Key takeaways:

-

XRP confirms a bearish descending triangle on the every day chart, risking an 18% drop to $2.40.

-

Declining every day energetic addresses sign decreased transaction exercise and cooling demand for XRP.

-

Spot taker CVD stays damaging, suggesting waning investor demand.

XRP (XRP) traded 23% beneath its multi-year peak of $3.66, and a convergence of a number of information factors alerts a attainable drop towards $2.40.

Information from Cointelegraph Markets Professional and TradingView exhibits XRP buying and selling beneath a descending triangle within the every day time-frame, as proven within the chart beneath.

A descending triangle is a bearish chart sample, characterised by a flat, horizontal assist line and a descending higher trendline that slopes downward.

The worth broke beneath the assist line of the prevailing chart sample at $2.95 on Tuesday to proceed the downward development, with a measured goal of $2.40.

Such a transfer would deliver the whole good points to 18% from the present stage.

As Cointelegraph reported, the altcoin must reclaim the $3 assist stage to keep away from a deeper correction to $2.24. The final two instances the value reclaimed this stage within the current previous had been in mid-July and early August, previous 25% and 15% rallies, respectively.

XRP/BTC bearish divergence

XRP’s bearishness is supported by a rising bearish divergence between its XRP/BTC pair and the relative energy index (RSI).

The every day chart beneath exhibits that the XRP/BTC pair rose between July 10 and Aug. 18, forming increased lows.

However, in the identical interval, its every day RSI descended to 43 from overbought situations at 75 over the identical time-frame, forming decrease lows, as proven within the chart beneath.

Associated: Value predictions 8/18: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, ADA, LINK

A damaging divergence between falling costs and a rising RSI normally signifies weak spot within the prevailing uptrend, prompting merchants to e-book earnings at increased ranges as investor curiosity decreases and purchaser exhaustion units in.

The chart above additionally reveals that XRP/BTC sits above a key assist zone between 0.0000245 BTC and 0.0000250 BTC, embraced by the 200-day easy transferring common.

A drop beneath this space might see the XRP/BTC pair proceed its downtrend, fueled by an additional drop in XRP value.

