James Wynn, a crypto dealer recognized for his high-leverage crypto bets, has entered an enormous leveraged place on Ether (ETH), opening a 25x lengthy as ETH pushes to contemporary highs above $4,860.

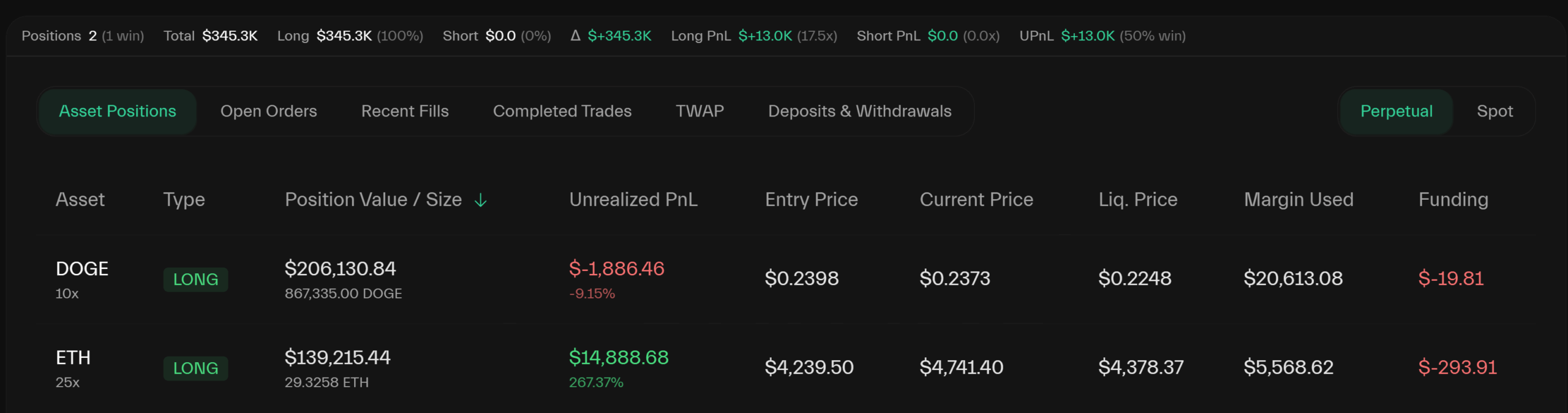

In keeping with onchain knowledge, Wynn deployed roughly $5,568 in margin to manage a 29.3 Ether place valued at $139,215, with a mean entry value of $4,239. On the time of writing, the place is displaying unrealized positive aspects of $14,888, representing a return of greater than 267%.

Wynn can be operating a 10x Dogecoin (DOGE) lengthy, valued at $206,130 for 867,335 DOGE. Entered at a mean value of $0.2398, the commerce is barely underwater, displaying an unrealized lack of $1,886 with DOGE at the moment close to $0.237.

General, Wynn’s mixed leveraged publicity is $345,000, along with his complete fairness hovering round $26,600. His margin utilization sits at round 110%.

Associated: This crypto dealer simply misplaced $100M, however he’s nonetheless not achieved

Wynn returns to buying and selling

Final month, Wynn resurfaced after a quick disappearance from social media, throughout which he deactivated his X account with a closing bio replace studying merely, “broke.”

On July 15, he re-entered the market with two aggressive trades, together with a 40x Bitcoin (BTC) lengthy price $19.5 million and a 10x PEPE (PEPE) lengthy valued at over $100,000.

Wynn gained notoriety when his $100 million leveraged Bitcoin place was liquidated on Might 30, adopted by one other $25 million loss simply days afterward June 5. On the time, he alleged that enormous gamers intentionally focused his liquidation ranges.

Associated: EU exploring Ethereum, Solana for digital euro launch: FT

Ether surges to a brand new excessive

Ethereum’s native token Ether surged to a contemporary file excessive on Friday, hitting $4,867 on Coinbase, its strongest stage since November 2021. The rally got here after Federal Reserve Chair Jerome Powell signaled a attainable rate of interest lower in September, sparking renewed urge for food for danger belongings.

The bullish backdrop has been bolstered by contemporary inflows into spot ETH ETFs. On Thursday, the funds recorded $287.6 million in web inflows, lifting their collective belongings underneath administration to over $12.1 billion. The rebound adopted 4 straight days of outflows.

Company treasuries are additionally fueling momentum. Previously month, companies together with BitMine, SharpLink, Bit Digital, BTCS and GameSquare have added roughly $1.6 billion price of ETH, taking complete company Ethereum reserves to almost $30 billion.

Journal: Altcoin season 2025 is nearly right here… however the guidelines have modified