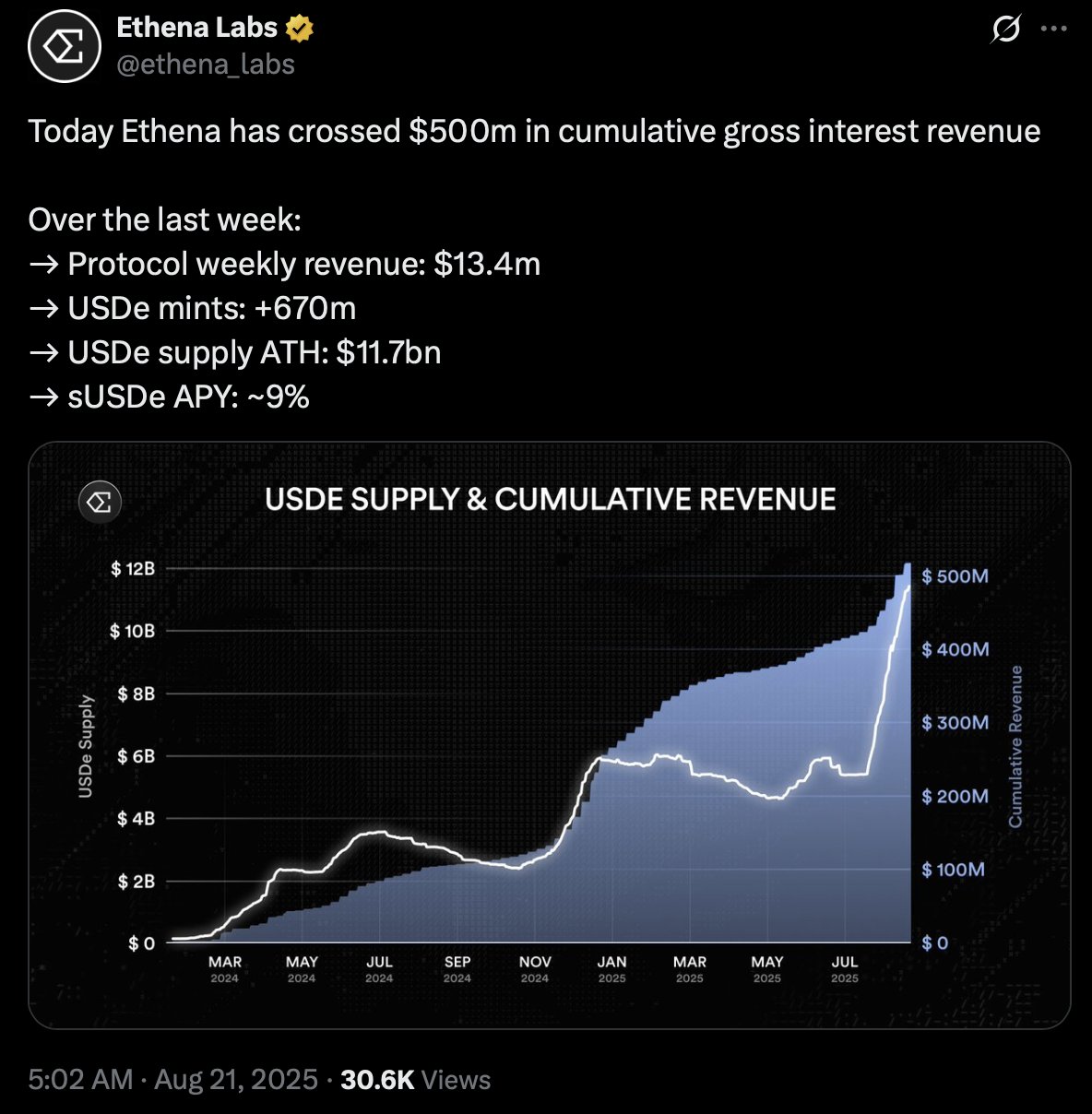

Ethena Labs on Thursday stated its Ethena protocol has generated greater than $500 million in cumulative income. Progress in each income and the circulating provide of its artificial stablecoin, Ethena USDe (USDe), has accelerated since July as artificial stablecoins acquire market share.

Ethena Labs shared the information through a submit on X, saying that previously week, protocol income hit $13.4 million and USDe provide hit an all-time excessive of $11.7 billion.

“Ethena’s income has been pushed by sturdy inflows into USDe and favorable market situations which have amplified returns from its delta-neutral hedging reserve mannequin,” an Ethena Labs spokesperson informed Cointelegraph. “The protocol’s momentum displays rising demand for and confidence in USDe as a retailer of worth.”

In response to decentralized finance analytics platform DefiLlama, Ethena USDe has the third-largest market capitalization of all stablecoins at the moment of writing. It additionally has the highest market capitalization amongst artificial stablecoins. Previously month, the market cap of Ethena USDe has risen 86.6%.

Together with Ethena USDe, different artificial stablecoins are gaining momentum and market share. Sky Greenback (USDS), which powers the Sky ecosystem and is an upgraded model of DAI (DAI), has seen a 14% improve in market cap. Falcon USD (USDf), an artificial greenback created by Falcon Finance, has seen its market cap leap 89.4%.

Artificial stablecoins have advantages in addition to dangers. As a result of they aren’t collateralized by bodily belongings, they might have decrease transaction prices. However there’s a danger of instability and depegging, which may end up in vital investor losses.

Associated: Ethena Labs exits German market following settlement with BaFin

Stablecoin market jumps 4% in August 2025

In response to DefiLlama, the stablecoin market cap has jumped 4% in August, rising to $277.8 billion on Thursday from $266.6 billion on July 31. The uptick comes amid rising regulatory readability in the USA, with President Donald Trump signing the GENIUS Act into regulation on July 18.

On the Wyoming Blockchain Symposium 2025, US Federal Reserve Governor Christopher Waller acknowledged that the GENIUS Act might assist stablecoins attain their full potential and broaden the greenback’s function worldwide.

China could counter with its personal stablecoin transfer. In what can be a big coverage shift, it’s reportedly contemplating permitting Chinese language yuan-backed stablecoins.

Journal: Authorized Panel: Crypto wished to overthrow banks, now it’s changing into them in stablecoin struggle