The Australian Transaction Reviews and Evaluation Centre (AUSTRAC) has ordered the native unit of crypto change Binance appoint an exterior auditor over considerations round Anti-Cash Laundering (AML) and Counter-Terrorist Financing (CTF) techniques.

The regulator mentioned Friday the choice was taken “after figuring out severe considerations” with Binance’s AML/CTF controls.

Matt Poblocki, Binance Australia and New Zealand normal supervisor, advised Cointelegraph, “Binance Australia acknowledges AUSTRAC’s choice,” including that the transfer “is one in every of their supervisory overview measures and never an enforcement motion.”

AUSTRAC CEO Brendan Thomas mentioned final 12 months’s threat evaluation by the regulator “highlights the rising vulnerability of digital currencies to prison abuse.” The request for an exterior audit follows regulatory engagement throughout the “precedence sector” that the crypto trade has turn into.

The regulator additionally shared considerations round excessive employees turnover at Binance and an absence of native resourcing and senior administration oversight. This, AUSTRAC mentioned, raises questions in regards to the adequacy of the agency’s AML and CTF governance.

“It is a international firm working throughout borders in a high-risk setting. We count on strong buyer identification, due diligence and efficient transaction monitoring,” mentioned Thomas.

Associated: Australia rolls out new crypto ATM guidelines as feds flag rising scams

Binance’s troubles in Australia

Binance has discovered itself within the crosshairs of Australian regulators earlier than. In late 2024, the Australian Securities and Investments Fee (ASIC) took authorized motion in opposition to Binance Australia Derivatives over alleged client safety failures.

Again in the summertime of 2023, ASIC searched Binance Australia’s places of work. The investigation was a part of a probe into the change’s defunct Australian derivatives enterprise. This adopted ASIC’s cancellation of Binance Australia Derivatives’ license after a overview earlier that 12 months.

The cancellation of he license adopted native regulators reviewing Binance Derivatives over notifications of account closures despatched to customers as a result of a false classification of some customers as “wholesale purchasers.”

Associated: Australian regulator takes former Blockchain World director to court docket

Binance debanked in Australia

In 2023, Binance was additionally compelled to droop Australian greenback fiat cash companies after its native fee companies supplier, Zepto, was instructed to cease supporting the change. Subsequent statements point out that the change acquired lower than a day’s warning from its funds companion earlier than it was “reduce off” from the native banking system.

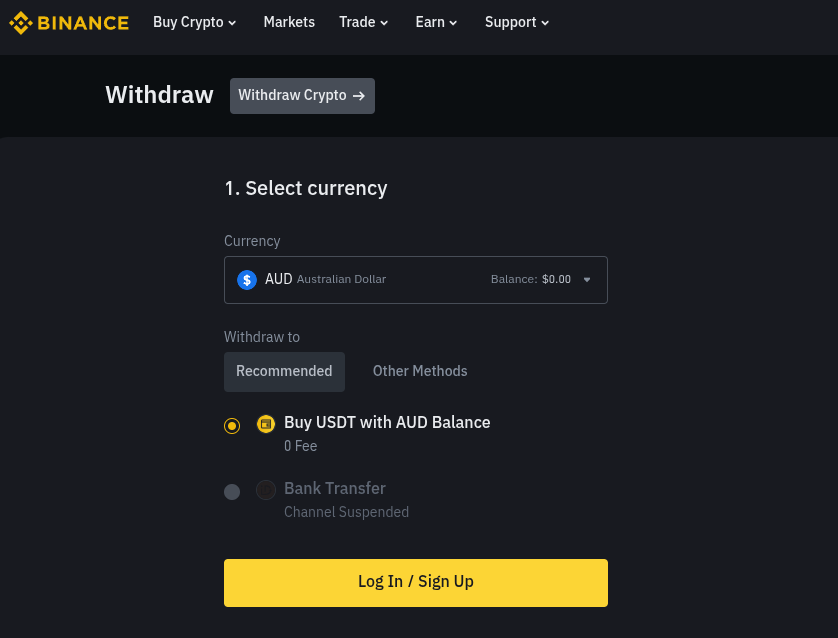

To this present day, Binance advises customers who intend to withdraw Australian {dollars} from the platform to both purchase the USDt (USDT) stablecoin to switch the funds off the platform or make the most of the peer-to-peer buying and selling companies. The “Financial institution Switch” possibility is greyed out with a “Channel Suspended” message.

Journal: Can privateness survive in US crypto coverage after Roman Storm’s conviction?