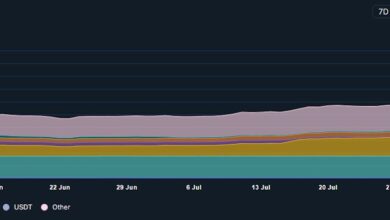

A US decide has unfrozen $57.6 million in USDC (USDC) stablecoins tied to the Libra token scandal in February, giving memecoin promoter Hayden Davis and former CEO of the Meteora decentralized alternate Ben Chow entry to the funds.

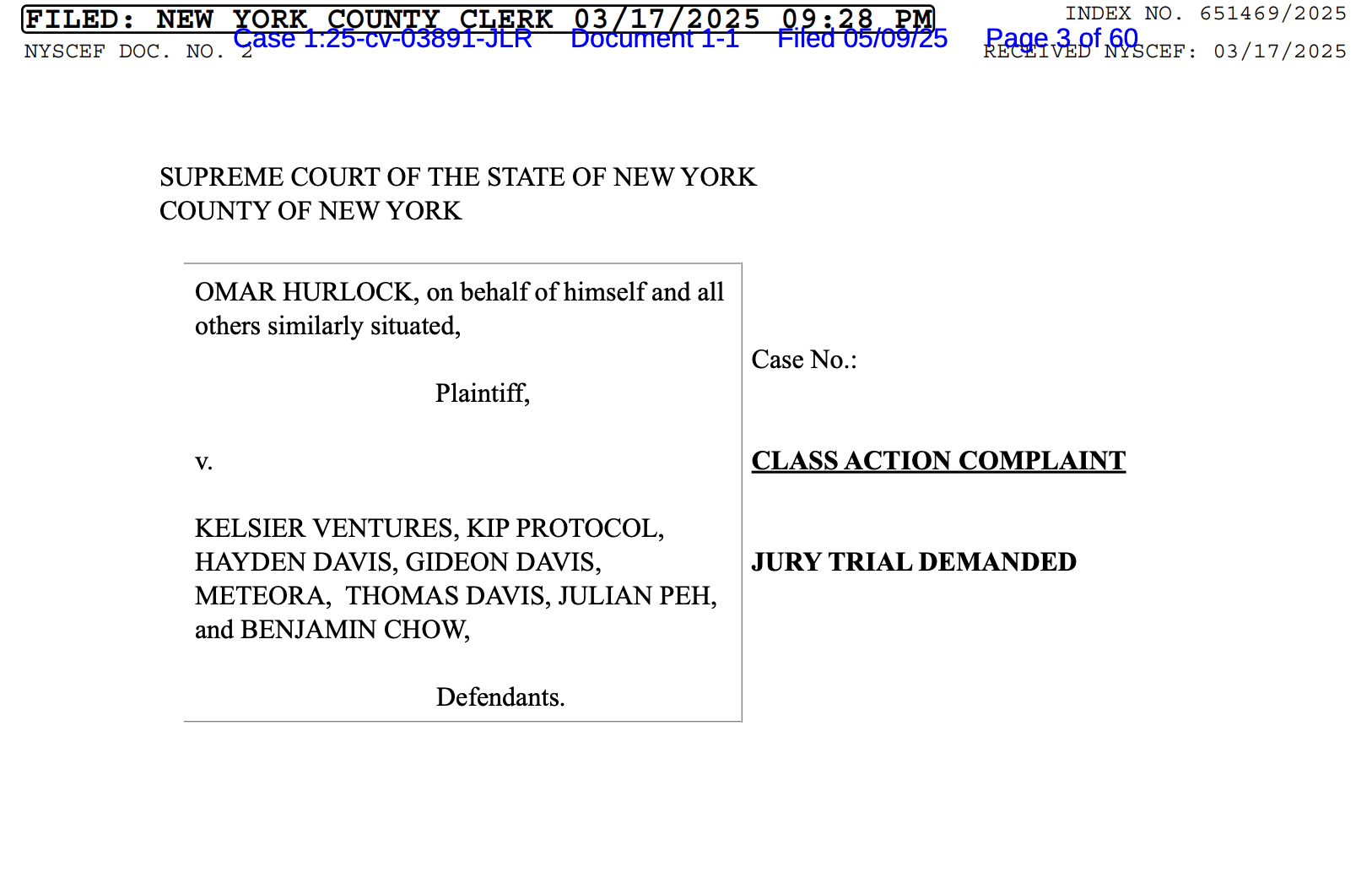

US decide Jennifer L. Rochon froze the funds in Might as a part of a listening to in a class-action lawsuit in opposition to Davis, Chow, blockchain infrastructure firm KIP Protocol and KIP’s co-founder, Julian Peh.

The Choose mentioned the defendants didn’t reveal “irreparable” hurt as a result of the funds to reimburse victims are nonetheless obtainable, and the defendants have made no effort to maneuver the frozen funds, in response to Law360.

In July, Davis filed a movement to dismiss the lawsuit in opposition to him, which was denied as “moot” by the courtroom. Regardless of this, Rochon mentioned she was uncertain that the class-action lawsuit in opposition to Davis, Chow and others would succeed.

The Libra token scandal is taken into account one of the vital vital rug pulls in historical past, drawing in Argentine President Javier Milei, prompting an ethics investigation into the chief and class-action lawsuits from buyers.

Associated: From Coinbase to Milei and LIBRA: Crypto class-action fits pile up

The Libra token scandal and the aftermath that rocked the crypto world

The Libra token launched in February, billing itself as a mission to assist help Argentina’s small companies, and was initially promoted by Milei on social media.

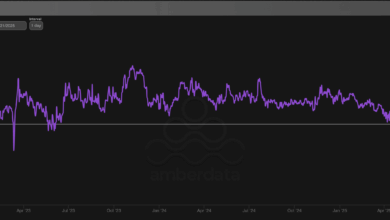

Libra crashed and burned inside hours of launching, prompting widespread backlash from buyers who had been caught up in what was characterised as a $107 million rug pull.

Milei distanced himself from the token, denying information of the mission’s fundamentals and backtracking on the preliminary promotion.

“Just a few hours in the past, I posted a tweet, like so many different numerous occasions, supporting a supposed personal enterprise with which I clearly haven’t any connection,” Milei wrote in a Feb. 14 X submit.

The assertion did little to stem a congressional probe into Milei for attainable ethics violations and calls from Argentine lawmakers to question Milei.

Nonetheless, Milei closed the investigation and disbanded the duty drive with none expenses or findings of wrongdoing in opposition to the president’s workplace, prompting allegations of a politically motivated cover-up.

Journal: Crypto merchants ‘idiot themselves’ with value predictions: Peter Brandt