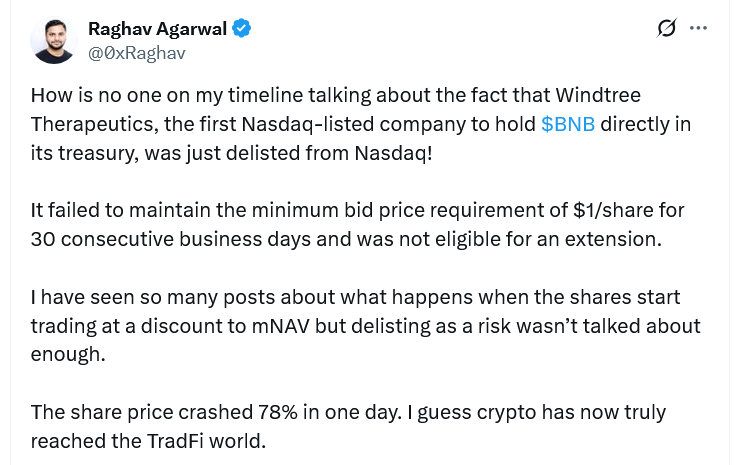

Windtree Therapeutics, a biotech firm that established a BNB treasury technique final month, fell 77% on Wednesday after the Nasdaq knowledgeable the agency it might be delisted from the inventory trade for failing to fulfill compliance necessities.

The noncompliance involved Nasdaq Itemizing Rule 5550(a)(2) that requires an organization’s inventory to take care of a minimal bid worth of $1.00 per share, Windtree acknowledged in a submitting to the US securities regulator on Tuesday. Nasdaq will droop WINT buying and selling on Thursday.

Windtree (WINT) shares dropped a staggering 77.2% to $0.11 on the information, and are down one other 4.7% in after-hours, Google Finance information reveals. WINT shares noticed a minor rise on July 16, when it introduced its BNB treasury technique, however have fallen over 90% since its July 18 peak.

Whereas some corporations have gained after adopting a crypto treasury technique, others haven’t been as fortunate. Windtree is a part of a rising variety of publicly traded corporations to undertake a BNB technique, giving traders publicity to BNB with out holding the cryptocurrency straight.

Windtree to proceed making monetary disclosures

The corporate’s CEO, Jed Latkin, stated within the submitting that Windtree would proceed its reporting obligations regardless of the delisting.

Some crypto corporations, equivalent to Argo Blockchain, have been suspended on the Nasdaq however have been relisted after satisfying compliance necessities.

Windtree made large bulletins, then went quiet

Windtree kickstarted its BNB treasury on July 16, disclosing a $60 million buy settlement with Construct and Construct Corp, with choices for an extra $140 million.

WINT rose 32.2% over the subsequent two days earlier than it began tumbling down.

A couple of week later, it signed a $500 million fairness line of credit score with an unnamed investor, with a separate $20 million inventory‑buy pact with Construct and Construct Corp to buy extra BNB tokens.

Windtree hasn’t disclosed how a lot BNB it holds or whether or not it intends to proceed its BNB treasury technique. Cointelegraph reached out to Windtree for remark.

BNB rises on Wednesday, notches one other excessive

BNB was among the finest performers amongst blue-chip altcoins on Wednesday, rising 5.6% to $876.26 and setting a brand new all-time excessive because the broader crypto market bounced again from a two-week low, CoinGecko information reveals.

Associated: Banking foyer fights to alter GENIUS Act: Is it too late?

BNB is among the solely giant altcoins to set a brand new excessive this bull cycle, together with XRP (XRP) and Solana (SOL) — whereas the likes of Ether (ETH), Dogecoin (DOGE), Chainlink (LINK) and Cardano (ADA) are nonetheless chasing highs set from again in 2021.

Journal: Solana Seeker overview: Is the $500 crypto cellphone value it?