Whereas a lot of crypto chases volatility, essentially the most capital-efficient allocations of 2025 are hiding in plain sight: looping. These structured methods quietly recycle billions by way of the identical property, remodeling modest yield spreads into outsized, risk-adjusted returns. In essence, they’re the on-chain counterpart to TradFi’s repo and carry trades, now enhanced by tokenized real-world property.

What’s DeFi looping and the way does it work?

DeFi looping is a yield amplification mechanism constructed on correlated collateral and debt. The essence of looping is yield-bearing property — tokens that develop in worth over time. Good examples embrace liquid staking tokens like Lido’s wstETH, artificial {dollars} like Ethena’s sUSDe or tokenized non-public credit score funds like Hamilton Lane’s SCOPE. The method begins by depositing such a yield-bearing asset, e.g. weETH, right into a cash market account, borrowing a carefully associated asset in opposition to it, e.g. ETH, allocating the borrowed quantity again into the yield-bearing model, e.g. staking ETH on EtherFi after which redepositing it as collateral — that’s one full loop. One of the broadly adopted looping buildings is weETH (EtherFi’s wrapped staking ether) paired with ETH on lending platforms similar to Spark.

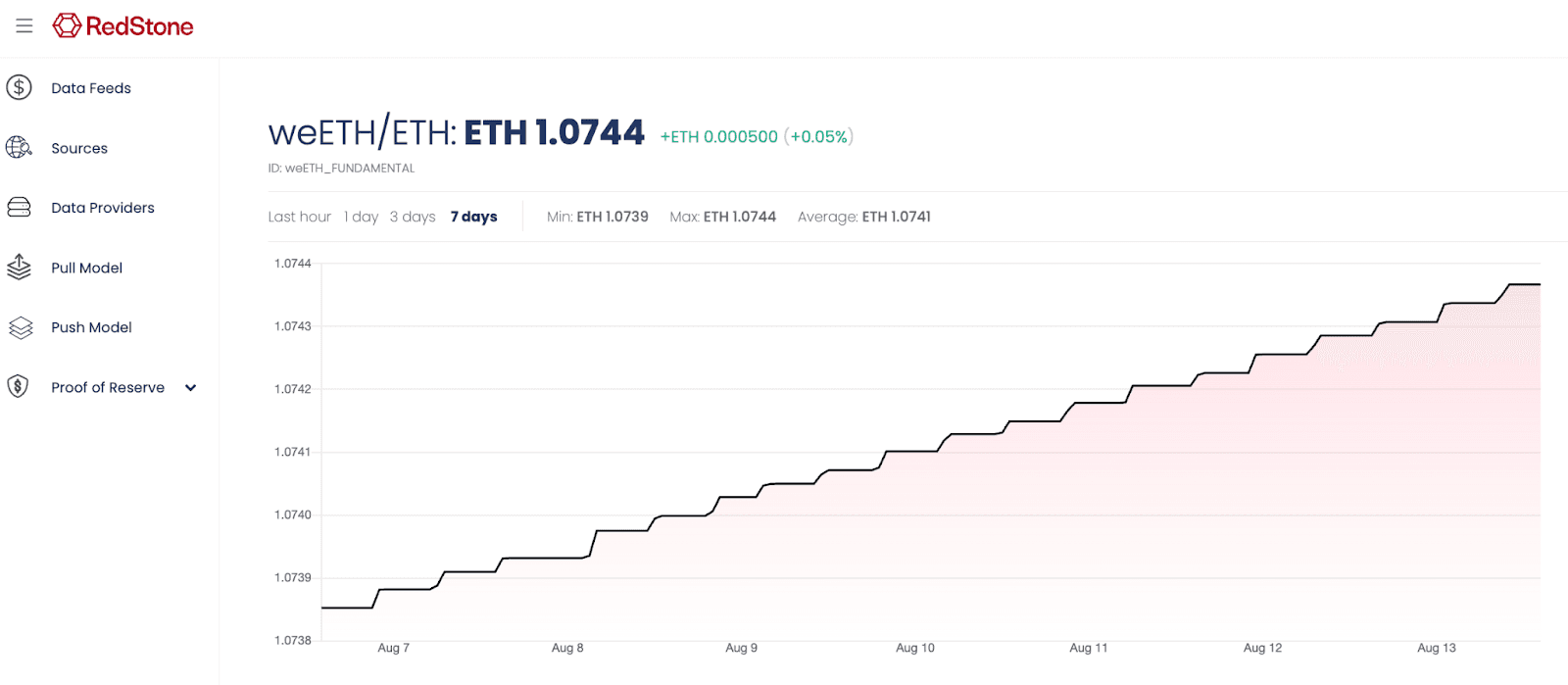

Asset design: weETH accrues staking rewards, so one unit step by step turns into price extra ETH over time. Right here, at EtherFi protocol launch 1 weETH equalled 1 ETH. Now, it equals 1.0744 ETH.

weETH / ETH worth appreciation over time by way of liquid restaking yield accrual, Supply: RedStone

Danger correlation: If weETH yields ~3 % yearly and ETH borrow charges are 2.5 %, every loop captures a 0.5 % unfold. With 90 % loan-to-value ratio and 10 loops, that unfold compounds, doubtlessly rising returns to roughly 7.5 % yearly.

Market dimension in 2025 and development potential

Contango’s Q3 2024 estimates recommended that 20 to 30 % of the $40 billion-plus locked in cash markets and collateralized debt positions was attributable to looping methods. This implied $12–15 billion in open curiosity, or roughly 2–3 % of complete DeFi TVL on the time.

At the moment, that scale is probably going a lot bigger: Aave alone holds near $60 billion in TVL. On condition that buying and selling volumes in leverage-based methods usually exceed open curiosity by an element of ten, annual transaction quantity from looping could already surpass $100 billion.

