Aave, a decentralized finance (DeFi) protocol with $70 billion in internet deposits, has launched on Aptos, a layer-1 blockchain based by former Meta staff. The transfer might deepen stablecoin and liquid staking token liquidity on the blockchain, two asset courses topic to regulation in 2025.

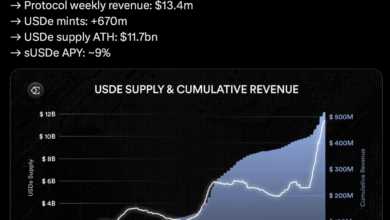

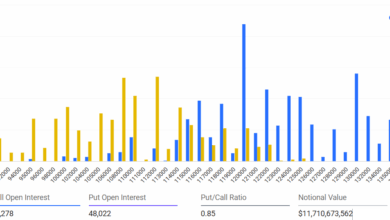

In response to an announcement shared with Cointelegraph, Aave will assist 4 cash native to the blockchain at launch: stablecoins USDC (USDC) and USDt (USDT), Aptos (APT), and Ethena Staked USDe (sUSDe). The Aptos Basis will present customers with rewards and liquidity incentives to advertise using Aave on the Aptos blockchain.

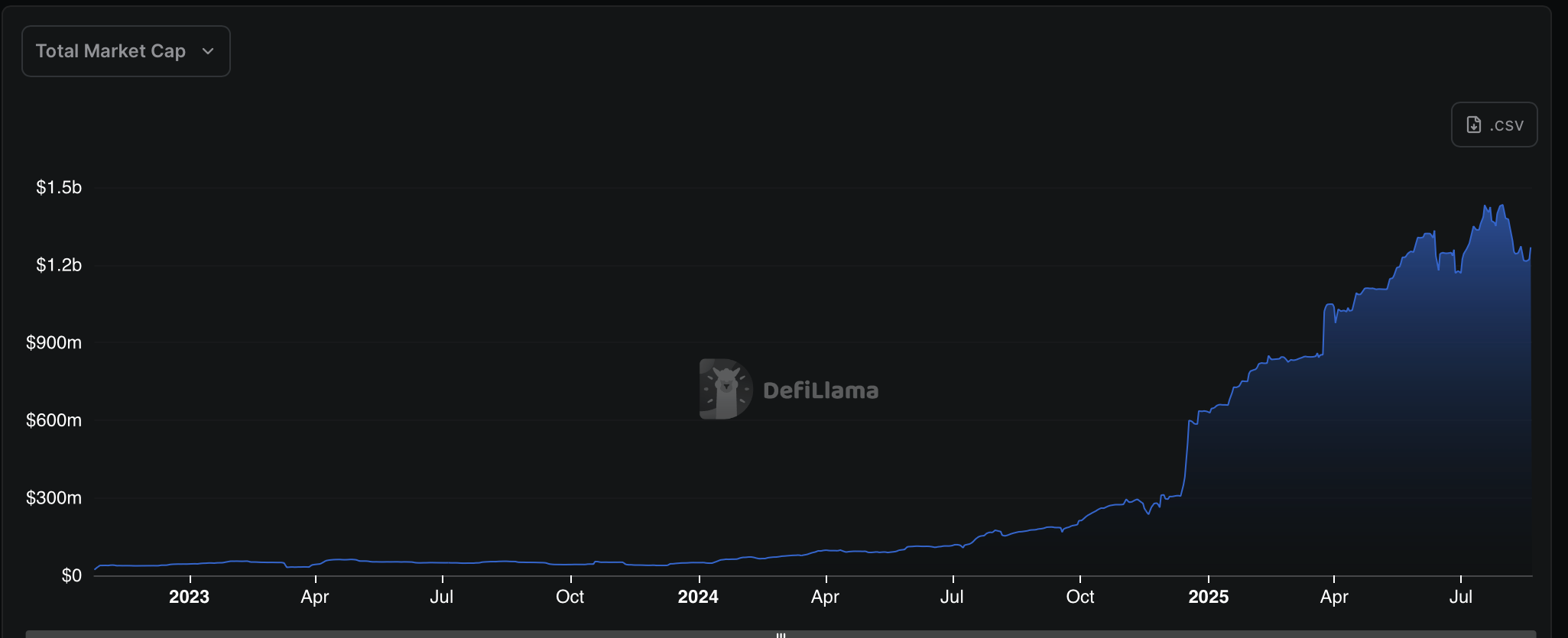

The arrival of Aave might deepen stablecoin liquidity on the blockchain, because the fiat-pegged cryptocurrencies are experiencing a breakthrough and are one of many trade’s most-discussed use instances. On Aptos, the stablecoin market cap has surged in 2025, leaping to $1.27 billion on Thursday from $627.8 million on Jan. 1.

The launch comes as Aave positions itself to reap the benefits of “new collateral markets,” reminiscent of liquid staking tokens (LSTs). LSTs are a sort of token given to customers who stake property, contributing to community safety. These tokens can be utilized for DeFi actions reminiscent of lending or buying and selling.

“By increasing to Aptos, Aave will increase entry to lending, borrowing, and financial savings to a brand new, fast-growing group,” an Aave spokesperson informed Cointelegraph.

At the moment, Aptos has a complete worth locked of $857 million, in accordance with DefiLlama. Aave enters an ecosystem with few DeFi protocol rivals. Of the highest 5 protocols listed by DefiLlama, just one has a complete worth locked of over $1 billion: PancakeSwap at $2.1 billion.

Associated: Spain slaps DeFi investor with $10.5M again tax for mortgage: Report

Regulators, indexes weigh DeFi strikes

Decentralized finance is a sector of crypto that has blossomed in recent times, pushed by the utility of accessing mainstream monetary providers with out intermediaries. In DeFi, customers can have interaction in lots of actions, together with lending, market making, investing and buying and selling.

It has additionally caught the eye of indexes and regulators not too long ago. On Saturday, it was revealed that the S&P Dow Jones Indices is contemplating licensing and itemizing tokenized variations of its common benchmarks on DeFi protocols and exchanges.

Final weekend, the US Treasury issued a discover soliciting enter on the potential addition of digital ID verification for DeFi, a instrument the entity says can be used to struggle crypto crime. Nonetheless, on Wednesday, Federal Reserve Governor Christopher Waller informed policymakers and banking stakeholders that there’s nothing to concern from DeFi.

Journal: Pakistan will deploy Bitcoin reserve in DeFi for yield, says Bilal Bin Saqib