A longtime Bitcoin holder offered his whole place this week to rotate into practically $300 million value of Ether.

The hodler offered 550 Bitcoin (BTC) value roughly $62 million after holding the asset for seven years.

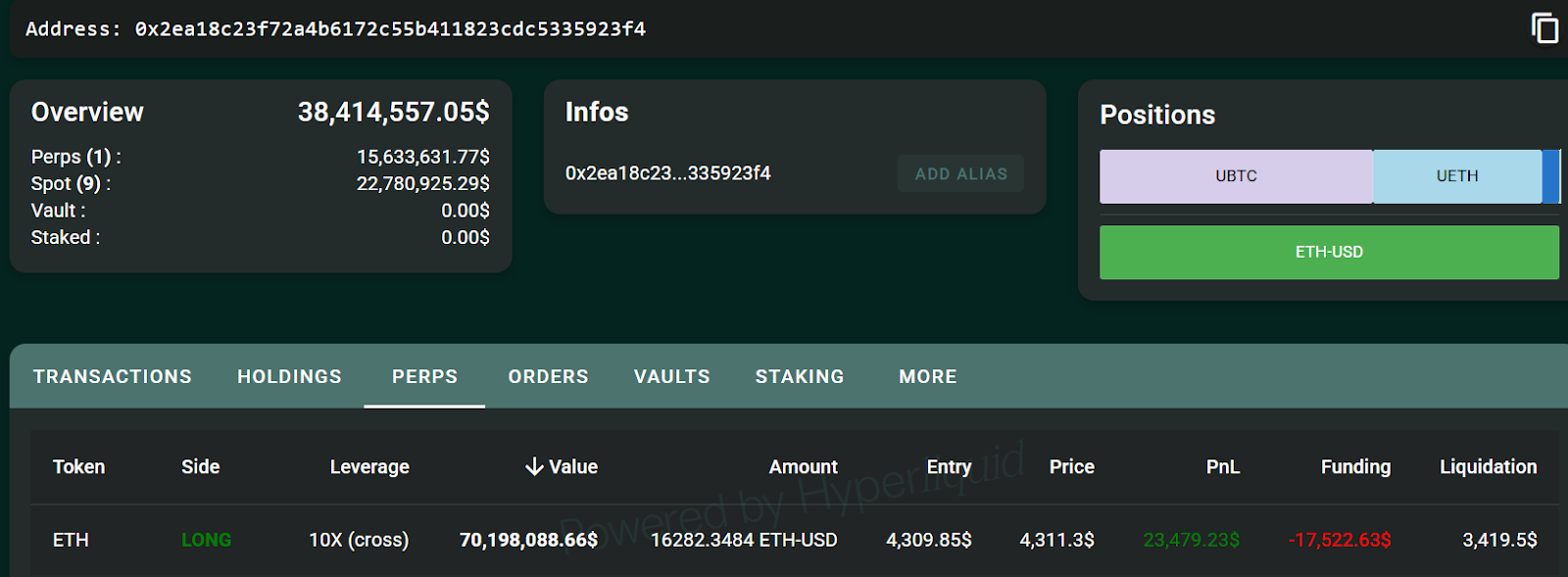

After promoting all their Bitcoin via the decentralized trade Hyperliquid, they opened a $282 million lengthy place on Ether (ETH) via three separate accounts, based on a pseudonymous onchain analyst MLM.

“Both he caught some loopy bullish insider information, or he’s simply playing. The execution seemed sloppy and rushed,” mentioned the onchain sleuth in a Wednesday X publish.

Massive strikes are sometimes tracked by merchants to gauge short-term market developments.

The hodler’s rotation got here shortly after Bitcoin dipped close to a two-week low of $112,000 on Wednesday, signaling “rising nerves available in the market” forward of US Federal Reserve Chair Jerome Powell’s upcoming remarks and the Jackson Gap symposium Friday, which can present key alerts on September’s rate of interest coverage, Ryan Lee, chief analyst at Bitget trade, advised Cointelegraph.

Associated: David Bailey’s KindlyMD kicks off Bitcoin treasury with huge $679M purchase

Hyperliquid Bitcoin value dips 200bps after $60 million BTC promote

Whereas the Bitcoin hodler’s $60 million sale was modest in comparison with different giant transactions, it was sufficient to set off a value dislocation on Hyperliquid.

The $60 million sale prompted Bitcoin’s value to fall by 200 foundation factors (bps) on the Hyperliquid trade, with Bitcoin “now buying and selling at a 30 bps low cost in comparison with different exchanges,” added MLM in a Wednesday X publish.

