Opinion by: Nicholas Krapels, head of analysis and improvement at Mantra

By 2035, the real-world asset (RWA) market is predicted to succeed in over $60 trillion, with inexperienced RWAs well-positioned to develop into a major subsector on this international onchain motion.

As we speak, tokenized inexperienced property nonetheless signify lower than 1% of whole local weather property and a equally small share of RWAs, which at present are principally tokenized treasuries.

Nonetheless, with the entire worth of inexperienced property set to soar and the speed of tokenization rising, the inexperienced RWA market is an untapped progress alternative.

Platforms are rising to tokenize billions in inexperienced credit

Impending strict EU regulatory frameworks are set to exponentially ramp up international carbon buying and selling within the subsequent few years. And whereas provide bottlenecks and verification hurdles persist — primarily because of the infancy of accepted and controlled tokenization practices — the prospect of programmable inexperienced property onchain has impressed many bold infrastructure initiatives, notably in rising markets.

For a proof-of-concept, simply have a look at Dimitra, which makes use of blockchain and AI to assist smallholder farmers enhance productiveness and construct extra resilient agricultural methods. Their focus is on cacao manufacturing in Brazil’s Amazon and carbon credit score initiatives in Mexico. These are initiatives that can enable direct funding in smallhold farms, in the end offering venture funding and estimated returns between 10% and 30% yearly.

Exterior of agriculture, however nonetheless very a lot targeted on making a class poised for better and greener good, sits Liquidstar. Its waypoint stations cost batteries, allow e-mobility, generate atmospheric water, present web connectivity and host micro-data facilities. For powerless communities, it’s a leapfrog into wi-fi, sustainable electron ecosystems.

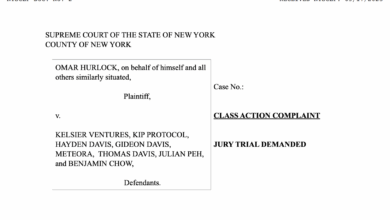

A Liquidstar waypoint arrange final yr in Jamaica. Supply: Liquidstar

Within the subsequent decade, digital innovation fostered by regulatory readability will provide international society its finest likelihood to reconcile the all-too-often incompatible objectives of sustainability and profitability.

Whereas inexperienced property was anathema to profit-driven buyers, alienated by the complicated environmental, social and governmental narrative, there are indicators of “inexperienced shoots” within the nascent inexperienced RWA motion.

Not like their Web2 counterparts, blockchain efficiencies enable tokenized inexperienced property to comprehend synergies that remodel beforehand undesirable local weather property into a brand new breed of worthwhile ones.

Inexperienced RWA is a trillion-dollar addressable market

Originating with the Kyoto Protocol within the late Nineteen Nineties, carbon credit incentivize greenhouse fuel emission reductions by initiatives equivalent to reforestation, renewable power, methane seize and soil reconditioning.

Briefly, every credit score represents one ton of CO₂ lowered, averted or eliminated. Compliance schemes just like the EU Emissions Buying and selling System initially drove the market. It’s the cap-and-trade system for environmental regulation you will have heard about.

After gaining traction within the 2010s — owing to rising company sustainability objectives — the Voluntary Carbon Market (VCM) is rising. It’s $1.7 billion and anticipated to develop by 25% yearly for the following 10 years. The carbon dioxide removing (CDR) market is predicted to be $1.2 trillion by 2050. In response to S&P World, “sustainable bonds” already make up 11% of the worldwide bond market in 2024. “Local weather bonds” are an previous ESG time period; nevertheless, the Local weather Bonds Initiative tagged the cumulative quantity of the inexperienced element of its property to succeed in $3.5 trillion by the tip of 2024. Renewable power certificates (RECs) and biodiversity credit additional increase this economic system.

As proven by initiatives like CarbonHood’s effort to tokenize $70 billion in carbon credit, broad adoption remains to be in its early levels. This determine represents simply 3.5% of a a lot bigger $2-trillion asset ebook.

Timing is essential

Why now? Whereas the generally criticized ESG narrative massively underperformed for capital allocators, the thesis was not completely misinformed.

As early as 2028, the Paris Settlement (signed in 2015) is programmatically designed to introduce way more stringent local weather laws. These restrictions might spike demand for carbon credit and inexperienced power property. The worldwide objective is to restrict warming to 1.5°C, with international locations submitting Nationally Decided Contributions (NDCs) to chop emissions.

Associated: Carbon market will get a much-needed enhance from blockchain know-how

These commitments will tighten over time, with stricter environmental targets phasing in from 2028 to 2030. A key driver is Article 6 of the Paris Settlement, notably Article 6.4, which establishes a world carbon credit score buying and selling market. This mechanism, finalized at COP26, permits international locations and firms to purchase and promote credit to satisfy NDCs, with full implementation anticipated by 2028.

