Key factors:

-

Bitcoin has a brand new make-or-break worth level to watch into the weekly shut: $114,000.

-

Bid liquidity traces up beneath native lows as BTC market construction dangers trying “weak.”

-

Fed rate-cut odds fall for September regardless of a US-EU commerce deal.

Bitcoin (BTC) noticed volatility at Thursday’s Wall Road open as markets digested a US-EU commerce deal.

Bitcoin analyst flags key BTC worth stage

Knowledge from Cointelegraph Markets Professional and TradingView confirmed BTC/USD ranging as much as the $114,000 mark.

That stage continued to behave as short-term resistance, with bulls showing caught as even macroeconomic information introduced little indicators of development change.

“Bitcoin is clearly rejecting from ~$114k resistance on the Every day timeframe,” well-liked dealer and analyst Rekt Capital summarized in one in all his newest X posts.

The day prior, Rekt Capital stated that additional BTC worth draw back relied on shedding $114,000 “convincingly,” with the weekly shut relative to that worth stage additionally vital.

That is the value motion to observe within the short-term

Bitcoin must proceed rejecting from $114k to enter draw back continuation

In any case, $114k must be convincingly misplaced for BTC to go decrease

Weekly Shut relative to $114k may also be key$BTC #Crypto #Bitcoin https://t.co/6Yubx4CqHd pic.twitter.com/VfJicvzqjf