A 200 bps value drop equals a 2% value distinction or roughly $2,267 per Bitcoin, assuming at present’s spot value of $113,370, signaling a major distinction in comparison with different exchanges.

The transfer could counsel Hyperliquid’s order books lack the depth to soak up outsized trades with out vital value influence.

Cointelegraph has approached Hyperliquid for touch upon the trade’s liquidity situations.

Associated: Ether dealer practically worn out after epic run from $125K to $43M

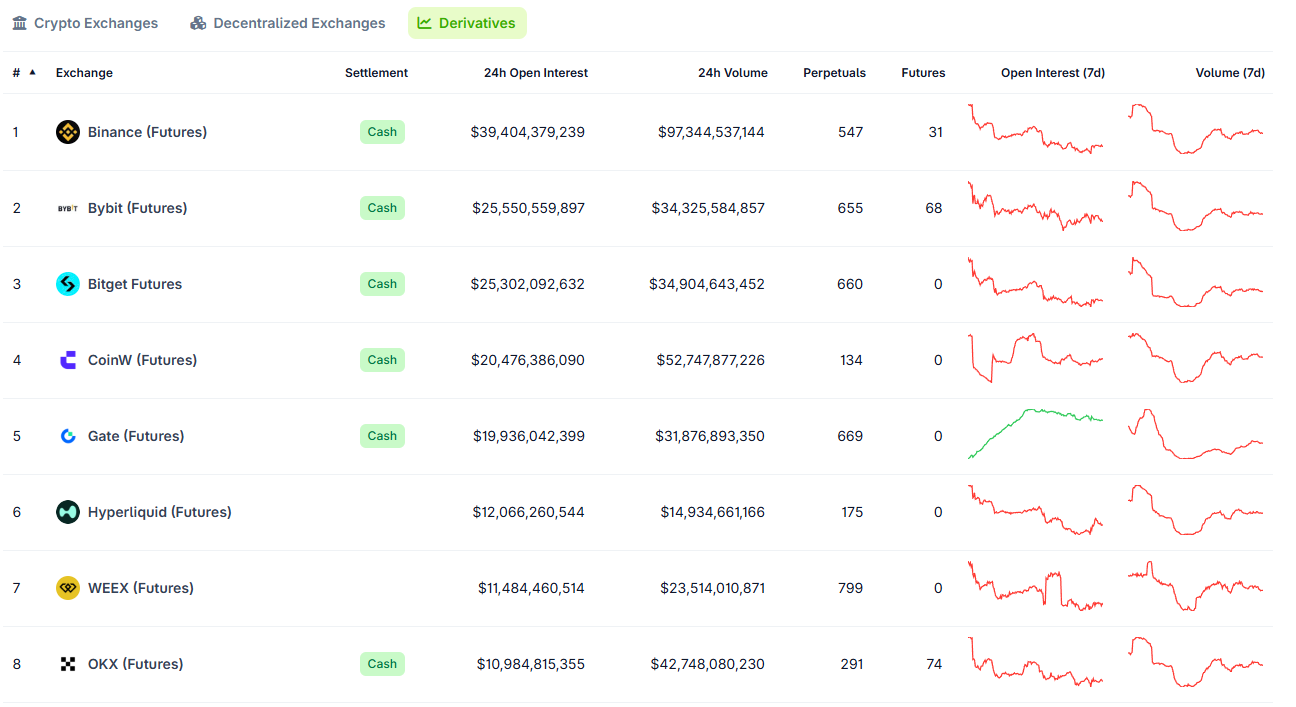

Hyperliquid reached a brand new month-to-month excessive of $319 billion in buying and selling quantity in July, pushing decentralized finance perpetual futures platforms to a brand new cumulative excessive of $487 billion, Cointelegraph reported on Aug. 7.

Hyperliquid earned 35% of all blockchain income in July, capturing vital worth on the expense of Solana, Ethereum and BNB Chain, VanEck researchers mentioned in a month-to-month crypto recap report.

Hyperliquid has grown to develop into the sixth-largest derivatives trade on the planet, with over $12 billion of 24-hour open curiosity, up from twelfth place because the starting of April, CoinGecko knowledge exhibits.

Hyperliquid gained reputation in April 2024 after launching spot buying and selling with an aggressive itemizing technique and an easy-to-navigate consumer interface.

Journal: Altcoin season 2025 is nearly right here… however the guidelines have modified