This might massively enhance demand for carbon credit, as nations equivalent to China (aiming to peak emissions by 2030) and India (focusing on a forty five% discount in emissions depth by 2030) lean on credit to bridge gaps.

The EU’s 2030 Local weather Goal Plan, aiming for a 55% emissions lower from 1990 ranges, additionally ramps up stress on the cap-and-trade compliance markets, driving strong demand for inexperienced power property effectively into the longer term.

Nonetheless, to hit the 1.5°C goal, international emissions should drop 7.6% yearly from 2020 to 2030, requiring a surge in inexperienced investments. VCM’s large anticipated progress is based upon compliance markets doubtlessly reaching lots of of billions, fueled by laws just like the EU’s Carbon Border Adjustment Mechanism, set for 2026-2028, which taxes high-carbon imports.

Fundamental local weather property (assume bonds and thematic exchange-traded funds), already with billions in property below administration, will doubtless see exponential progress because the funding combine shifts. Provide constraints and verification points might bottleneck this market. Nonetheless, by blockchain-based tokenization and verification, effectivity and transparency might be improved.

The Center East is well-positioned to emerge as a powerhouse for inexperienced RWAs

The package deal of EV insurance policies, photo voltaic parks and government-backed blockchain registries in these applications is accelerating adoption throughout the area.

By means of EV adoption and carbon credit score initiatives, the UAE and Saudi Arabia are advancing demand for inexperienced property. The UAE’s EV insurance policies intention for 50% electrical automobiles by 2050, with Dubai focusing on 100% eco-friendly taxis by 2027. Their Internet Zero by 2050 initiative encourages initiatives like photo voltaic parks, EV charging networks and tokenized carbon credit to spice up sustainable investments and eco-friendly city improvement. Imaginative and prescient 2030 contains 50,000 EV charging stations by 2025.

Each international locations are investing in renewables. Look to Dubai’s Mohammed bin Rashid Al Maktoum Photo voltaic Park, which not too long ago reached 3.86 gigawatts whole capability and is aiming for 7.26 GW by the tip of the last decade, and Saudi Arabia’s EV battery metals plant to additional drive inexperienced asset demand. Once more, blockchain know-how helps these efforts through carbon credit score registries and tokenization.

The Highway and Transport Authority (RTA) itself is main many of those efforts. Particularly, the RTA has focused supply corporations, encouraging a change to electrical bikes, which might massively scale back carbon emissions. It’s an initiative driving Pyse, which is placing supply EVs on the highway to interchange high-emission supply automobiles.

The UAE’s Ministry of Local weather Change and Surroundings is growing a blockchain-based nationwide carbon credit score registry to bolster transparency, and hubs like Dubai’s DMCC Crypto Centre and the Abu Dhabi World Market monetary heart are fostering innovation in tokenizing environmental property.

It’s a robust tailwind.

It’s nonetheless early within the tokenization recreation

Whereas blockchain know-how might assist ease the transition to trendy climate-friendly infrastructure and progressive authorities initiatives have been put in place, adoption nonetheless lags.

The United Nations’ Financial and Social Fee for Western Asia not too long ago highlighted the rising curiosity in utilizing blockchain know-how to scale up sustainable power, in addition to carbon administration applied sciences and carbon markets. Only a few of the UAE’s EV infrastructure initiatives and Saudi Arabia’s clear power ventures explicitly use blockchain as a result of they’re hampered by regulatory ambiguity and technical obstacles. Nonetheless, as governments deal with hyperscaling these initiatives, such utilization charges ought to quickly enhance over the following few years.

Projections counsel the inexperienced asset market would wish to increase from a peak of $2.1 trillion in 2024 to $5.6 trillion per yr from 2025 to 2030 simply to remain on monitor to satisfy the minimal necessities for international web zero. These prices are pushed by mechanisms like Article 6.4 and rising demand for clear, fractional possession of property like carbon credit and biodiversity tokens.

Blockchain’s potential to streamline verification and liquidity is evident. Widespread adoption hinges on resolving regulatory fragmentation and infrastructure gaps. As well as, client schooling is important to deliver these merchandise onchain after which to market.

Tokenization know-how for inexperienced property is primed for progress, however the market stays in “catch-up mode,” counting on coverage alignment and private-sector collaboration to unlock its multitrillion-dollar potential.

Opinion by: Nicholas Krapels, head of analysis and improvement at Mantra.

This text is for basic info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the writer’s alone and don’t essentially replicate or signify the views and opinions of Cointelegraph.