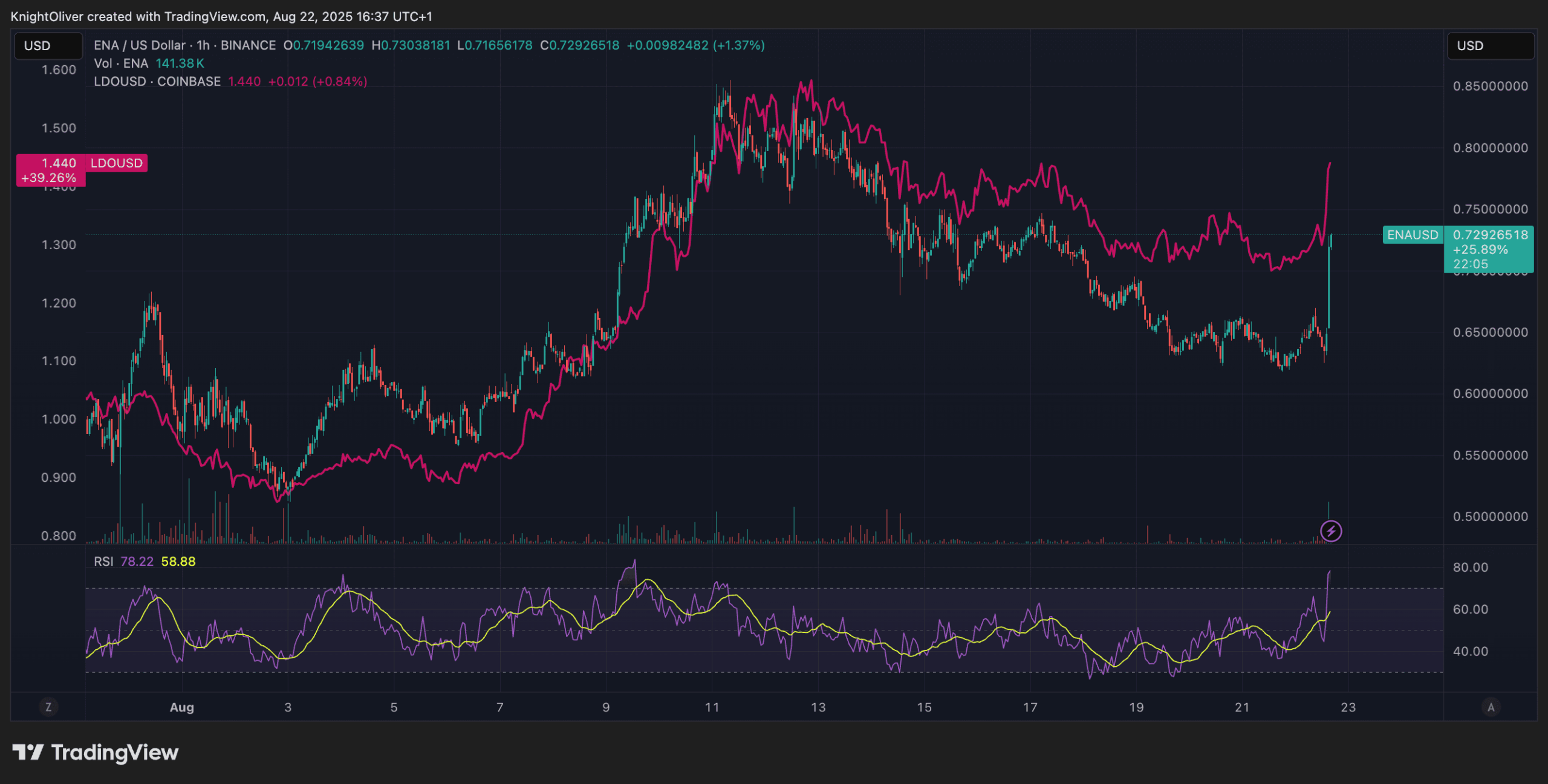

Crypto merchants purchased the dip in a number of Ethereum staking tokens on Friday, lifting the likes of lido (LDO) and ethena up by 14% and 15%, respectively.

The positive aspects follows a week-long decline that passed off alongside a fast shift in sentiment, which is usually a sign to purchase.

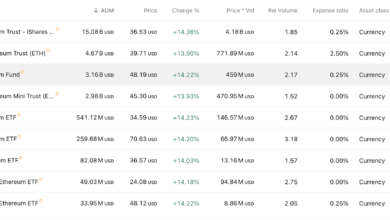

Lido and ethena are returning to final week’s highs after an early August rally spurred by the U.S. Securities and Alternate Fee’s assertion that liquid staking protocols aren’t securities.

The SEC’s assertion was seen as bullish for the decentralized finance (DeFi) ecosystem, specifically for Ethereum-based protocols that rely upon staking mechanisms to generate a yield.

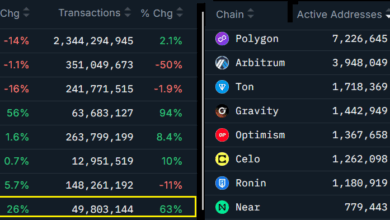

The readability additionally opened the floodgates for establishments, with Figment’s dominance over different liquid-staking protocols suggesting that institutional inflows have been starting to drive the sector.

Buying and selling quantity for ENA buying and selling pairs doubled up to now 24 hours to $1 billion, whereas LDO is up by 83% to $256 million, in line with CoinMarketCap.

The surge in quantity coupled with bitcoin and ether’s (ETH) potential to carry key ranges of help bodes effectively for the altcoin sector on the whole, though it is value noting that the ether validator queue stays extraordinarily excessive at 825,580 ETH ($3.8 billion).

When these ether tokens are unstaked, they’ll both be bought on the open market as a type of profit-taking, or staked elsewhere to generate the next yield — the previous would seemingly halt any additional strikes to the upside.