On Wednesday, cryptocurrency trade Kraken and tokenization platform Backed Finance introduced an growth of xStocks, a tokenized inventory product providing, to the Tron blockchain. The transfer comes as real-world asset (RWA) tokenization, notably inside shares, is taking maintain.

In accordance with the announcement, Backed will deploy the shares as TRC-20 tokens. Beforehand, Kraken and Backed launched xStocks on Solana and BNB Chain. Debuted in late June 2025, xStocks has had greater than $2.5 billion in mixed DEX and CEX quantity, in line with a Kraken weblog publish.

“The passion creating within the RWA sector is extra indicative of a rising institutional confidence within the utility of layer 1 blockchain networks like Tron,” a TronDAO consultant instructed Cointelegraph. “As institutional blockchain continues to evolve, we plan to remain targeted on constructing the infrastructure wanted to help long-term adoption and real-world monetary use circumstances.”

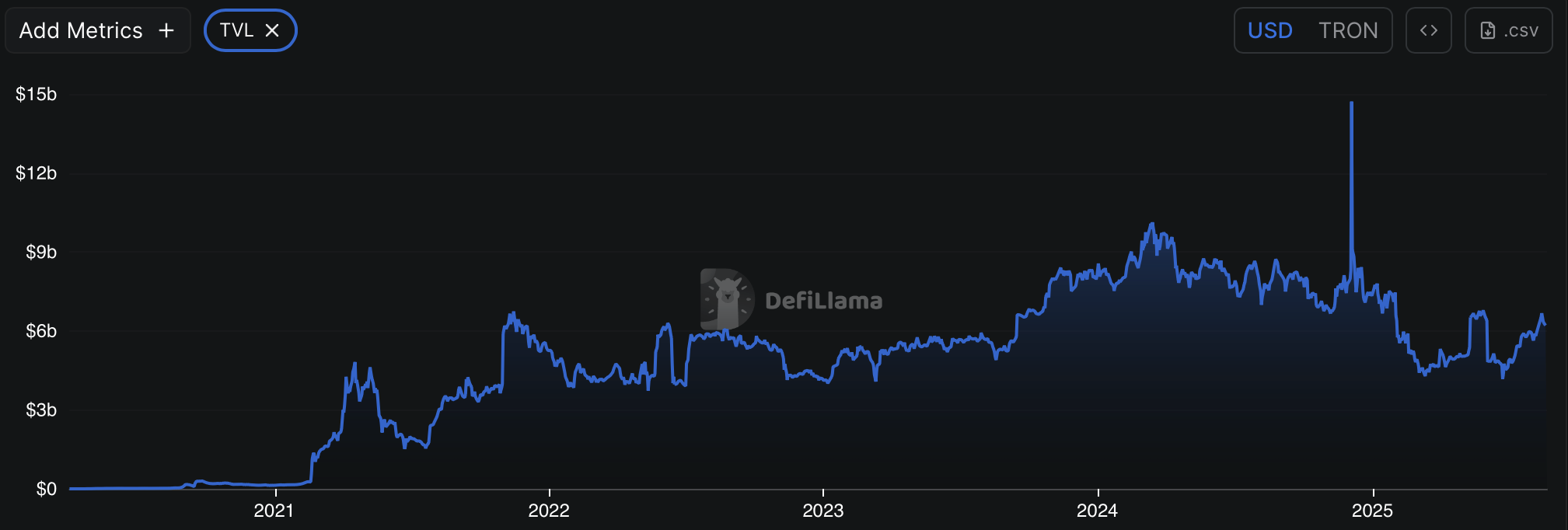

In accordance with DefiLlama, the Tron blockchain has a $6.2 billion complete worth locked (TVL) as of Tuesday. This TVL ranks Tron fifth total amongst all blockchains. TVL is a generally used metric to find out the well being of a decentralized finance ecosystem. Nonetheless, Tron’s TVL on Jan. 1, 2025, was $7.3 billion, indicating that it has dropped 15% this yr.

Ethereum nonetheless dominates DeFi exercise with a TVL of $89 billion, accounting for 60% of TVL throughout all blockchains. On July 29, investing and buying and selling platform eToro introduced plans to tokenize 100 of the most well-liked US shares on Ethereum. On June 30, Robinhood launched a layer-2 blockchain for buying and selling of US property in Europe.

Associated: DeFi soars with tokenized shares, however person exercise shifts to NFTs: Report

RWA tokenization positive factors steam in 2025

RWA tokenization has gained momentum in 2025 as establishments heat as much as placing property like US Treasurys, personal credit score and shares on the blockchain. In accordance with RWA.xyz, the RWA tokenization market has grown to $26.4 billion as of final Tuesday, up from $15.6 billion on Jan. 1, 2025.

In accordance with a Binance Analysis report shared with Cointelegraph, tokenized shares are nearing “a significant inflection level” and are seeing a development price much like the early days of decentralized finance.

Nansen CEO Alex Svanevik wrote in an opinion piece for Cointelegraph that the actual alternative with tokenized shares lies not within the public market however within the personal, the place there are deeper inefficiencies.

Journal: TradFi is constructing Ethereum L2s to tokenize trillions in RWAs — Inside story