As US President Donald Trump’s tariffs create an unpredictable commerce surroundings, some members of his administration have been investing in sectors influenced by his insurance policies, together with Bitcoin (BTC).

On Tuesday, the Trump administration introduced it could prolong the tariff delay on China. On the similar time, america Commerce Division will introduce aluminum tariffs on over 400 completely different merchandise, together with wind generators, cell cranes, railcars, bikes and building gear.

The unpredictability of Trump’s commerce tariffs has raised considerations amongst nationwide commerce teams just like the Nationwide Overseas Commerce Council (NFTC), which stated they’re “delaying progress, disrupting operations, and elevating authorized considerations amongst firms.”

Amid this uncertainty, officers linked with the Trump administration have deepened their ties with crypto and companies affected by his commerce insurance policies.

Lutnick’s agency buys Bitcoin amid tariffs

Current filings with the Securities and Alternate Fee, as reported by Sludge, present that US Secretary of Commerce Howard Lutnick, by way of his family-controlled agency, Cantor Fitzgerald, has been actively investing or divesting in sectors affected by Trump’s financial insurance policies.

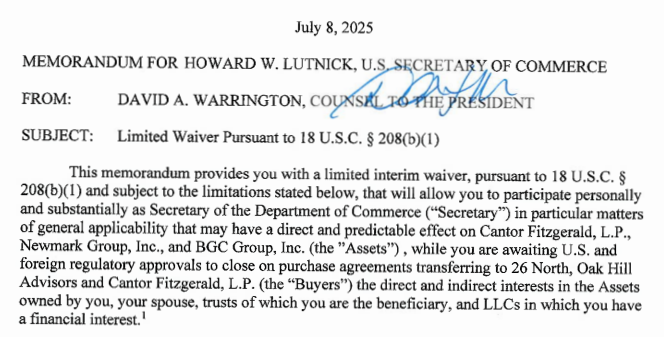

Whereas US regulation does embody sure provisions to guard towards conflicts of curiosity, Lutnick obtained a waiver on July 8, which permits him to take part “specifically issues … which will have a direct and predictable impact on Cantor Fitzgerald.”

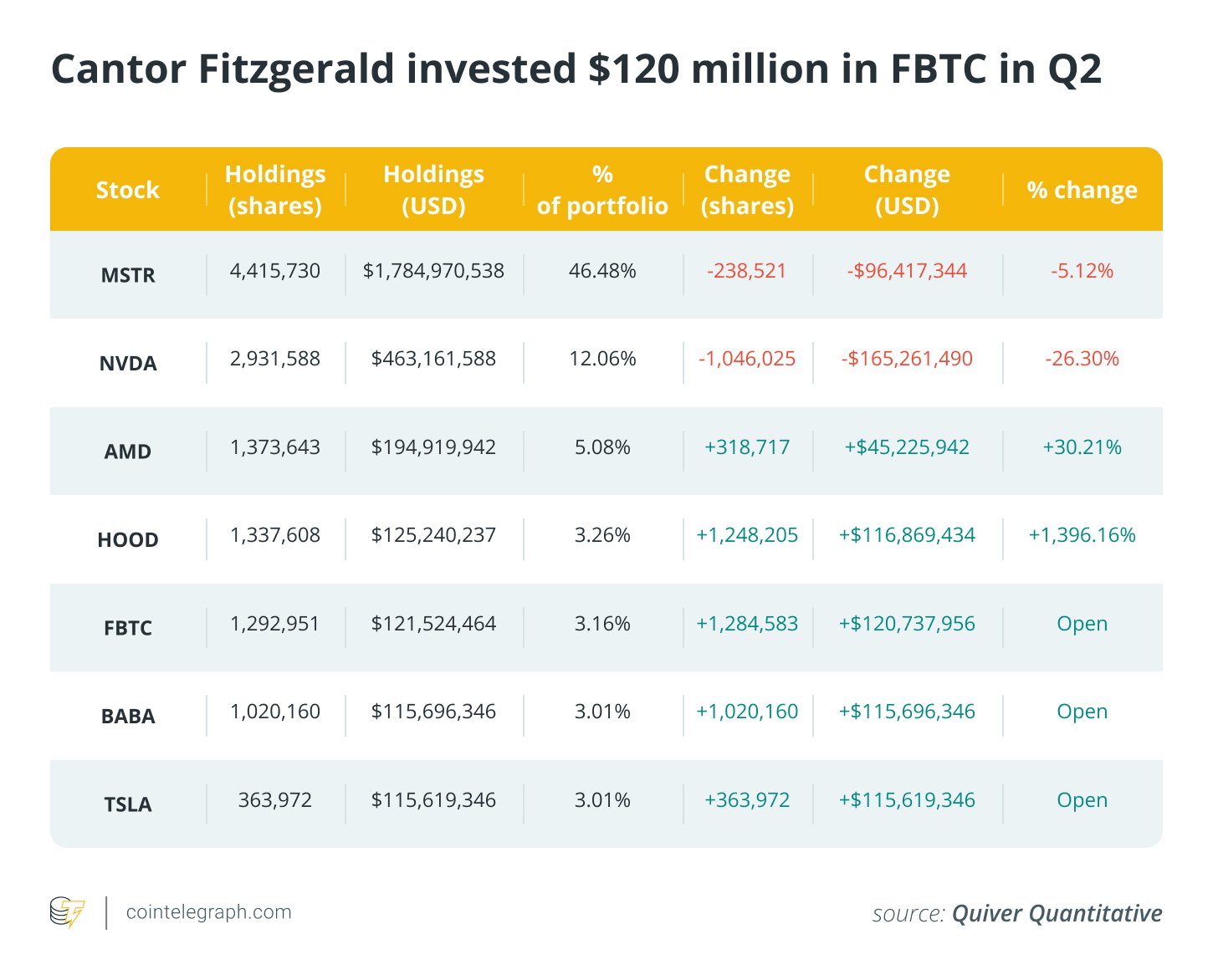

Based on an Aug. 14 submitting with the SEC and subsequent evaluation from Quiver Quantitative, Cantor Fitzgerald invested in a Constancy Sensible Origin Bitcoin Fund (FTBC) in addition to inventory in firms like chip producer AMD, Tesla, Alibaba and Robinhood.

