How a $123M crypto rip-off in Australia laundered thousands and thousands via a ‘legit’ enterprise

How Australian authorities uncovered a $123-million crypto fraud

Australian authorities uncovered a crypto crime group that allegedly laundered $123 million. 4 suspects are charged in reference to the scheme.

The invention is the result of an 18-month crypto investigation by Australian authorities. Members of the Australian Federal Police, Queensland Police Service and Australian Prison Intelligence Fee, together with many different companies, joined forces to analyze suspicious transactions again in December 2023.

The collaborative entity, Queensland Joint Organized Crime Taskforce (QJOCTF), trailed the cash flows of a hoop member and discovered it was a part of a large-scale, refined cash laundering scheme that concerned entrance companies and cryptocurrencies.

Authorities revealed {that a} complete of $123 million was laundered with this difficult scheme. And the laundered cash was finally transformed into cryptocurrencies.

Earlier than diving into the modus operandi of the scheme, let’s get began with understanding what cash laundering is.

What’s cash laundering?

Cash laundering refers back to the course of of constructing illicit cash look authorized. Criminals launder cash to make use of the proceeds of crimes with out drawing consideration from authorities.

The method typically unfolds in three levels. The primary is “placement” of unlawful cash into the monetary system. Criminals do that by using generally used strategies, resembling:

- Smurfing: Prison proceeds are deposited in smaller quantities into financial institution accounts. The aim is to maintain deposits below a selected sum and keep away from reporting.

- Commingling: This method includes mixing illicit cash with legit revenue, often from a cash-heavy enterprise.

- False invoices: Faux transactions or inflated invoices is likely to be used to justify illicit cash move between corporations.

The following stage, “layering,” is supposed to additional obscure the supply of illicit cash. The cash is moved throughout accounts and nations or transformed into totally different kinds, which makes it tougher to hint.

When the cash seems clear sufficient, the “integration” stage kicks in to redistribute cash to house owners. Laundered cash is likely to be used to purchase actual property, luxurious items and, in some instances, transformed to cryptocurrencies.

To fight cash laundering, many nations observe worldwide requirements set by the Monetary Motion Process Drive (FATF). These embrace buyer verification guidelines, reporting of suspicious exercise and tighter rules on cryptocurrency exchanges.

Do you know? The United Nations Workplace on Medicine and Crime (UNODC) estimates that as much as $5.54 trillion was laundered in 2024. This equals round 5% of world GDP.

How an Aussie rip-off ring used automobile sellers and crypto to launder illicit funds

Although unsuccessful in the long run, the Australian crypto rip-off ring created a multi-step scheme to evade Anti-Cash Laundering (AML) measures.

The ringleader of the crypto rip-off was a cash-in-transit safety firm. It used couriers to choose up illicit cash at lifeless drop places in numerous cities and carry it to Queensland.

After receiving the cash, the safety firm needed to switch it to its entrance companies. To do this, it used an armored automobile and transported illicit funds along with legit cash, avoiding elevating suspicion.

Nevertheless, this was just one amongst many easy steps to obfuscate.

The following step was to maneuver the money to a basic automobile dealership that managed many financial institution accounts. Automotive dealerships make excellent entrance companies for cash laundering, as they repeatedly cope with giant money funds and might simply cover unlawful funds amongst actual gross sales.

When the dealership received the cash, it commingled illicit funds with legit earnings throughout financial institution deposits. So as to add an additional layer to hide the supply, it transferred cash between its financial institution accounts. The dealership later despatched the laundered cash to a gross sales promotion firm, which was additionally a part of the ring.

The final step was to ship laundered cash, which was dealt with by the gross sales promotion firm. It transformed a part of the proceeds to cryptocurrencies, most likely so as to add one other layer to complicate tracing. Ultimately, the funds reached beneficiaries in crypto or via third-party companies.

Aftermath of the Australian crypto investigation

As soon as the construction was clear, authorities moved shortly to look associated places and produce suspects earlier than the courtroom.

In June 2025, the QJOCTF raided 14 houses and companies in Queensland. Throughout the operations, authorities seized $170,000 price of crypto property, together with $30,000 money, enterprise paperwork and gadgets.

The police additionally froze 17 properties, vehicles and funds in a number of financial institution accounts. The entire worth of frozen property is round $21 million.

4 folks had been charged as a part of the Australian crypto investigation: the director and common supervisor of the safety firm, a person linked to the gross sales promotion firm and the proprietor of the basic automobile dealership.

Every suspect faces critical expenses, resembling coping with crime proceeds and forging paperwork. Most penalties vary from three years to life in jail.

The investigation is ongoing. Authorities say extra folks might be charged as they proceed to trace down hyperlinks within the broader community.

Crypto’s darkish facet: A haven for crime?

Crypto’s affiliation with unlawful actions is a long-standing and central argument amongst naysayers. Economist Nouriel Roubini as soon as criticized cryptocurrency exchanges for facilitating cash laundering. In the meantime, Nobel laureate economist Paul Krugman claims that a lot of crypto exercise is legal.

