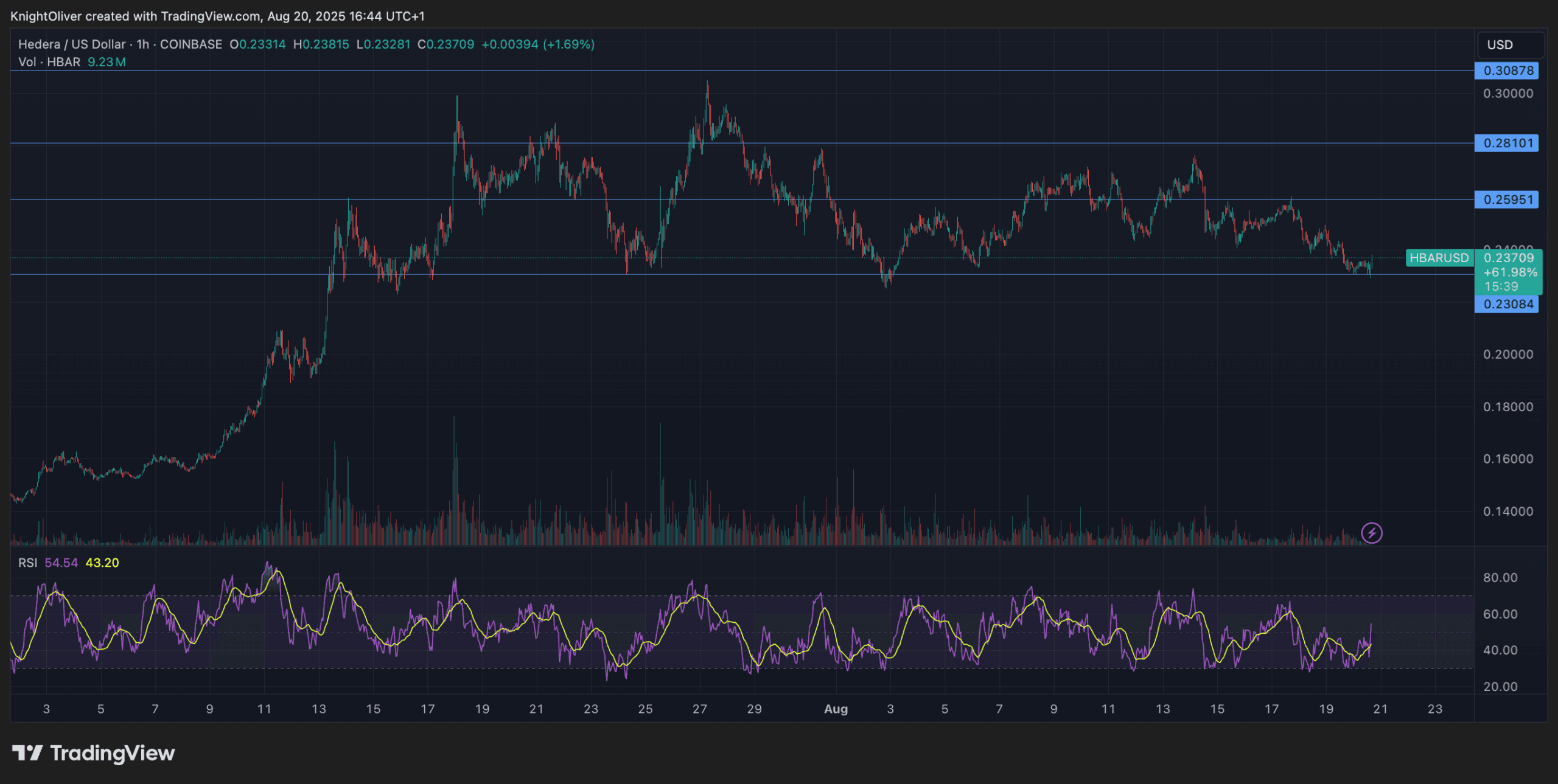

Hedera Hashgraph’s HBAR token confronted heavy promoting strain throughout a unstable 23-hour stretch between August 19 at 15:00 and August 20 at 14:00, sliding 3% from $0.24 to $0.23.

The token traded inside a good $0.01 band, marking a 4% unfold between its session excessive and low, as merchants adjusted publicity throughout different digital property. Analysts highlighted the $0.24 stage as a key level of resistance, the place shopping for momentum pale and downward strain intensified.

Probably the most pronounced exercise got here throughout the closing hour of buying and selling on August 20, when volumes surged to 85.82 million HBAR.

Market observers famous that the token tumbled to $0.23 earlier than staging a modest restoration into the shut, a sample that underscored the elevated volatility. The heavy turnover throughout this window suggests sellers had been dominant, creating short-term weak spot and testing key assist ranges.

Between 13:45 and 14:06, greater than 3.8 million tokens modified arms, coinciding with the sharpest a part of the decline. Costs briefly dipped to session lows earlier than bouncing, as shopping for curiosity re-emerged to stabilize the market.

By the ultimate minutes, HBAR recovered sufficient to shut close to $0.23, signaling that whereas draw back dangers stay, short-term assist is holding for now.

Technical Indicators Evaluation

- Token declined 3% from opening worth of $0.24 to closing worth of $0.23 over 23-hour institutional promoting interval.

- Buying and selling vary of $0.01 represents 4% unfold between absolute session excessive and low.

- Resistance stage established round $0.24 the place institutional shopping for curiosity diminished considerably.

- Help stage emerged close to $0.23 with retail shopping for offering technical ground.

- Elevated quantity of 85.82 million throughout closing hours confirms institutional distribution patterns.

- Quantity exceeded 3.8 million throughout peak promoting interval between 13:45-14:06 indicating coordinated liquidation.

- Remaining 14 minutes confirmed technical restoration from $0.23 assist stage suggesting retail shopping for curiosity.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.