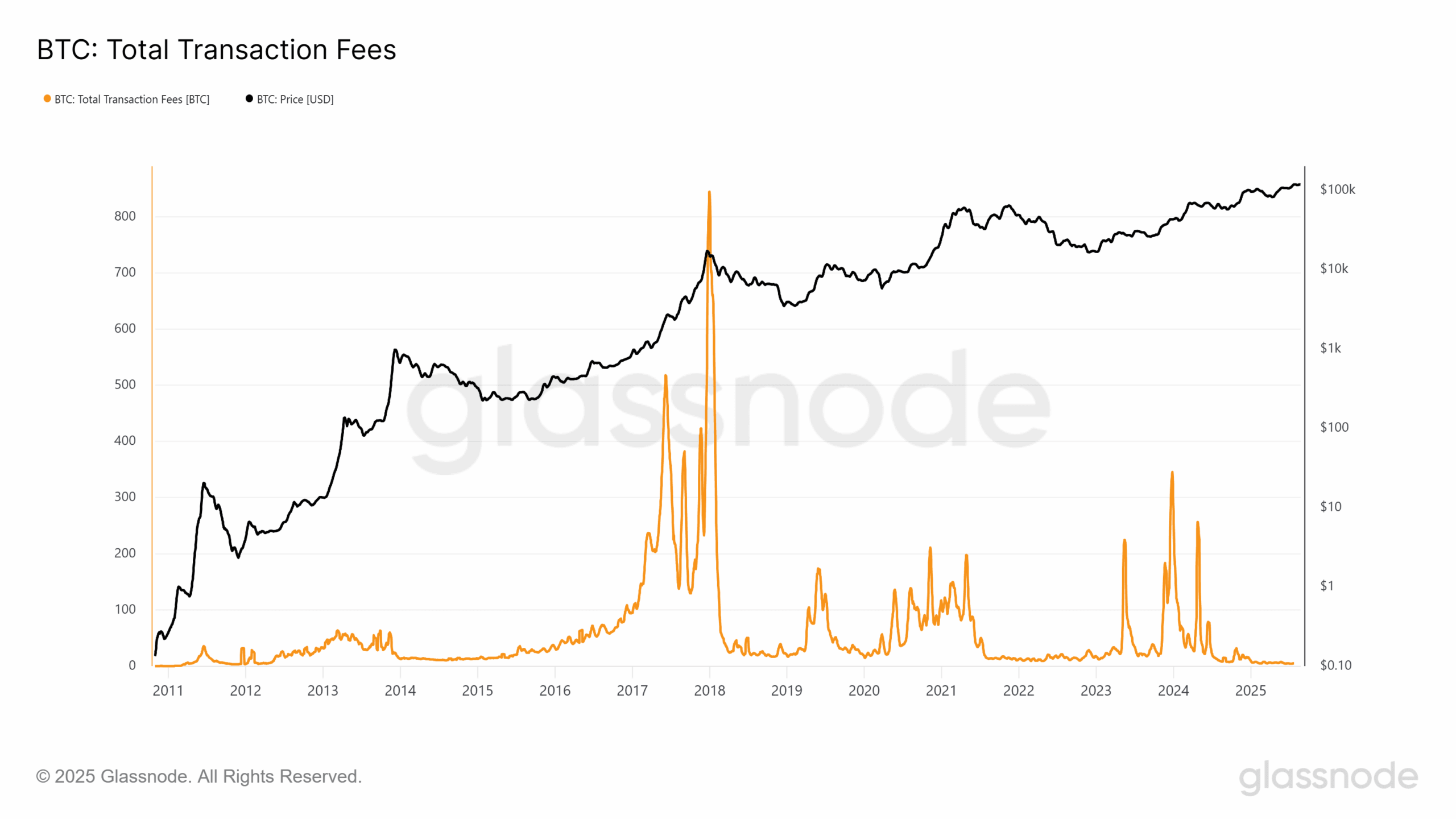

Bitcoin’s value is holding close to information, however the chain itself is quiet. Glassnode knowledge exhibits transaction charges have collapsed again towards decade lows, at the same time as BTC flirts with six figures.

