Emails race throughout the globe in milliseconds, but cash nonetheless strikes at a crawl. It will possibly take days to make funds, particularly cross-border — longer over weekends or holidays. The end result? Trillions of {dollars} are trapped the place they’ll’t earn yield.

This inefficiency is greater than an inconvenience — it’s a systemic drag. For firms and monetary establishments, delayed entry to liquidity means larger prices, constrained working capital and a structural handicap in a world that expects every part in actual real-time.

Stablecoins because the catalyst

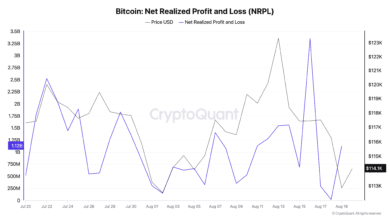

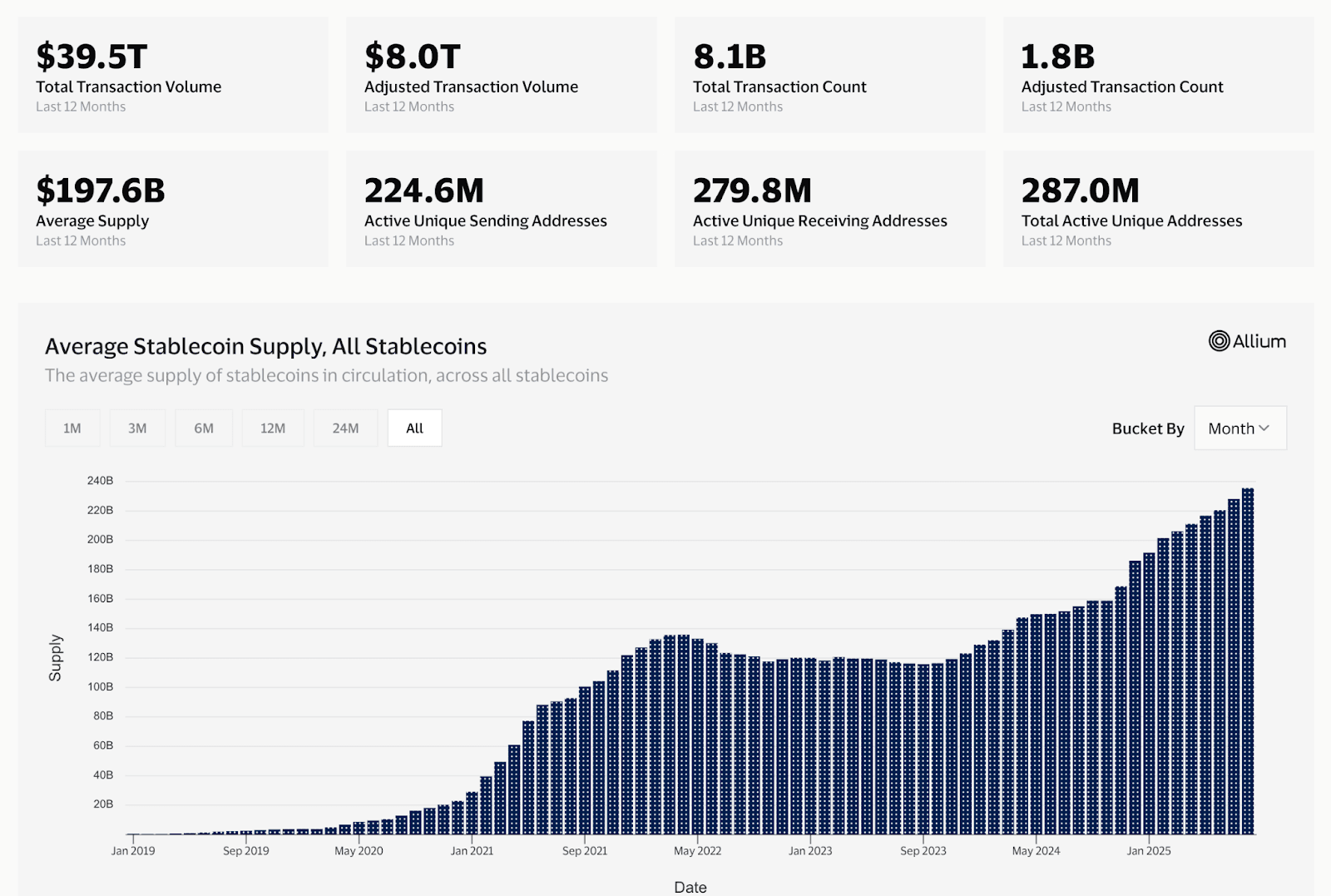

The appearance of stablecoins proved that cash may transfer on the pace of the web. Immediately, trillions of {dollars}’ value of transactions settle immediately on blockchain rails, with stablecoins offering the greenback liquidity that powers crypto markets, funds and remittances. However stablecoins themselves solely clear up half the issue.

Supply: https://visaonchainanalytics.com/

They supply pace, not yield. Stablecoin balances, in mixture a whole lot of billions of {dollars}, sometimes earn nothing. Distinction that with tokenized treasury property and cash market funds, that are low-risk, yield-bearing devices that pay the risk-free fee. The problem is that subscriptions and redemptions into and out of those merchandise nonetheless run on asynchronous, typically T+2 timelines locking out investable capital wanted within the fast time period.

Convergence and composability

The trade now stands on the cusp of convergence. The world’s main asset managers now provide tokenized cash market funds, with BlackRock’s BUIDL for instance topping $2 billion in property underneath administration.

Supply: https://app.rwa.xyz/property/BUIDL

These tokenized funds can switch and settle immediately, together with atomically, towards different tokenized devices like stablecoins. As stablecoin exercise will increase, so do money and treasury administration wants for which tokenized treasuries are the optimum answer.

What’s lacking is the connective tissue. With out impartial infrastructure to allow atomic, 24/7 swaps between stablecoins and tokenized treasuries, we’re solely digitizing previous constraints. The true breakthrough comes when establishments can maintain risk-free property and immediately convert them to money at any hour, with out intermediaries, delays or worth slippage.

The stakes

The stakes are huge. Within the U.S. alone, non-interest-bearing financial institution deposits complete practically $4.0 trillion. If even a fraction had been swept into tokenized treasuries and made immediately convertible to stablecoins, it could unlock a whole lot of billions of {dollars} in yield whereas preserving full liquidity. That isn’t a marginal effectivity — it’s a structural shift in world finance.

Critically, this future requires open, impartial and compliant infrastructure. Proprietary walled gardens might ship effectivity for one establishment, however systemic advantages solely emerge when incentives align throughout issuers, asset managers, custodians and buyers. Simply as world cost networks required interoperable requirements, tokenized markets want shared rails for liquidity.

The trail ahead

The liquidity hole isn’t a technical inevitability. The instruments exist: tokenized risk-free property, programmable cash and sensible contracts able to imposing trustless, on the spot settlement. What is required now’s urgency — by establishments, technologists and policymakers — to bridge the hole.

The way forward for finance isn’t merely quicker funds. It’s a world the place capital isn’t idle, the place the trade-off between liquidity and yield disappears and the place the foundations of economic markets are rebuilt for an always-on, world financial system.

That future is nearer than most understand. Those that embrace it’s going to outline the subsequent period of economic markets; those that hesitate will likely be left behind.