- Aussie Greenback stays depressed, with bears testing two-month lows at 0.6415.

- US Greenback is outperforming its friends in risk-averse markets, forward of Fed Powell’s speech.

- AUD/USD’s instant pattern is bearish, with the following draw back targets at 0.6400 and 0.6365.

Aussie Greenback’s upside makes an attempt have been contained under 0.6430 to date on Friday, and the pair turned decrease once more to two-month lows on the 0.6415 space, which is being examined on the time of writing.

The US Greenback is outperforming its foremost friends, underpinned by a reasonable risk-averse market. Traders are cautious of promoting US {Dollars}, forward of a speech by Fed Chair Jerome Powell, who is predicted to present some clues concerning the financial institution’s subsequent financial coverage steps.

AUD/USD is on monitor for a 1.3% weekly decline

This leaves the pair on the defensive, after an almost 1.3% sell-off to date this week. Within the absence of key macroeconomic knowledge, the cautious market temper has been bleeding the risk-sensitive Australian Greenback this week, with upbeat US figures prompting buyers to pare bets of Fed cuts and posing further help for the Dollar.

The technical image, thus, is strongly bearish, with sellers pushing in opposition to help close to the August 1 low of 0.6415 for the time being. Under right here, the psychological stage at 0.6400 may present some help, however the 0.6375 stage, the place the June 23 low meets the 127.2 Fibiopnacci retracement of the early August rally, appears like a extra believable stage.

To the upside, instant resistance is on the talked about 0.6435 intra-day excessive. Additional up, the realm between the August 5 low and August 20 excessive at 0.6450-0.6455 may problem bulls forward of the earlier help close to the 0.6480 space, the place bears have been contained on August 12, 14, and 18.

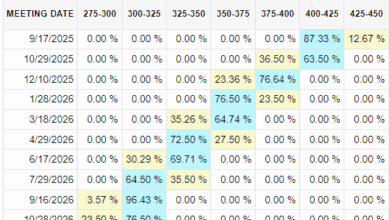

Australian Greenback Value This week

The desk under reveals the share change of Australian Greenback (AUD) in opposition to listed main currencies this week. Australian Greenback was the strongest in opposition to the New Zealand Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.94% | 1.04% | 1.06% | 0.69% | 1.39% | 2.03% | 0.36% | |

| EUR | -0.94% | 0.09% | 0.10% | -0.25% | 0.46% | 1.05% | -0.57% | |

| GBP | -1.04% | -0.09% | -0.10% | -0.33% | 0.37% | 0.96% | -0.70% | |

| JPY | -1.06% | -0.10% | 0.10% | -0.34% | 0.35% | 0.99% | -0.69% | |

| CAD | -0.69% | 0.25% | 0.33% | 0.34% | 0.67% | 1.33% | -0.36% | |

| AUD | -1.39% | -0.46% | -0.37% | -0.35% | -0.67% | 0.59% | -1.03% | |

| NZD | -2.03% | -1.05% | -0.96% | -0.99% | -1.33% | -0.59% | -1.67% | |

| CHF | -0.36% | 0.57% | 0.70% | 0.69% | 0.36% | 1.03% | 1.67% |

The warmth map reveals share adjustments of main currencies in opposition to one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, in the event you choose the Australian Greenback from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will symbolize AUD (base)/USD (quote).