Past ETH: stable-yield property

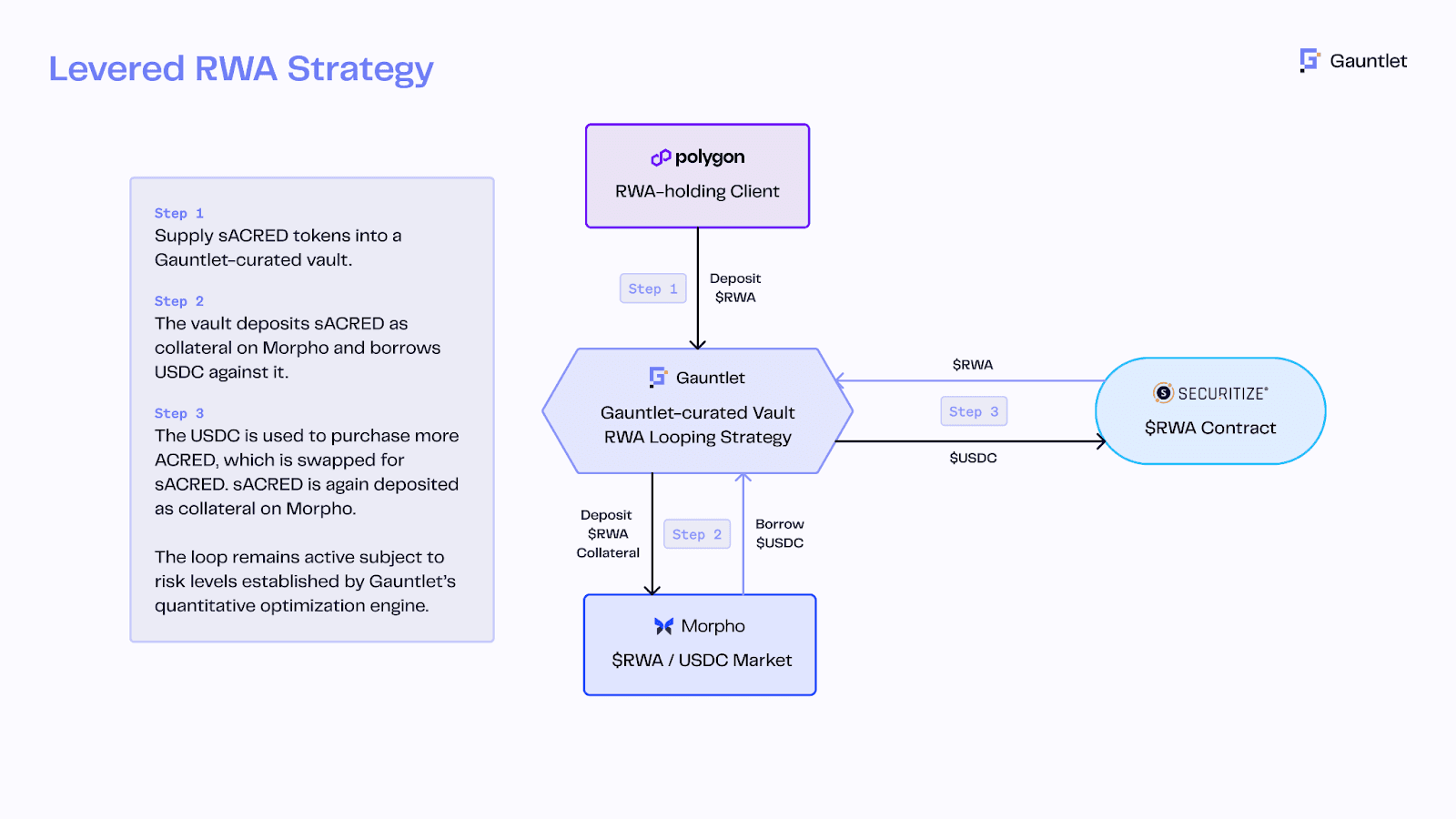

Looping can be utilized to asset pairs that aren’t essentially crypto native. A sensible instance is sACRED / USDC looping on Morpho. Right here, a token representing a tokenized non-public credit score fund (Apollo’s ACRED by way of sACRED vault) is deposited to borrow USDC, which is then transformed into sACRED and redeposited. Whereas the yield profile is designed to be predictable, it will depend on the efficiency of the underlying non-public credit score portfolio and isn’t as inherently secure as ETH staking rewards.

RWA looping technique on Morpho secured by RedStone worth feeds, Supply: Gauntlet.

Future instructions: tokenized funds as loop collateral

Establishments are bringing RWAs on-chain partly as a result of looping can amplify returns with clear, modelable dangers and auditable parameters. Seemingly development lanes embrace:

- Personal credit score automobiles, e.g., Hamilton Lane’s SCOPE, made out there by way of Securitize with every day on-chain NAV delivered by RedStone, and on-demand redemptions, positioned for regular month-to-month yield per issuer supplies.

- Money-and-carry methods like Spiko C&C, capturing predictable time period premia.

- Reinsurance-linked securities, like MembersCap MCM Fund I, traditionally have been related to low default charges and constant payouts.

Why this issues for establishments

Looping permits extra environment friendly use of capital by turning yield-generating positions into repeatable, collateralizable devices. The danger–return profile is just like conventional fixed-income and cash market desks, however right here it’s delivered with 24/7 liquidity, clear collateralization metrics and automatic place administration.

It’s certainly one of DeFi’s most battle-tested methods, with clear attraction for conventional finance: increased yields inside a framework of clear, well-defined and actively monitored dangers. As tokenized RWAs scale, looping is poised to turn into a foundational constructing block in on-chain portfolio building, additional narrowing the hole between conventional and decentralized finance.