Declining community exercise might amplify XRP sell-off

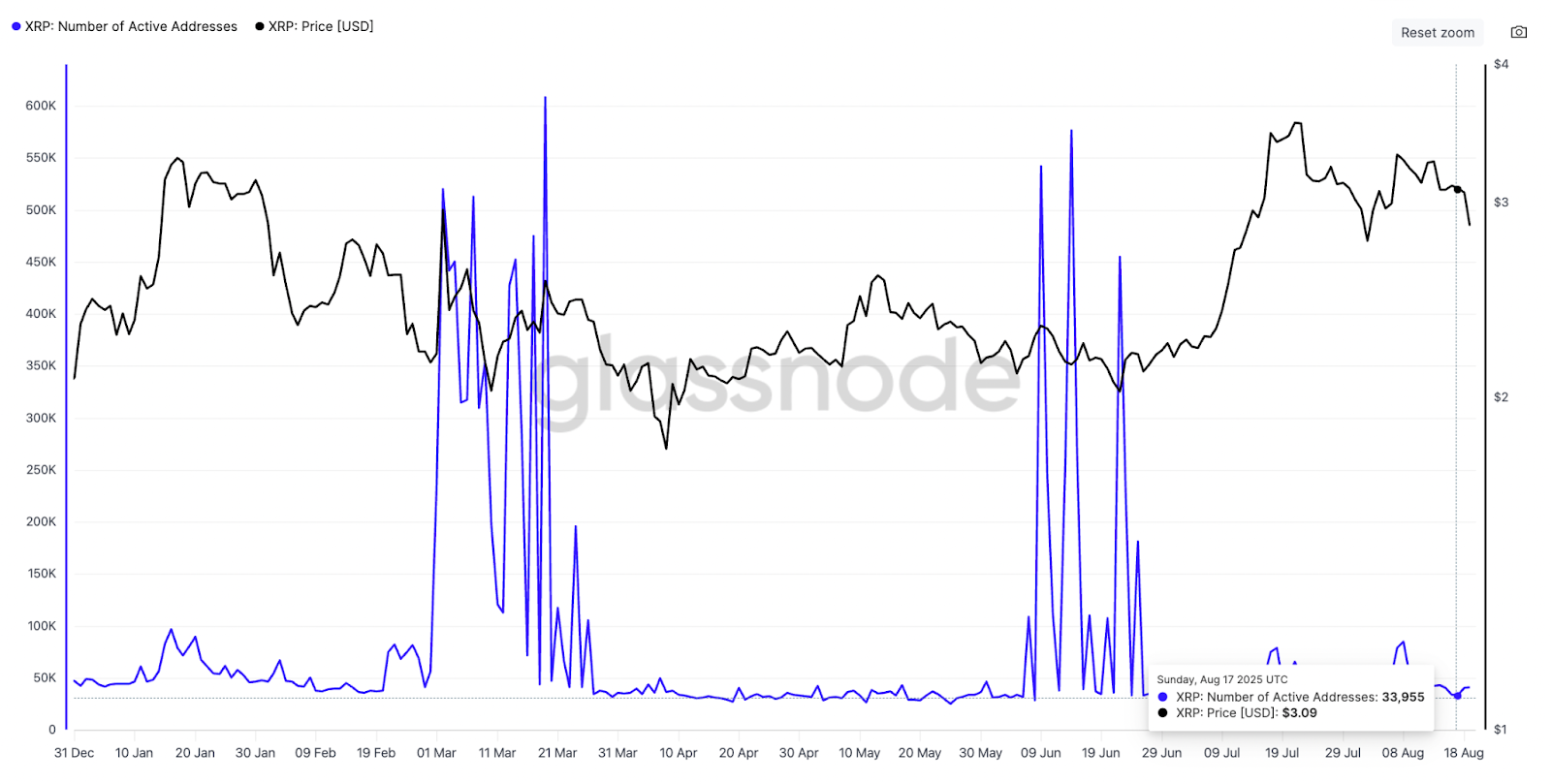

The XRP Ledger has skilled a big drop in community exercise in comparison with Q1/2025 and the interval between June and July. On-chain information from Glassnode reveals that the every day energetic addresses (DAAs) on the community are actually far beneath the numbers seen in March and June.

The ledger recorded a sturdy 608,000 DAAs on March 19 and 577,134 on June 16, reflecting excessive consumer engagement and transaction exercise. Nonetheless, there was a dramatic stoop from the tip of June via August, as proven within the chart beneath.

With solely round 33,000 every day energetic addresses, consumer transactions have decreased, probably signaling decreased curiosity or a insecurity in XRP’s near-term outlook.

Traditionally, declines in community exercise usually sign upcoming value stagnation as decrease transaction quantity reduces liquidity and shopping for momentum.

The variety of transactions has additionally decreased by 51% from 2.5 million in June to 1.25 million on the time of writing, per information from CryptoQuant.

Transaction depend and energetic addresses are broadly used to estimate the variety of customers interacting with a community. They provide invaluable insights into the community’s total exercise and consumer engagement, serving as a key indicator of blockchain adoption and interplay with the underlying token.

As such, this vital drop in these onchain indicators may drive XRP’s worth decrease, sparking hypothesis that the token might sink deeper within the brief time period.