— Rekt Capital (@rektcapital) August 20, 2025

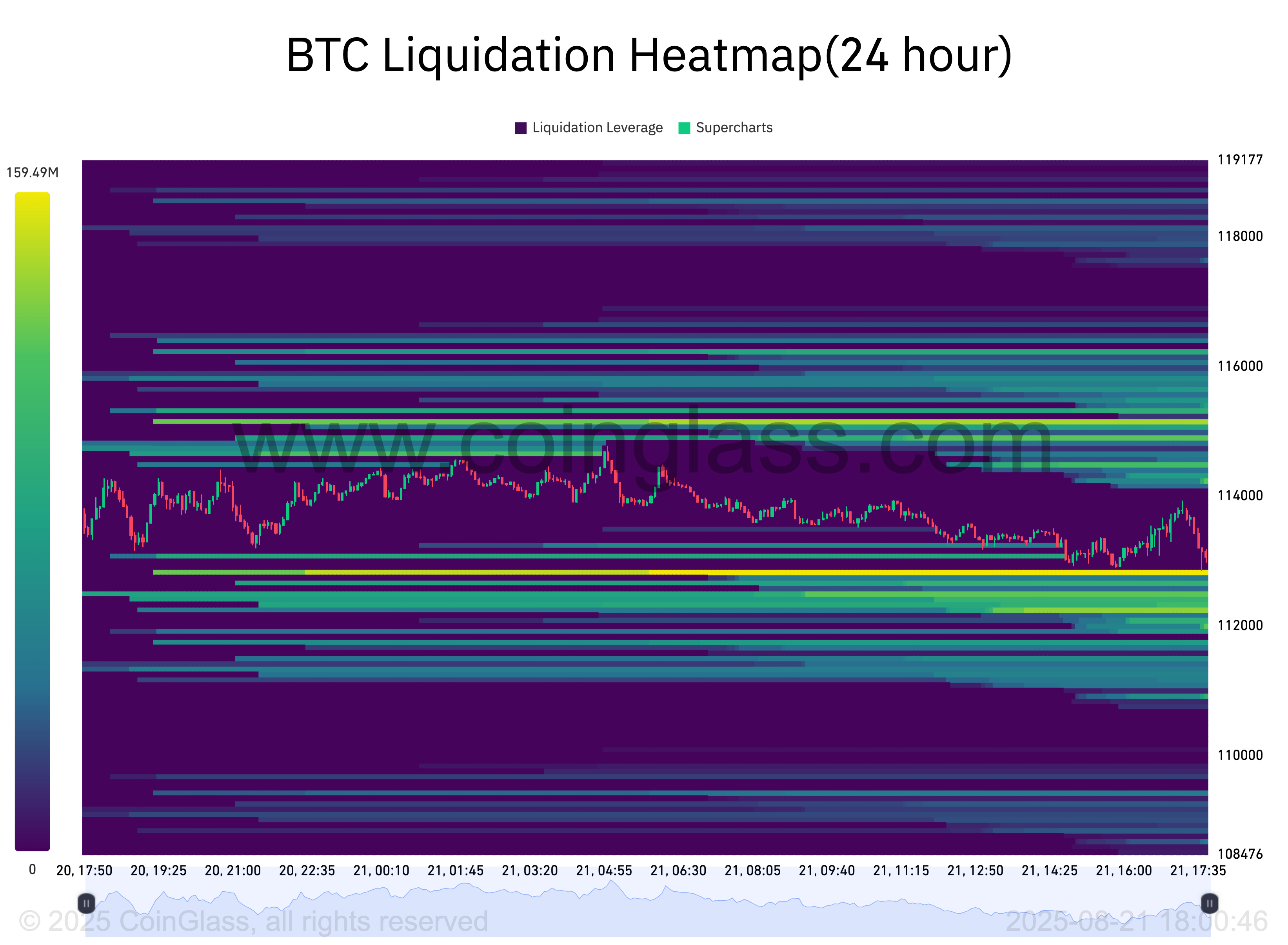

Fellow dealer Daan Crypto Trades recognized an “fascinating” space for an area low between round $109,850 and $111,900.

“Something decrease and I believe the construction goes to be trying a bit weak,” he instructed X followers on the day.

“Usually you do not need to see worth transfer again into such a wide variety/consolidation interval after breaking out of it.”

Trade order-book knowledge from CoinGlass confirmed the day’s lows coinciding with a band of bid liquidity starting at $112,900.

Uncertainty reigns forward of Jackson Gap

The commerce deal, in the meantime, had little influence on US inventory markets, with each the S&P 500 and Nasdaq Composite Index ranging after the open.

Associated: Bitcoin gained’t go beneath $100K ‘this cycle’ as $145K goal stays: Analyst

