Key takeaways:

-

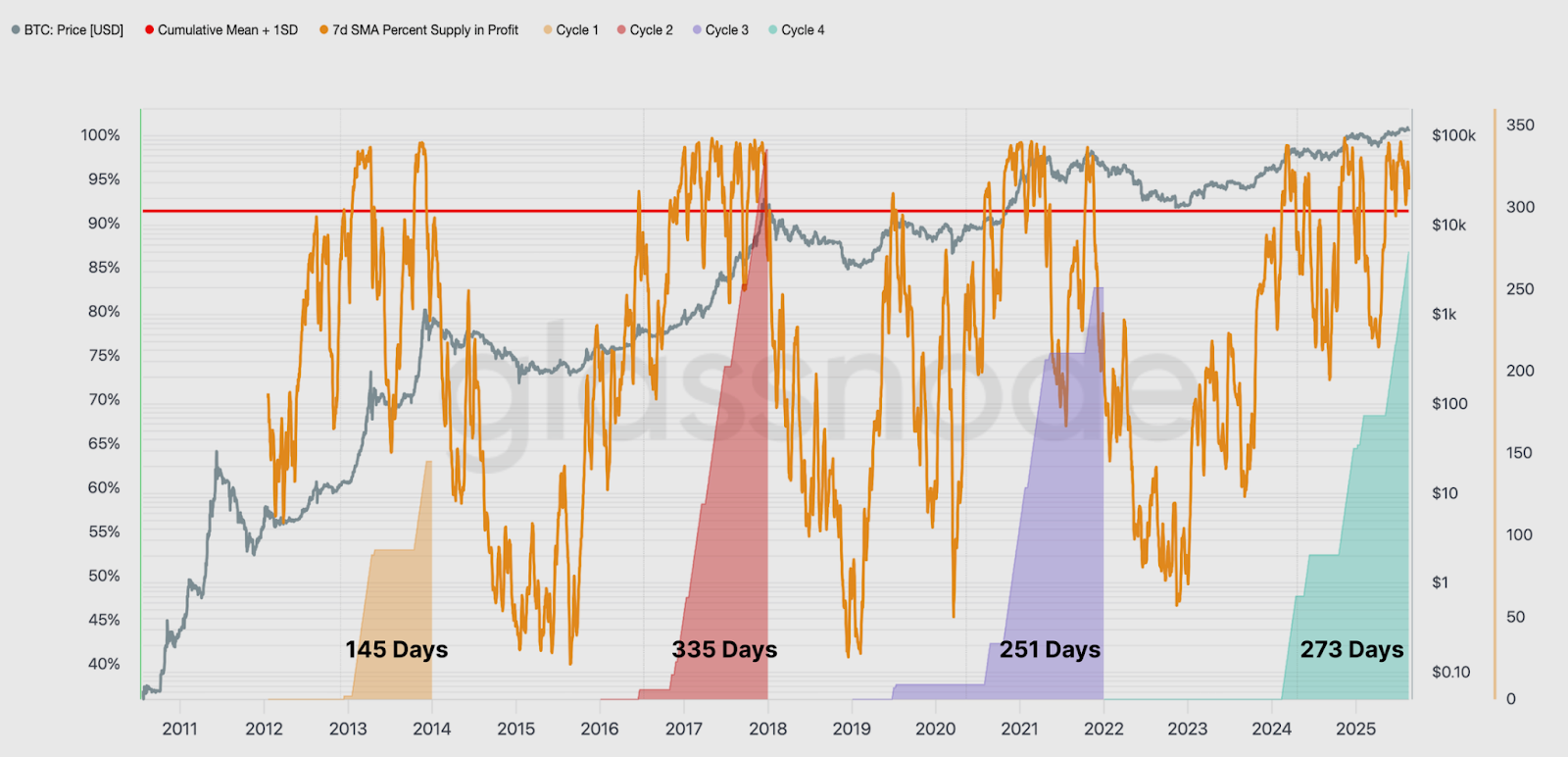

BTC’s 700% rally from $15,500 to $124,500 suggests a market high in 2 to three months, primarily based on previous cycles.

-

Bitcoin provide in revenue has been elevated for 273 days, signaling a possible cycle peak quickly.

-

Bitcoin dangers dropping into the $90,000-$100,000 vary if the psychological assist at $110,000 is misplaced.

Bitcoin (BTC) is struggling to reclaim $114,000 on Thursday, as a convergence of onchain metrics indicators waning bullish momentum and a basic setup for a market late in its cycle.

The Bitcoin market is nearing a cycle high

Bitcoin has had an unbelievable efficiency during the last three years, rising as a lot as 700% to an all-time excessive of $124,500 final week from a cycle low of $15,500 reached in November 2022.

In comparison with previous cycles, this efficiency means that BTC value is roughly two to 3 months away from the cycle high, in line with market intelligence agency Glassnode.

Associated: Bitcoin analysts level to ‘manipulation’ as BTC value falls to 17-day low

In its newest Week On-chain report, Glassnode stated:

“In each the 2015–2018 and 2018–2022 cycles, the all-time highs had been reached roughly 2–3 months past the place we’re within the present cycle, by relative timing.”

As of Aug. 21, roughly 91% of all Bitcoin had been in revenue, and have remained above the +1 customary deviation band for greater than 273 days within the present cycle, as proven within the chart beneath. This makes it the second-longest on report, behind the 2015–2018 cycle at 335 days.

This suggests that the current cycle has delivered a comparable period to that which has preceded cycle tops in prior cycles.

When thought of towards the backdrop of the waves of onchain profit-taking over the previous two years, the information reveals a similarity to earlier cycle tops

Analyzing the cumulative revenue realized (in BTC phrases) by long-term holders (LTHs) — buyers who’ve held Bitcoin for at the very least 155 days — from the purpose of reaching a brand new cycle all-time excessive, till the ultimate peak of the cycle, revealed that LTHs have realized extra revenue than in prior cycles.

Such heightened ranges of profit-taking by LTHs, similar to previous euphoric phases, add “one other dimension by way of the lens of sell-side strain,” Glassnode defined, including:

“Taken collectively, these indicators reinforce the view that the present cycle is firmly in its traditionally late part.”

Well-liked crypto analyst Rekt Capital stated that if Bitcoin goes to peak in its bull market primarily based on historic halving cycles, that may be in mid-September/mid-October 2025.

“That’s solely 1-2 months away.”

Bitcoin value rejected at $114,000

On Wednesday, Bitcoin bounced strongly from the $112,000 assist stage, however the value was rejected at $114,000, strengthening the case for additional draw back.

This stage “must be convincingly misplaced for BTC to go decrease,” stated analyst Rekt Capital in an X publish, including:

“A weekly shut relative to $114K may even be key.”

Under it, the $112,000–$110,000 area stays untested within the newest drawdown, aligning with the 100-day easy transferring common.

If Bitcoin faces deeper pullbacks, this zone may function a “nice purchase alternative,” in line with MN Capital founder Michael van de Poppe.

Basic value motion on #Bitcoin.

This outcomes right into a case that we could not break by way of the primary resistance level and that we’re remaining unstable.

It stays the actual fact: if the markets are dropping south of that earlier low –> nice purchase alternative. pic.twitter.com/7BmbrS47RE

— Michaël van de Poppe (@CryptoMichNL) August 21, 2025

For now, bulls are required to aggressively defend the $110,000 to $112,000 zone, to keep away from a return into the $100,000 to $90,000 vary, in line with Daan Crypto Trades.

“Something decrease and I believe the construction goes to be wanting a bit weak.”

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.