Key takeaways:

-

Bitcoin volatility is anticipated to stay current forward of Fed Chair Powell’s speech on Friday.

-

Analysts say Bitcoin’s dip beneath $112,000 provides a “nice entry” alternative for merchants.

-

BTC worth might drop as little as $110,000 if key help ranges are damaged.

Bitcoin (BTC) has been trending down alongside the broader crypto market since Aug. 14, dropping to a 17-day low beneath $112,500 on Wednesday. With Federal Reserve Chair Jerome Powell’s Jackson Gap speech anticipated on Friday, markets may see unstable worth swings towards key BTC worth ranges over the subsequent few days.

Bitcoin worth key “accumulation” stage sits close to $112,000

A break beneath the $115,000 help stage was what merchants wanted to determine whether or not so as to add or cut back publicity.

MN Capital founder Michael van de Poppe noticed Bitcoin hovering at $113,700, saying that the worth has reached a “potential space of curiosity for longs.”

An accompanying chart instructed the world between the August low at $111,900 and the $113,000 psychological stage was a key stage to look at in BTC’s six-hour timeframe.

Associated: Bitcoin promote stress ‘palpable’ as BTC bid help stacks at $105K

A dip beneath this zone would supply merchants with a “nice” alternative to purchase extra at a reduction, van de Poppe stated, including:

“If we sweep the lows, that is essentially the most optimum space to purchase these. Nice space to build up.”

Comparable sentiments have been shared by fellow analyst AlphaBTC, who stated that Bitcoin’s worth was prone to revisit the month-to-month low at $111,980 earlier than making a “larger squeeze again up.”

📈#Bitcoin recreation plan 📈

Decrease timeframe, I am searching for the month-to-month low to get run then an even bigger squeeze again up.#Crypto #BTC https://t.co/l3t7AGOX0x pic.twitter.com/lyI7CN2asf

— AlphaBTC (@mark_cullen) August 20, 2025

Decrease than that, $110,000 is a vital stage to keep watch over, an space that has supported BTC worth since July 10, in accordance with buying and selling agency Swissblock. It lies inside a key demand zone outlined by the 100-day easy transferring common (SMA) at $111,000 and $105,000.

As Cointegraph reported, Bitcoin’s key help stage stays $100,000, which is embraced by the 200-day SMA and acts because the final line of protection for the bulls.

On the upside, Bitcoin should flip the world between $116,000 (50-day SMA) and $120,000 into help to safe the bull run. This is able to improve the probabilities of revisiting the all-time excessive above $124,500 or larger into worth discovery.

Will liquidations drive BTC beneath $110,000?

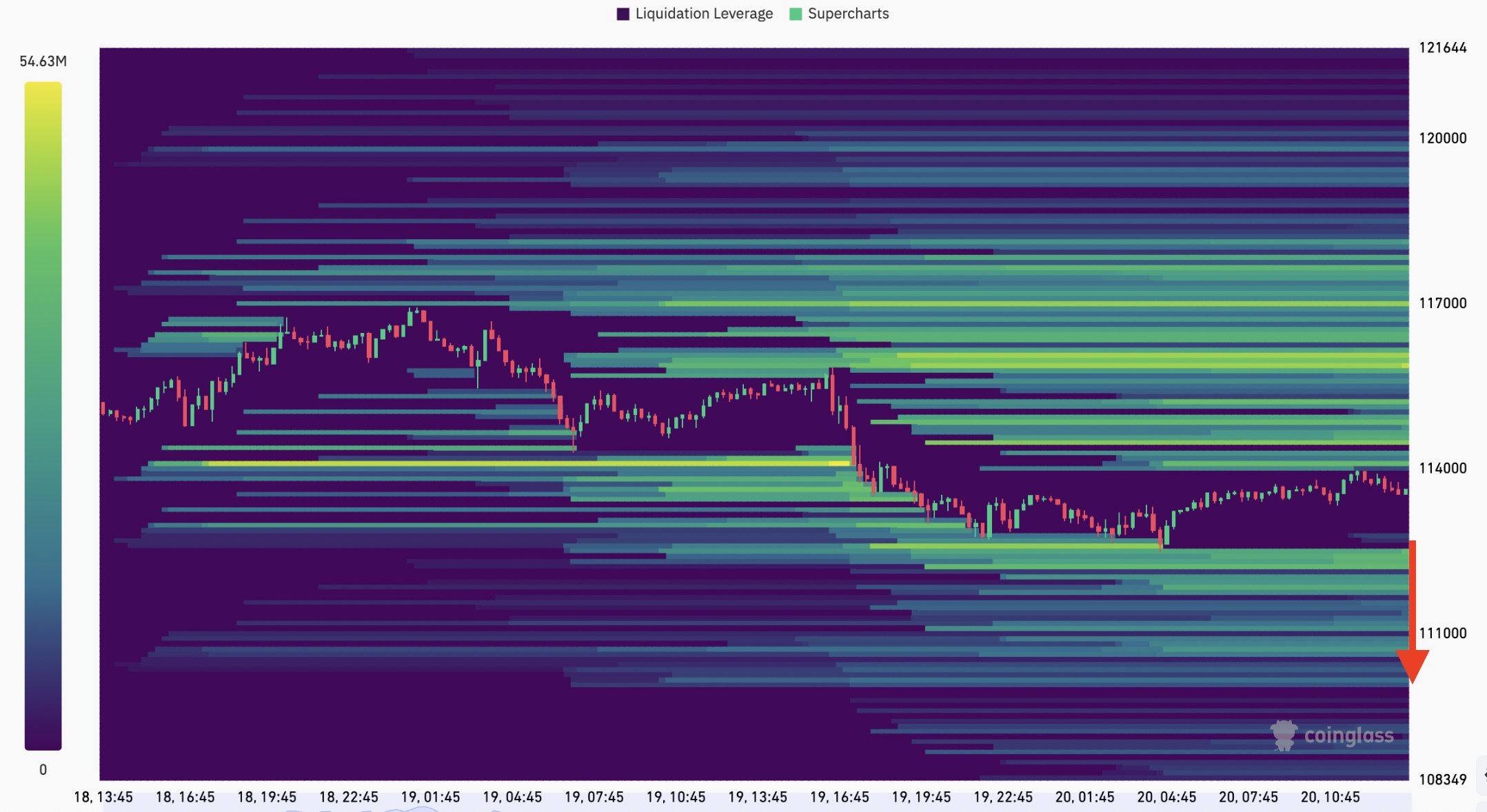

A number of merchants eye a possible downward liquidity seize with bid orders extending to $110,000.

The newest information from monitoring useful resource CoinGlass confirmed worth consuming away at round $113,000, with the majority of curiosity clustered beneath $112,000. Greater than $110.4 million bid orders have been sitting between $111,000 and $110,000.

To the upside, nonetheless, ask orders have been build up, with the majority of liquidations sitting between $115,800 and $118,100.

If the $118,000 stage is damaged, it may spark a liquidation squeeze, forcing brief sellers to shut positions and driving costs towards $120,000, which is the subsequent main liquidity cluster.

“The largest cluster in shut proximity now sits at round $120K and naturally, the native vary low at $112K continues to be in play,” stated Bitcoin dealer Daan Crypto Trades in an X put up on X, including:

“Maintain a watch out of these areas as they usually act as native reversal zones and/or magnets when worth will get near them.”

As Cointelegraph reported, elevated promoting by Bitcoin short-term holders may heighten the percentages of BTC worth dropping towards $110,000.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.