Cantor’s investments in FTBC and buying and selling platform Robinhood numbered $120.7 million and $116.8 million, respectively. This got here after Bo Hines, government director of the Presidential Council of Advisers on Digital Belongings, instructed after a White Home interview in April that the federal government might use tariffs to fund purchases for the newly created Strategic Bitcoin Reserve.

Associated: US ought to fund Bitcoin strategic reserve with tariff surplus: Writer

In the meantime, Cantor’s different investments have been deemed by analysts as both proof against tariff insurance policies, within the case of Chinese language e-commerce web site Alibaba or instantly benefitting from tariffs, within the case of Tesla.

Bartlett Naylor, monetary coverage advocate on the watchdog Public Citizen, instructed Sludge, “When the Oxford English Dictionary subsequent updates its conflict-of-interest definition, it’ll use Cantor Fitzgerald’s crypto ventures and the Lutnick connection as prime instance.”

Different members of Trump’s interior circle have proven reported cases of battle of curiosity. David Sacks, the administration’s crypto and AI Czar, offered some $200 million in crypto investments at the start of Trump’s second time period to keep away from such claims.

Nevertheless, following the divestment, Sacks additionally obtained an identical waiver to Lutnick, claiming that “the monetary pursuits coated by this waiver aren’t so substantial as to be deemed prone to have an effect on the integrity of your companies to the Authorities.”

On July 11, US-based AI agency Vultron introduced that it obtained $22 million in Sacks’ enterprise capital agency, Craft Ventures. The agency, which is pursuing federal contracts, even famous Sacks in its announcement, stating:

“Craft Ventures, co-founded by White Home AI adviser David Sacks, backed the spherical, signaling investor confidence that Vultrons [sic] is the category-defining system for AI-driven federal progress. This funding will speed up Vultron’s mission to rework enterprise federal progress and elevate the workforce.”

The funding from Sacks’ agency comes as AI companies are increasing investments in knowledge facilities and racing for predominance. AI growth has been forged as a prime precedence for the Trump administration. The White Home launched its AI motion plan on July 10, which included investing in manufacturing capability for AI {hardware}. Trump has additionally negotiated hardline offers with particular person tech firms that produce semiconductors for AI.

Uncertainty as Trump delays one other 90 days

On Tuesday, US Treasury Secretary Scott Bessent stated that the established order of 90-day delays with China was “working fairly properly.”

In an interview with CNBC, he stated that the tariffs had been projected to herald $300 billion in income however that he’d “must revise that up considerably. … We’re going to deliver down the deficit to GDP. We’ll begin paying down the debt, after which at that time that can be utilized as an offset to the American individuals.”

Commerce teams are much less optimistic concerning the results the tariffs are having on the American financial system. The NFTC stated that “economists and trade consultants warn of broad potential impacts on provide chains.”

The commerce group stated that the tariffs are creating uncertainty and growing the price of uncooked supplies throughout provide chains.

Associated: Tariffs, defined: How they work and why they matter

“In sectors like superior manufacturing, the stakes are notably excessive. 4 in 5 firms stated tariffs threaten their capability to innovate in areas crucial to competitiveness, from gasoline effectivity to security and sustainability,” it stated.

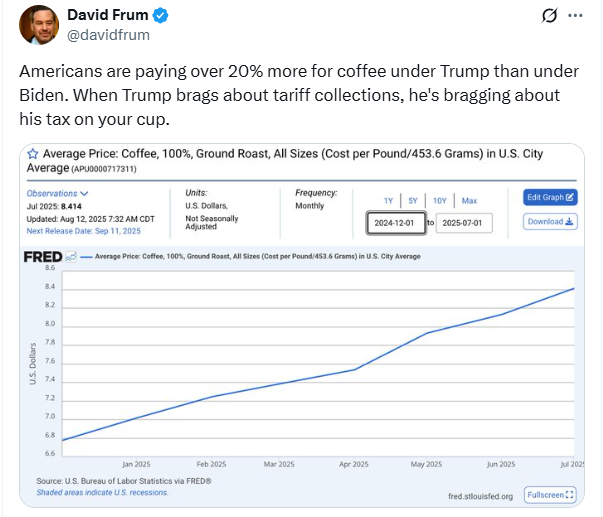

The tariffs don’t simply have an effect on massive enterprise however on a regular basis customers as properly. The Price range Lab at Yale College stated in an Aug. 7 report that “the value stage from all 2025 tariffs rises by 1.8% within the short-run, the equal of a mean per family revenue lack of $2,400 in 2025.”

Tariffs on imported meals have led to jumps in home produce. In July, wholesale costs for home recent and dry greens had been 38.9% greater than the 12 months earlier than.

Tariffs have but to critically affect building supplies, however Residence Depot, a big house enchancment and building supplies chain, stated owners had been delaying massive tasks, as costs elevated as a result of tariffs. The corporate stated it’s attempting to offset the impact tariffs can have on costs by diversifying its provide chain.

The US and world financial system are nonetheless ready to really feel the complete affect of Trump’s unpredictable commerce coverage. Whereas this has led to uncertainty and a few elevated prices for buyers, it’s clear that some members of his administration are ready to make use of that to their very own acquire.

Journal: Bitcoin’s long-term safety finances downside: Impending disaster or FUD?