- Gold stays below stress for a second consecutive day, weighed down by a robust US Greenback and agency Treasury yields.

- Market focus is squarely on Fed Powell’s speech in Jackson Gap at 14:00 GMT, his closing look on the occasion earlier than his time period ends in Could 2026.

- From a technical perspective, Gold is testing speedy help at $3,330; a break decrease would expose $3,310-$3,300, whereas a restoration above $3,350 might goal $3,370-$3,400.

Gold (XAU/USD) is buying and selling on the again foot for a second straight day on Friday, weighed down by a robust US Greenback (USD) and agency Treasury yields. On the time of writing, the valuable steel is hovering close to $3,330, down 0.21% on the day. Regardless of the decline, bullion stays locked throughout the acquainted $3,320-$3,350 vary that has formed this week’s value motion.

All eyes now flip to Federal Reserve (Fed) Chair Jerome Powell’s speech on the Jackson Gap Symposium, scheduled for 14:00 GMT, which carries outsized significance this 12 months. It will likely be his closing Jackson Gap tackle earlier than his time period expires in Could 2026. Powell’s remarks come at a fragile juncture, with the Fed going through intensifying political stress by US President Donald Trump and an economic system sending blended alerts, with resilient shopper spending on one hand, however softening labor market knowledge and sticky inflation on the opposite.

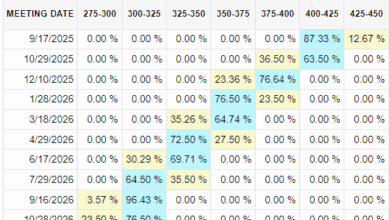

Analysts count on Powell to keep away from signaling an rate of interest lower in September, as an alternative reinforcing the Fed’s data-dependent stance and stressing that future motion hinges on upcoming labor and inflation figures. In keeping with the CME FedWatch Instrument, markets now value close to a 70% likelihood of a 25 foundation level (bps) lower in September, down from near-certainty every week in the past as resilient US financial knowledge tempered expectations for aggressive easing.

Buyers will dissect Powell’s feedback for indicators of a coverage shift, particularly any transfer away from the Fed’s 2020 framework prioritizing most employment towards a extra balanced stance between inflation management and development. Till then, Gold is more likely to stay range-bound, with geopolitical uncertainty round Russia-Ukraine talks conserving safe-haven demand alive even because the agency US Greenback and yields cap the upside.

Market movers: Hawkish lean in Fed rhetoric retains Greenback and yields bid

- The US Greenback Index (DXY), which measures the Buck in opposition to a basket of six main currencies, extends its weekly acquire to a two-week excessive, buying and selling round 98.76. The transfer is supported by declining expectations of Fed price cuts and hawkish feedback from Fed officers.

- Jeffrey Schmid, Kansas Metropolis Fed President, struck a cautious tone on Wednesday, telling CNBC that inflation stays “nearer to three% than 2%” and that policymakers nonetheless have “work to do” earlier than easing coverage. He emphasised that the Fed will carefully monitor the upcoming August and September inflation prints, noting that financial coverage is “modestly restrictive and acceptable” for now. Schmid added that markets and spreads stay in fine condition however pressured the necessity for extra definitive knowledge earlier than contemplating any coverage shift, making clear that he’s “not in a rush” to chop rates of interest.

- Atlanta Fed President Raphael Bostic echoed the cautious stance, reiterating his outlook for only one price lower this 12 months whereas warning that the employment trajectory is “doubtlessly troubling.” Bostic added that coverage ought to transfer persistently, projecting that charges might return nearer to impartial solely by 2026.

- Fed Governor Hammack additionally leaned hawkish, stating that inflation continues to be too excessive, its development stays unfavorable, and he doesn’t see a case for a September price lower primarily based on present knowledge, whereas underscoring the significance of sustaining modestly restrictive coverage.

- Boston Fed President Susan Collins struck a extra balanced tone in comparison with her colleagues, signaling openness to a price lower as quickly as subsequent month, given the twin dangers of weaker employment and better tariffs. She cautioned that elevated tariffs might erode shopper buying energy and dampen spending, posing draw back dangers to development.

- US Treasury Yields are edging larger for a second day, with the benchmark 10-year word regular close to 4.33% and the 30-year bond round 4.95%. The ten-year TIPS yield hovers at 1.95%. This sustained elevation in yields displays markets recalibrating towards a extra cautious Fed, conserving stress on bullion forward of Powell’s remarks.

- On the geopolitical entrance, diplomatic uncertainty persists as prospects for Russia-Ukraine peace talks stay fragile. In keeping with a Bloomberg report, US President Donald Trump has determined to step again from direct mediation, telling advisers that any US-hosted trilateral summit would solely comply with a bilateral assembly between Presidents Putin and Zelenskyy. In the meantime, Moscow has raised sweeping calls for, together with Ukraine ceding the Donbas area, renouncing NATO ambitions, adopting neutrality, and banning Western troops. The shortage of tangible progress underscores elevated geopolitical threat, offering a ground for safe-haven demand in Gold.

Technical evaluation: XAU/USD holds inside a good vary, draw back dangers loom beneath $3,330

Gold (XAU/USD) is buying and selling close to $3,330, testing a pivotal horizontal help space that aligns with the higher boundary of a falling wedge sample on the 4-hour chart. This zone has develop into the speedy line of protection for patrons.

The Relative Power Index (RSI) sits round 44, beneath the impartial 50 mark, indicating fading momentum and leaving the near-term bias tilted barely bearish. A dip towards 40 would strengthen draw back stress, whereas a rebound above 55 would trace at renewed shopping for curiosity.

The Shifting Common Convergence Divergence (MACD) line stay beneath the zero axis and beneath the sign line with a mildly unfavorable histogram, reflecting a scarcity of bullish conviction and signaling that sellers nonetheless have the higher hand for now.

A decisive transfer beneath $3,330 would expose the subsequent helps at $3,310 and $3,300. On the flip aspect, a restoration above $3,350, strengthened by the 100-period SMA, would open the door for a retest of $3,370, with scope towards $3,400 if momentum builds.

Financial Indicator

Fed’s Chair Powell speech

Jerome H. Powell took workplace as a member of the Board of Governors of the Federal Reserve System on Could 25, 2012, to fill an unexpired time period. On November 2, 2017, President Donald Trump nominated Powell to function the subsequent Chairman of the Federal Reserve. Powell assumed workplace as Chair on February 5, 2018.

Learn extra.

Subsequent launch:

Fri Aug 22, 2025 14:00

Frequency:

Irregular

Consensus:

–

Earlier:

–

Supply:

Federal Reserve

a