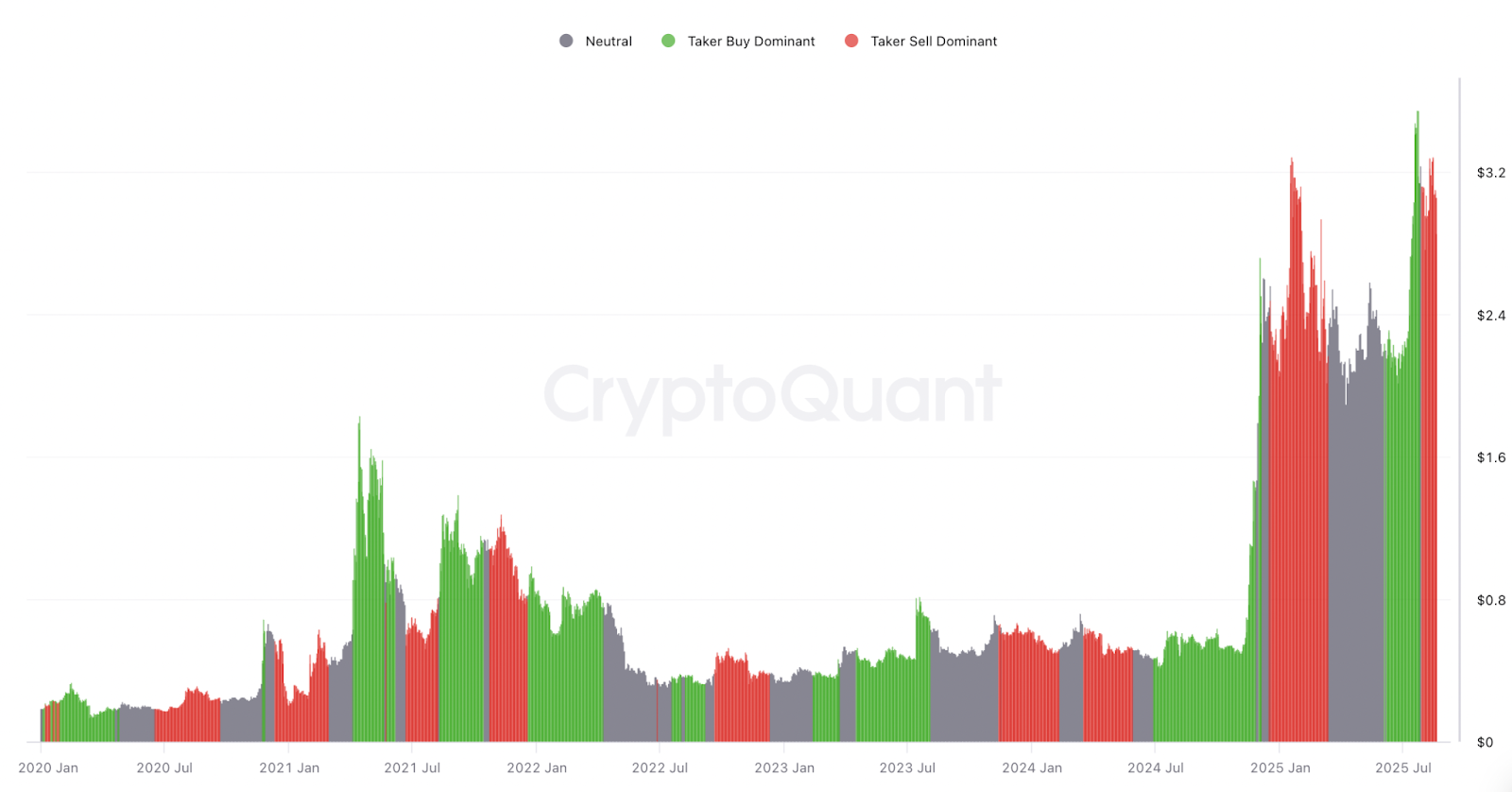

Damaging 90-day CVD backs XRP’s draw back

Analyzing the 90-day spot taker cumulative quantity delta (CVD) reveals the extent to which the sell-side exercise is intensifying.

CVD measures the distinction between purchase and promote quantity over a three-month interval.

Since July 28, promoting stress has dominated the order e-book, after the XRP/USD pair hit multi-year highs above $3.66 on July 18.

The damaging CVD (purple bars within the chart above) signifies profit-taking amongst merchants, which alerts waning demand as sellers take management.

If the CVD stays purple, it means sellers aren’t backing down, which might set the stage for one more leg down, as seen in historic corrections.

With greater than 91% of the XRP provide nonetheless in revenue at present costs, buyers might proceed locking in good points, including to the headwinds.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.