In previous cycles, payment spikes tracked bull markets as merchants bid for blockspace. This yr, the payment curve is flat whereas value rises, a transparent signal that onchain demand is not driving the market.

A brand new report from Galaxy Analysis exhibits median day by day charges have fallen greater than 80% since April 2024, with as a lot as 15% of day by day blocks now clearing at simply 1 satoshi per vbyte. Almost half of current blocks aren’t full, signaling weak demand for blockspace and a dormant mempool.

This can be a sharp distinction to prior bull cycles, the place value rallies translated into congestion and payment spikes.

The info confirms a structural shift: spot ETFs and custodians now maintain greater than 1.3 million BTC, and cash parked in these wrappers not often contact the chain once more.

On the similar time, retail exercise that after clogged the Bitcoin blockchain has migrated to Solana, the place memecoins and NFTs profit from cheaper and quicker execution. The consequence, Galaxy notes, is that the bitcoin value is being set by custodial inflows whereas the community’s onchain demand – as soon as a proxy for value motion – has slowed down.

For miners, this dynamic is especially punishing. With rewards halved to three.125 BTC and charges contributing lower than 1% of block income in July, profitability is beneath pressure. That stress is pushing listed miners to diversify into AI and HPC internet hosting.

Learn extra: Bitcoin Mining Faces ‘Extremely Tough’ Market as Energy Turns into the Actual Foreign money

A report from earlier this yr by Rittenhouse Analysis argues that Galaxy Digital’s transfer out of mining altogether may very well be the mannequin for the sector.

This transfer has been applauded by the fairness markets. Whereas BTC is down greater than 3% on-year, the CoinShares Bitcoin Mining ETF has gained almost 22%. Traders are rewarding corporations which have leaned into diversification quite than counting on block rewards alone.

Listed miners inform the same story. Hive, Core Scientific, and TeraWulf all reported Q2 outcomes padded by HPC and AI internet hosting revenues.

These with no diversification, like Bitdeer and BitFuFu, stay deeply uncovered to electrical energy prices, tools depreciation, and a payment market that Galaxy warns in its report is “something however sturdy.”

The juxtaposition is telling: Galaxy’s personal analysis warns that the Bitcoin blockchain’s settlement function is stagnating, whereas Galaxy’s stability sheet is being repositioned for progress in AI knowledge facilities.

Onchain knowledge makes the purpose: with out natural demand for blockspace, charges can’t fund safety. And if charges keep low, fairness markets are portray a transparent image that mining sector’s greatest future returns might come from AI, not Bitcoin.

Market Actions

BTC: Bitcoin traded at $113,286.95, down 1.79%, after briefly plunging to a six-week low close to $110,600, with the broader crypto market dealing with heavy liquidations and volatility.

ETH: Ether traded flat at $4,779 as Jerome Powell’s dovish Jackson Gap remarks boosted expectations of a September price minimize, with asset managers predicting new highs for bitcoin and an ETH breakout above $5,000 regardless of dangers from treasury adoption and fairness volatility.

Gold: Gold closed at $3,371 after Powell’s dovish Jackson Gap remarks boosted September rate-cut odds.

Nikkei 225: Asia-Pacific shares climbed Monday, with Japan’s Nikkei 225 up 1.08%, after Powell signaled potential Fed price cuts in September throughout his Jackson Gap speech.

Elsewhere in Crypto

- The Funding: Why elevating a crypto VC fund is tougher now — even in a bull market (The Block)

- Why Luca Netz Will Be ‘Disillusioned’ If Pudgy Penguins Does not IPO Inside 2 Years (Decrypt)

- KPMG Says Investor Curiosity in Digital Belongings Will Drive Sturdy Second Half for Canadian Fintechs (CoinDesk)