- GBP/USD rallies close to 1.3500 as Fed Chair Jerome Powell hints at renewed easing cycle throughout Jackson Gap speech.

- Powell: “Draw back dangers to the labor market are rising,” boosting September reduce odds from 75% to 90%.

- Fed stability: tariffs might drive one-time inflation, whereas stagflation dangers emerge from opposing inflation and employment pressures.

The GBP/USD pair rallies on Friday because the Federal Reserve (Fed) Chair Jerome Powell takes the stand on the Jackson Gap Symposium. On the time of writing, the pair trades above 1.3500 after Powell hinted that the Fed is perhaps able to resume its easing cycle in September.

Markets worth in larger odds of a September reduce after Powell warns of labor market draw back dangers

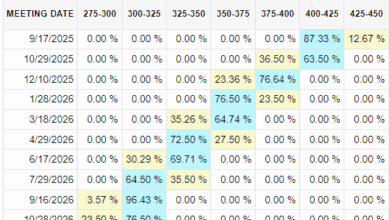

The Fed Chair Jerome Powell’s speech has elevated the percentages for a Fed fee reduce on the September assembly. Market individuals have totally priced in 50 foundation factors (bps) by year-end, and the probabilities for a 25 bps September reduce rose from 75% to 90%.

Powell mentioned that “draw back dangers to the labor market are rising” and that “the baseline outlook and the shifting stability of dangers might warrant adjusting our coverage stance.” He added that “the steadiness of the unemployment fee and different labor market measures permits us to proceed rigorously.”

The Fed Chair mentioned that tariffs might create a “one-time” impact in inflation and that it might take a while to be mirrored. He talked about that dangers of inflation are tilted to the upside and dangers of employment to the draw back. Subsequently, a doable stagflation situation looms.

GBP/USD Worth Forecast: Technical outlook

GBP/USD climbed sharply above 1.3500, opening the door for additional upside. If the pair rises previous 1.3550, it places into play the August 14 peak of 1.3594 forward of 1.3600. Conversely, if the pair dives again under 1.3500, the subsequent space of demand could be the August excessive of 1.3482, earlier than testing 1.3450.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest foreign money on the planet (886 AD) and the official foreign money of the UK. It’s the fourth most traded unit for international change (FX) on the planet, accounting for 12% of all transactions, averaging $630 billion a day, based on 2022 knowledge.

Its key buying and selling pairs are GBP/USD, often known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it’s recognized by merchants (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Financial institution of England (BoE).

The only most vital issue influencing the worth of the Pound Sterling is financial coverage determined by the Financial institution of England. The BoE bases its selections on whether or not it has achieved its main aim of “worth stability” – a gradual inflation fee of round 2%. Its main instrument for attaining that is the adjustment of rates of interest.

When inflation is simply too excessive, the BoE will attempt to rein it in by elevating rates of interest, making it dearer for individuals and companies to entry credit score. That is typically constructive for GBP, as larger rates of interest make the UK a extra engaging place for international traders to park their cash.

When inflation falls too low it’s a signal financial development is slowing. On this situation, the BoE will contemplate reducing rates of interest to cheapen credit score so companies will borrow extra to spend money on growth-generating tasks.

Knowledge releases gauge the well being of the economic system and might affect the worth of the Pound Sterling. Indicators comparable to GDP, Manufacturing and Companies PMIs, and employment can all affect the course of the GBP.

A powerful economic system is nice for Sterling. Not solely does it entice extra international funding however it might encourage the BoE to place up rates of interest, which is able to immediately strengthen GBP. In any other case, if financial knowledge is weak, the Pound Sterling is prone to fall.

One other important knowledge launch for the Pound Sterling is the Commerce Stability. This indicator measures the distinction between what a rustic earns from its exports and what it spends on imports over a given interval.

If a rustic produces extremely sought-after exports, its foreign money will profit purely from the additional demand created from international consumers searching for to buy these items. Subsequently, a constructive internet Commerce Stability strengthens a foreign money and vice versa for a damaging stability.