Tokenization adoption could clear up a few of the systemic inefficiencies recognized in Latin American capital markets and speed up funding and capital movement within the area, in response to Bitfinex Securities.

Systemic inefficiencies, together with excessive charges, complicated laws and structural points reminiscent of technological obstacles and excessive startup prices, are slowing funding and hindering capital movement into Latin American capital markets, in a phenomenon dubbed “liquidity latency,” in response to the Bitfinex Securities Market Inclusion report, revealed on Thursday.

The area’s liquidity latency challenge could also be solved by the adoption of real-world asset (RWA) tokenization, which refers to monetary and different tangible belongings minted on the immutable blockchain ledger, growing investor accessibility and buying and selling alternatives for these belongings.

Monetary merchandise tokenized on the blockchain introduce extra accessibility, transparency and effectivity, together with reducing issuance prices for capital raises by as much as 4% and reducing itemizing instances by as much as 90 days, Bitfinex stated. The corporate stated tokenization may broaden investor entry and create extra buying and selling alternatives.

“Tokenisation represents the primary real alternative in generations to rethink finance,” Jesse Knutson, head of operations at Bitfinex Securities, stated within the report. “It lowers prices, accelerates entry, and creates a extra direct connection between issuers and traders.”

Associated: RWA protocol exploits attain $14.6M in H1 2025, surpassing 2024

Tokenization removes capital entry obstacles for creating economies: Paolo Ardoino

Adopting tokenized monetary merchandise could open new capital entry alternatives for creating economies, in response to Paolo Ardoino, the CEO of Tether, and the chief expertise officer of Bitfinex Securities.

“For many years, companies and people, notably in rising economies and industries, have struggled to entry capital by way of legacy markets and organisations,” stated Ardoino.

“Tokenisation actively removes these obstacles.”

He added that tokenized merchandise may unlock capital extra effectively and cost-effectively whereas giving traders entry to higher-yielding merchandise backed by compliance and regulatory approvals.

Associated: Ex-White Home crypto director Bo Hines takes Tether advisory position

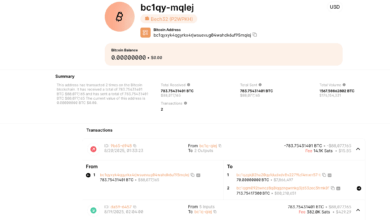

Bitfinex was the primary alternate to obtain a digital asset service supplier license beneath El Salvador’s new Digital Property Issuance Legislation, which allowed the platform to challenge and facilitate secondary buying and selling of tokenized belongings.

Tokenized US Treasury payments have been among the many first belongings tokenized by the platform, to allow “actually anybody to hedge their financial savings towards the world’s reserve forex.”

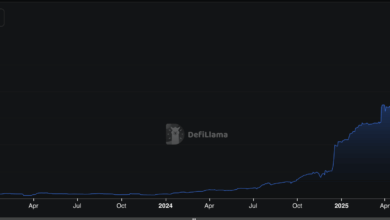

A few of the world’s largest consulting corporations see tokenization as a multi-trillion-dollar alternative.

Tokenized securities alone could attain a possible $3 trillion market by 2030 within the bull case and $1.8 trillion within the base case, in response to predictions from McKinsey, cited within the Bitfinex report.

Journal: Ethereum is destroying the competitors within the $16.1T TradFi tokenization race