Fed Chair Jerome Powell’s speech on Friday at this 12 months’s Jackson Gap Financial Coverage Symposium balanced rising inflation threat towards a fragile labor market, and the political calendar now raises the percentages that his eventual successor will probably be much less cautious on charges.

Powell’s message was intentionally sober.

He stated the “results of tariffs on client costs at the moment are clearly seen” and can preserve filtering by with unsure timing. Headline PCE inflation ran 2.6% in July and core 2.9%, with items costs flipping from final 12 months’s declines to positive aspects.

He framed the labor market as a “curious form of steadiness,” with payroll progress slowing to about 35,000 a month in latest months from 168,000 in 2024 whereas unemployment sits at 4.2%.

Immigration has cooled, labor pressure progress has softened and the breakeven tempo of hiring wanted to maintain joblessness regular is decrease, which masks fragility. Web-net, he stated near-term dangers are “tilted to the upside” for inflation and “to the draw back” for employment, a mixture that argues for care slightly than a speedy easing cycle.

He additionally reset the framework.

The Fed dropped 2020’s “common inflation concentrating on,” returned to versatile 2% concentrating on and clarified that employment can run above estimated most ranges with out robotically forcing hikes, however not on the expense of worth stability.

He underscored, “We won’t permit a one-time improve within the worth stage to turn out to be an ongoing inflation downside.” Coverage is “not on a preset course,” and whereas September is dwell, the bar for a quick sequence of cuts appears excessive until the information weakens extra.

That macro stance lands inside a brand new political backdrop that markets can’t ignore. Powell’s present time period ends Might 15, 2026, and he has stated he intends to serve it out. Donald Trump has attacked Powell and requires decrease charges, however authorized protections imply a president can’t take away a Fed governor or chair over coverage disagreements.

Trump can announce his most well-liked substitute for Powell nicely earlier than 2026, giving markets time to cost in a chair who’s prone to be extra dovish and tolerant of progress threat than Powell. That looming shift issues for the way the trail of charges evolves into 2026, even when the following few FOMC conferences stay knowledge dependent.

Political rigidity surfaced once more on Friday when Trump publicly threatened to fireside Fed Governor Lisa Cook dinner over alleged mortgage fraud if she didn’t resign. Like Powell, governors have sturdy protections and may solely be eliminated for trigger. Markets learn this much less as a direct governance risk and extra as an indication that personnel stress on the Fed might develop, growing uncertainty round future management and communication.

What this implies for U.S. Treasurys

The speech factors to a slower, shallower easing path within the fourth quarter of 2025 until inflation retreats convincingly. Tariff pass-through retains items costs sticky whereas providers ease solely progressively, which argues for front-end yields staying agency and the curve steepening provided that progress knowledge weakens.

A future, much less cautious chair might compress time period premiums later by signaling a faster path to impartial, however between from time to time price volatility stays excessive and rallies are data-led slightly than policy-led.

What this implies for U.S. equities

A cautious Fed helps the soft-landing narrative however not a fast a number of growth. Earnings progress can carry benchmarks, but rate-sensitive progress shares stay weak to upside surprises in inflation or wages that push cuts additional out.

If markets start to cost a chair who’s extra keen to ease right into a heat inflation backdrop, cyclicals and small caps might catch a bid, however credibility threat rises if inflation expectations drift. For now, equities commerce the gaps between every inflation print, payrolls replace and Fed communication.

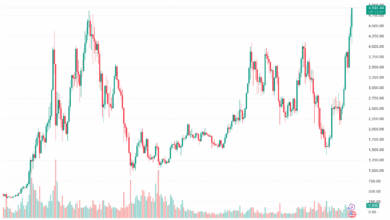

What this implies for crypto

Crypto lives on the intersection of liquidity and the inflation story. A better-for-longer stance curbs speculative flows into altcoins and crypto-related equities like miners, exchanges and treasury-heavy companies as a result of funding prices keep elevated and threat budgets tight.

On the similar time, sustained inflation above goal retains the hard-asset narrative alive and helps demand for property with shortage or settlement finality. That mixture favors bitcoin and large-cap, cash-flow-supported tokens over long-duration, storytelling-heavy tasks till the Fed alerts extra conviction on cuts.

If a successor chair in 2026 is perceived as much less cautious, the liquidity cycle might flip extra decisively in crypto’s favor, however the worth to get there may be extra volatility as merchants handicap management, Senate affirmation and the information.

Why the trail issues greater than the primary reduce

Even when the Fed trims charges in September, because it now appears extremely seemingly, Powell’s framing implies a glidepath paced by inflation expectations, not market hope. Housing transmission is muted by mortgage lock-in, so small cuts could not unlock progress rapidly.

International easing elsewhere provides a marginal liquidity tailwind, but the greenback’s path and time period premiums will hinge on whether or not U.S. inflation behaves like a one-time tariff shock or a stickier course of. Within the former case, crypto breadth can enhance and threat can rotate past bellwethers; within the latter, management stays slender and rallies fade on sizzling knowledge.

The 2026 wildcard

Markets now should worth a two-stage regime: Powell’s cautious data-driven stance by 2025, then the potential for a chair chosen by Trump who’s much less affected person with above-target inflation if progress weakens, or extra keen to just accept inflation threat to assist exercise. Appointment constraints and Senate affirmation are actual, so a wholesale pivot is just not computerized, however the distribution of outcomes broadens.

For Treasurys that may imply fatter time period premiums till management is understood; for equities it could imply rotation and issue churn; for crypto it could imply a stronger medium-term liquidity story paired with choppier near-term buying and selling.

Backside line

Powell requested for time and knowledge as tariffs elevate costs and the roles engine downshifts. Markets now should commerce that warning by the fourth quarter of 2025 whereas additionally discounting the practical likelihood of a much less cautious Fed chair in 2026.

That two-step makes the following 12 months a check of endurance in Treasurys, a grind in shares and a volatility commerce in crypto — with the payoff decided by whether or not inflation proves transitory sufficient for this Fed to chop, or persistent sufficient that the following one chooses to.