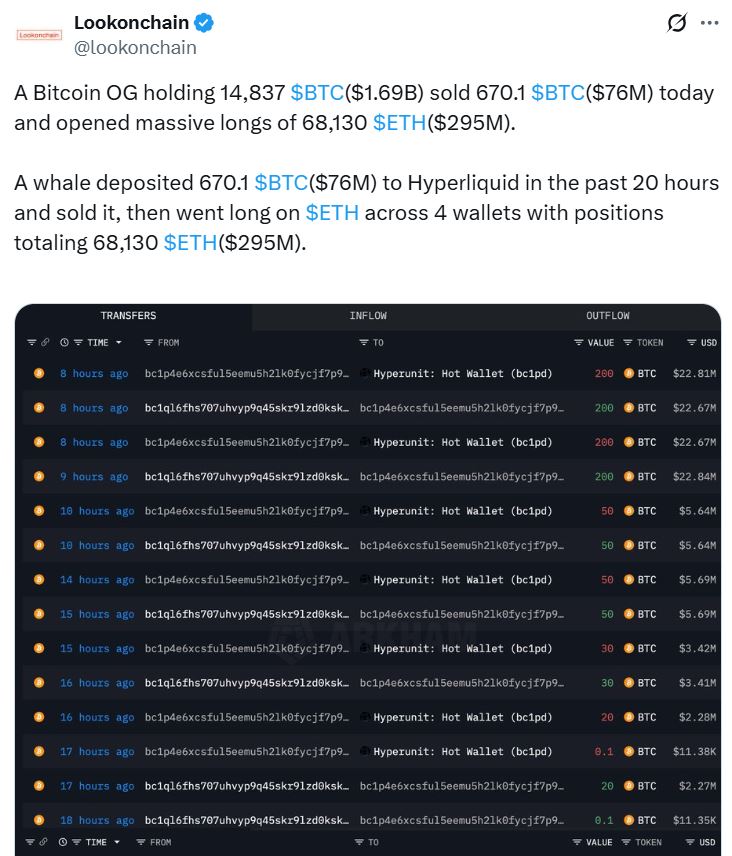

A significant Bitcoin whale who has diamond-handed Bitcoin for the final seven years offered off a few of its bag to open a protracted place in Ether (ETH), becoming a member of a current wave of Bitcoin whales opening as much as Ethereum.

The OG whale offered 670 Bitcoin (BTC) for $76 million on Wednesday, then used these funds to go lengthy throughout 4 positions, totaling 68,130 ETH, Lookonchain stated in an X submit on Thursday.

Earlier than the sale, the whale had 14,837 Bitcoin price over $1.6 billion, relationship again to purchases from crypto exchanges Binance and HTX over seven years in the past.

It got here solely per week after Bitcoin reached a brand new all-time excessive of $124,128 on Aug. 14, and Ether virtually reclaimed its 2021 all-time excessive of $4,878.

Whale positions went down after purchase

All 4 of the whales’ Ether positions have been opened at across the $4,300 mark, in line with Lookonchain, and the majority of the Ether was on 10x leverage, whereas a smaller place of two,449 was on 3x leverage.

Nonetheless, after the whale opened the positions on Wednesday, Ether’s worth dropped, hitting a low of $4,080, placing three into the crimson and solely about $300 away from the liquidation costs of $3,699, $3,700 and $3,732.

Ether is buying and selling up 2.9% within the final 24 hours, in line with CoinGecko, and was altering fingers for $4,287 per token on the time of writing.

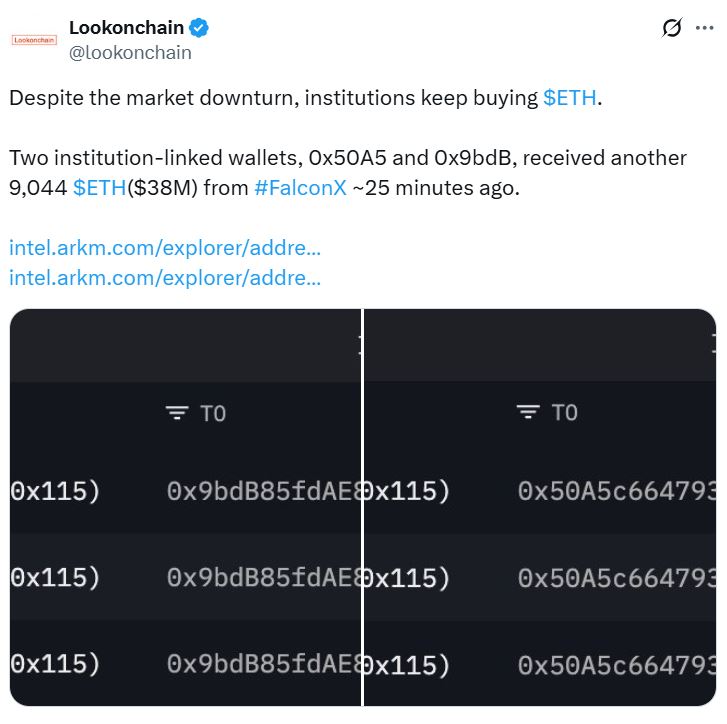

Establishments stacking Ether too

A trio of whales’ panic-sold 17,972, 13,521 and three,003 Ether throughout a market dip on Tuesday, Lookonchain stated, however others have been ready within the wings to snap it up.

On the identical time, two institution-linked wallets have been stacking Ether, accumulating 9,044 every price $38 million, in line with Lookonchain.

BitMine Immersion Applied sciences, a publicly traded Bitcoin firm, added one other 52,475 Ether to its treasury, bringing its holdings to 1.52 million tokens price $6.6 billion.

Previous whales moved their Bitcoin luggage final month

Two different Bitcoin whales additionally moved massive quantities of BTC final month however didn’t purchase Ether.

A Satoshi-era Bitcoin whale with 80,201 tokens began shifting its holdings to Galaxy Digital after being dormant for 14 years, making a ultimate switch on July 16.

Associated: Ether dealer turns $125K into $43M, locks in $7M after market downturn

After six years of dormancy, one other smaller whale awoke on the identical day and transferred out 1,042 Bitcoin, price $123 million, to a brand new pockets.

Crypto analyst Willy Woo stated in June that whales with greater than 10,000 Bitcoin have been steadily promoting since 2017, answering an X consumer’s query about who has been promoting amid heightened curiosity from establishments.

Nonetheless, analysts informed Cointelegraph that OG Bitcoiners promoting their holdings is nothing to fret about as a result of new consumers are leaping in, which is an effective signal of a maturing market.

Journal: Bitcoin’s long-term safety price range drawback: Impending disaster or FUD?