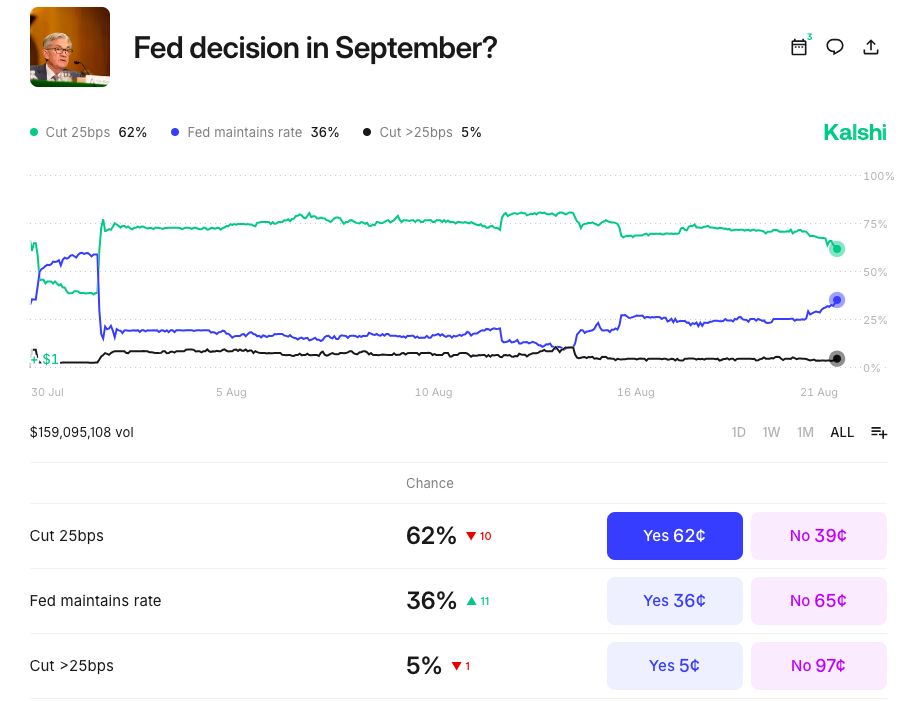

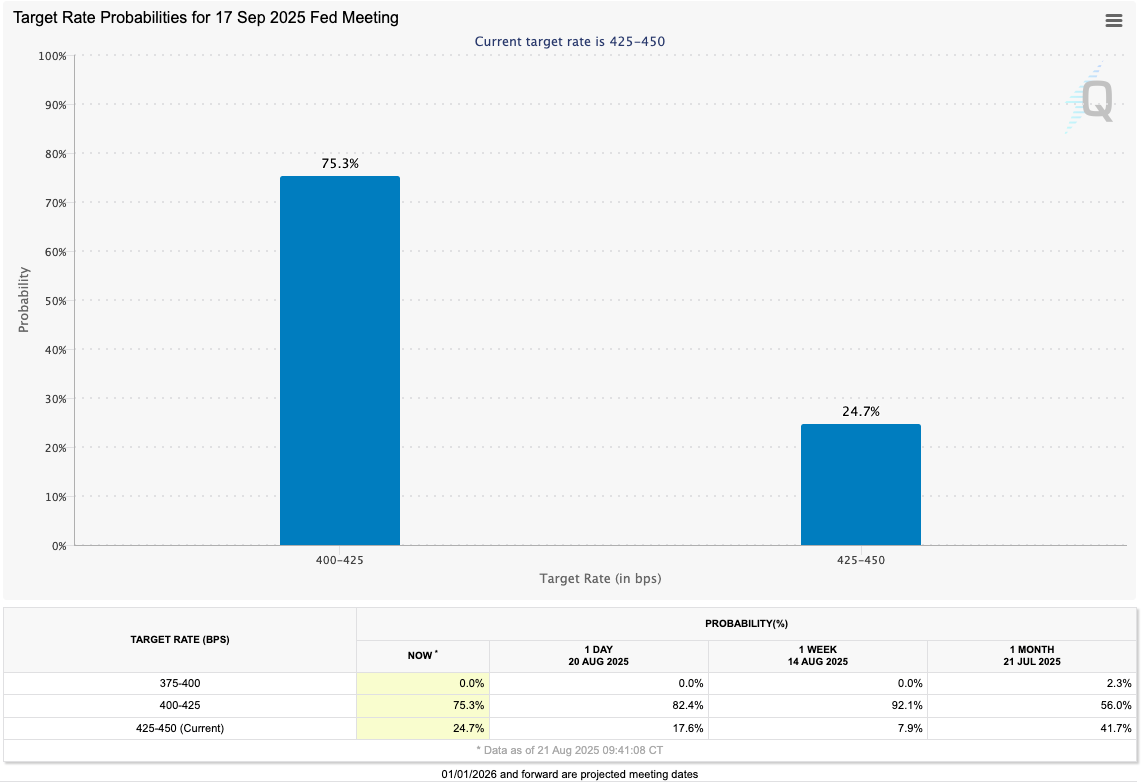

Forward of the Federal Reserve’s Jackson Gap financial symposium, bets on interest-rate cuts at its September assembly deteriorated on the day.

The chances of no reduce coming rose to 36% on prediction service Kalshi — probably the most since Aug. 1, buying and selling useful resource The Kobeissi Letter famous.

Knowledge from CME Group’s FedWatch Instrument was extra optimistic, giving 25% odds of charges being held at present ranges.

“Minutes of the Federal Reserve’s final rate-setting assembly confirmed a broadening consensus over dangers to the inflation outlook. The minutes famous that almost all of FOMC members noticed upside to inflation outweighing employment danger,” buying and selling agency Mosaic Asset wrote in an replace Thursday.

Mosaic stated that Friday’s Jackson Gap speech by Fed Chair Jerome Powell was “extremely anticipated.”

“Powell has used the venue in earlier years to broadcast key pivots on financial coverage,” it acknowledged.

“If considerations over inflation proceed to outweigh dangers to the labor market, Powell may mood expectations for any price cuts at upcoming conferences till extra knowledge is gathered.”

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.