Institutional traders from the standard finance world lack the up to date danger tolerance fashions to cope with crypto and should face bother throughout the subsequent bear market, in accordance with Custodia Financial institution CEO Caitlin Lengthy.

“Large Finance is right here in a giant approach, and that appears to be driving this cycle. I think it’ll proceed to drive this cycle,” Lengthy informed CNBC on the Wyoming Blockchain Symposium on Friday.

Lengthy mentioned that legacy monetary establishments are snug taking over giant quantities of leverage as a result of fail-safes constructed into the system, like low cost home windows and different “fault tolerances.”

Nonetheless, she warned that these benefits disappear in crypto, the place settlement happens in real-time. The CEO mentioned that the mismatch between crypto and legacy programs may create a liquidity crunch for these establishments:

“These sorts of fault tolerances are constructed into the system due to legacy causes, the place programs weren’t updating in real-time. In crypto, all the pieces needs to be real-time, and it is only a totally different animal.

I do fear how these titans of finance will react when the bear market inevitably comes once more. I do know some who’re optimistic and assume it will not come once more. I have been round since 2012, so I do know it is coming once more,” she added.

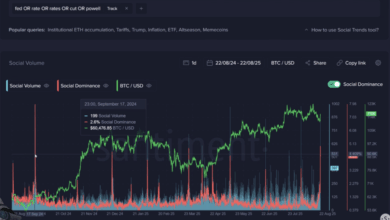

Institutional traders, together with crypto treasury firms, have been essentially the most outstanding characteristic of the present market cycle.

Some traders view this as a optimistic growth driving adoption ahead, whereas others warn that overleveraged and inexperienced corporations will dump crypto throughout the subsequent crypto bear market, triggering a contagion that spreads via the monetary system.

Associated: New crypto advocacy group debuts at Wyoming summit

Custodia CEO echoes widely-held considerations of business executives and analysts

“The largest systemic danger going ahead is the truth that you could have one ecosystem that manages danger and rebalances in real-time and one other ecosystem that takes weekends, nights, and holidays off,” Chris Perkins, president of funding agency CoinFund, mentioned.

This mismatch between settlement mechanisms can set off liquidity points, that are the foundation of all monetary crises, Perkins informed Cointelegraph.

In June, enterprise capital (VC) agency Breed launched a report concluding that almost all new Bitcoin (BTC) treasury firms wouldn’t survive the subsequent market downturn.

The VC agency warned that overleveraging and decrease asset costs will create a vicious cycle that forces these treasury firms to dump their belongings in the marketplace, additional miserable the crypto market.

Journal: Altcoin season 2025 is nearly right here… however the guidelines have modified