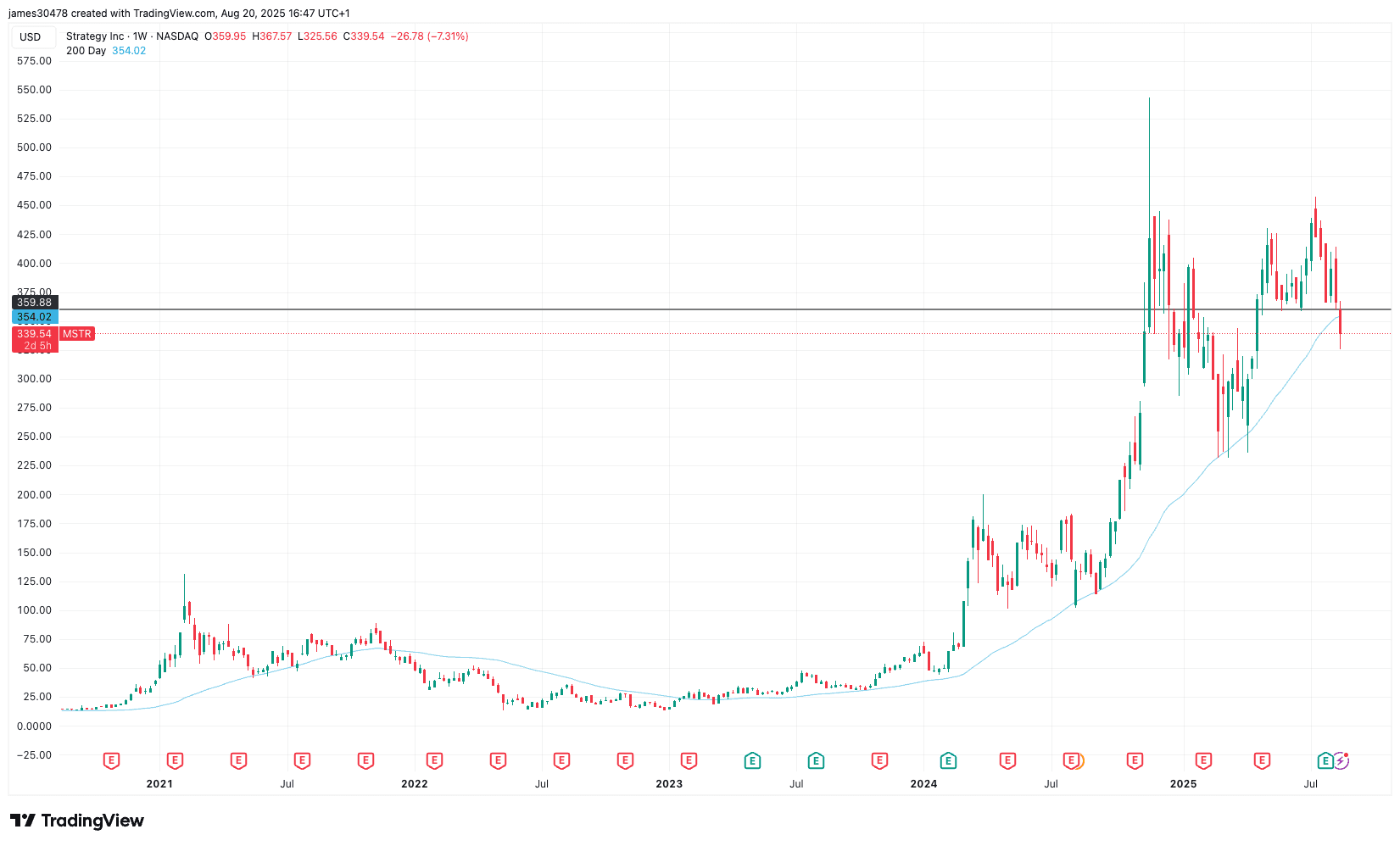

Technique (MSTR) fell to as little as $326 on Wednesday, buying and selling about 4% under the 200-Day Transferring Common (DMA) of $340, a key stage markets look ahead to buying and selling concepts.

The indicator is a broadly used technical measure that smooths out value information over roughly 9 months of buying and selling, serving to traders establish long-term traits. When a inventory trades above its 200-DMA, it’s usually seen as being in an uptrend, whereas buying and selling under it might sign potential weak spot or a shift in momentum. Due to its function as a key assist or resistance stage, the 200-DMA is carefully watched by each merchants and long-term traders.

Lately, the 200-DMA has been a notable stage of assist for MSTR.

For example, in April 2025, in the course of the so-called “Trump tariff tantrum,” the inventory examined this stage earlier than rebounding. An identical sample emerged in the course of the summer season of 2024, when MSTR as soon as once more discovered a ground across the 200-DMA earlier than resuming its upward trajectory.

Whether or not the present dip under this technical threshold proves short-term or alerts a extra sustained downturn will seemingly rely upon each bitcoin’s value motion and broader market sentiment.

Chanos notches a win

Famed short-seller James Chanos has been publicly bearish on Technique for various weeks, saying he is opened up a large wager in opposition to the Michael Saylor-led firm by shorting MSTR in opposition to a protracted in bitcoin.

Of late, the commerce has been wanting like a winner, with MSTR decrease by 21% over the previous month in comparison with bitcoin’s very modest 3.5% decline.

Market technician J.C. Parets famous on Wednesday that the ratio between MSTR and IBIT (BlackRock’s spot bitcoin ETF) has now fallen to a five-month low. “This one is accelerating rapidly,” stated Parets.