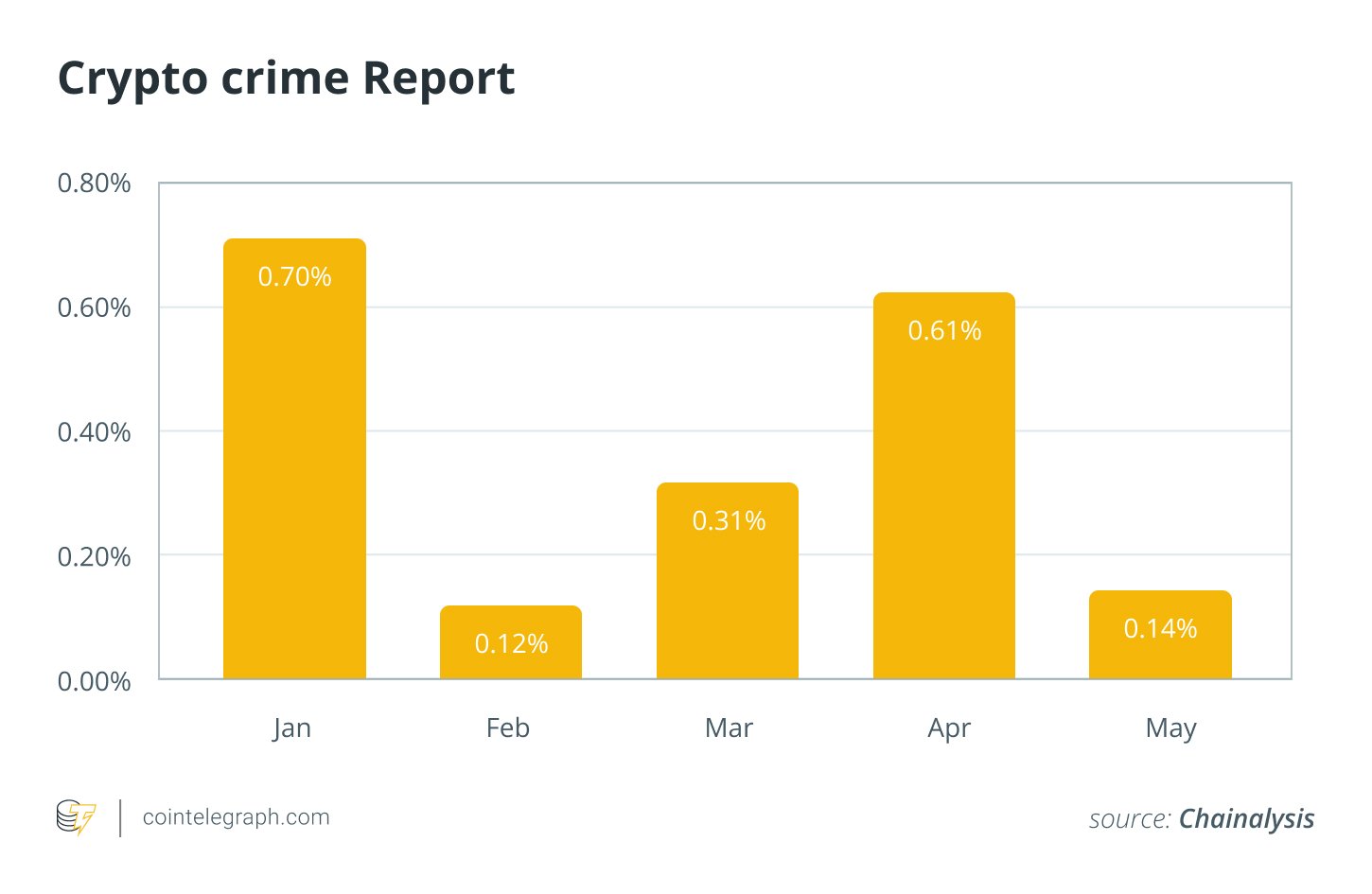

Blockchain analytics companies estimate that illicit crypto quantity reached $51 billion in 2024. Sure, that’s an enormous quantity, nevertheless it accounts for less than 0.14% of the whole crypto quantity, and the proportion is trending downward.

Crypto could enchantment to criminals for a number of causes:

- Cryptocurrency transactions are nameless until a regulated centralized trade is concerned.

- Blockchains are additionally world networks that work with out intermediaries and permit customers to maneuver giant sums independently of conventional banking techniques.

- Some crypto instruments like mixers provide enhanced privateness options as properly, which make transactions tougher to hint.

But the exact same options that appeal to criminals can get them caught by officers. Not like money, crypto leaves a everlasting path. Every transaction is recorded on a public ledger, and these data can’t be erased or altered. Blockchain analytics companies and regulation enforcement can observe these trails throughout wallets and exchanges to establish culprits.

A US Federal Bureau of Investigation operation carried out in 2023 offers a high quality instance. The company was investigating ransomware funds linked to the Caesars cyberattack. The attackers obtained ransom in cryptocurrency, hoping it could cover their id. However blockchain’s transparency gave the FBI an investigative edge.

The company traced the ransom via wallets and realized the funds had been despatched to 2 wallets with no transaction historical past. That alone was sturdy proof they had been arrange only for crypto cash laundering, one thing tougher to show with conventional strategies. The FBI adopted the path of blockchain data and finally froze the property earlier than they might be cashed out.

As this crypto case exhibits, blockchain crime is a double-edged sword. What criminals discover interesting can simply grow to be the proof that convicts them.