Key factors:

-

Bitcoin heads again beneath $113,000 on the Wall Avenue open as bulls fail to clinch help.

-

BTC worth manipulation is one rationalization for the draw back, with trade order-book bid liquidity in focus.

-

Extra crypto market volatility is anticipated from the Federal Reserve’s Jackson Gap occasion.

Bitcoin (BTC) sought new native lows at Wednesday’s Wall Avenue open as bulls struggled to halt a repeat US sell-off.

Bitcoin worth stress brings again “Spoofy the Whale”

Knowledge from Cointelegraph Markets Professional and TradingView adopted BTC/USD because it sank beneath $113,000 after initially reclaiming it after the each day open.

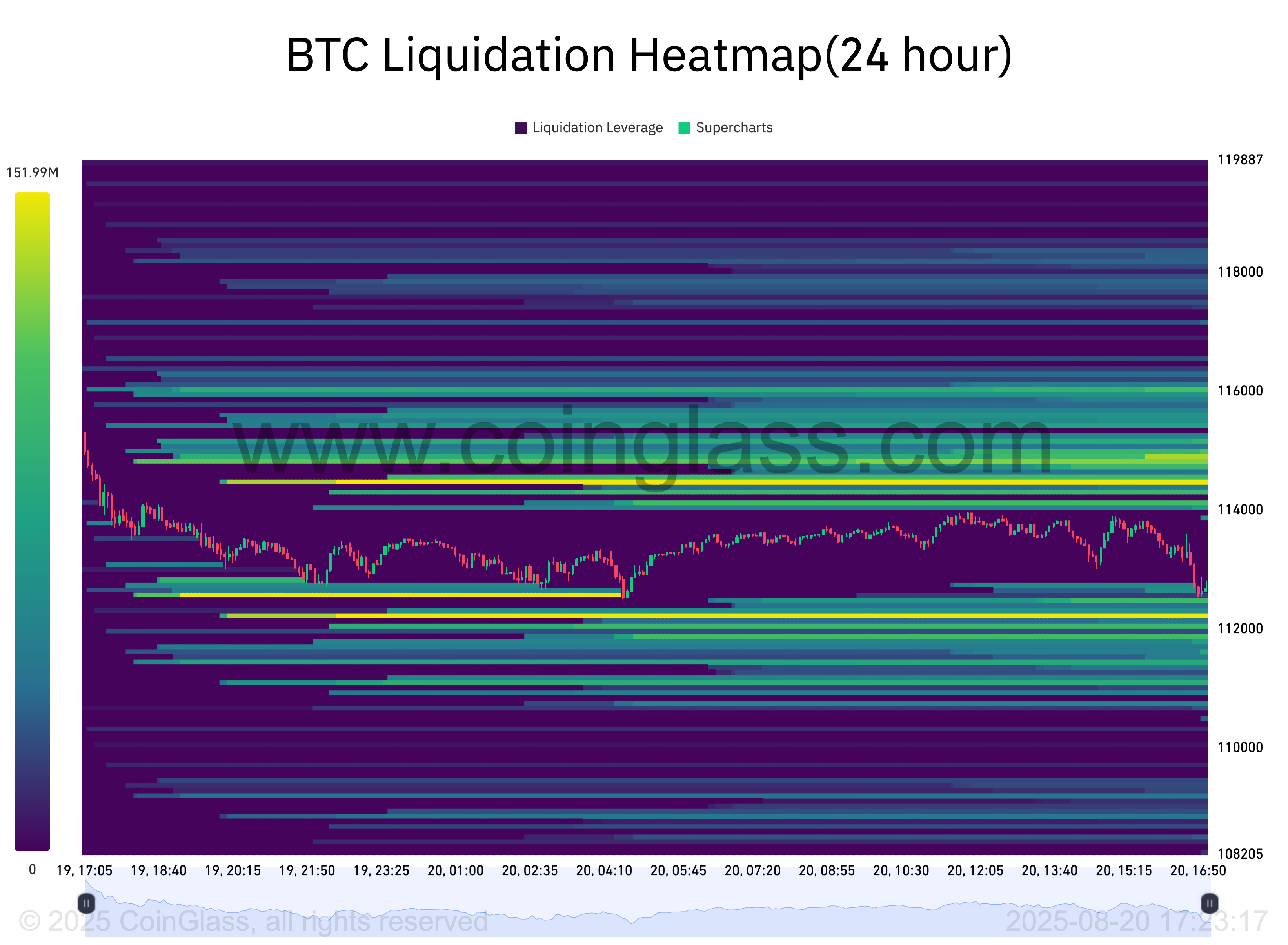

Bid liquidity was being taken on exchanges on the time of writing, with $112,300 now a degree of curiosity, per information from CoinGlass.

“$BTC Took out a bunch of liquidity on each side for the previous 6 weeks, because it ranged round this similar worth area,” fashionable dealer Daan Crypto Trades summarized on liquidity circumstances in his newest put up on X.

“The most important cluster in shut proximity now sits at round $120K and naturally the native vary low at $112K remains to be in play. Maintain an eye fixed out of these areas as they usually act as native reversal zones and/or magnets when worth will get near them.”

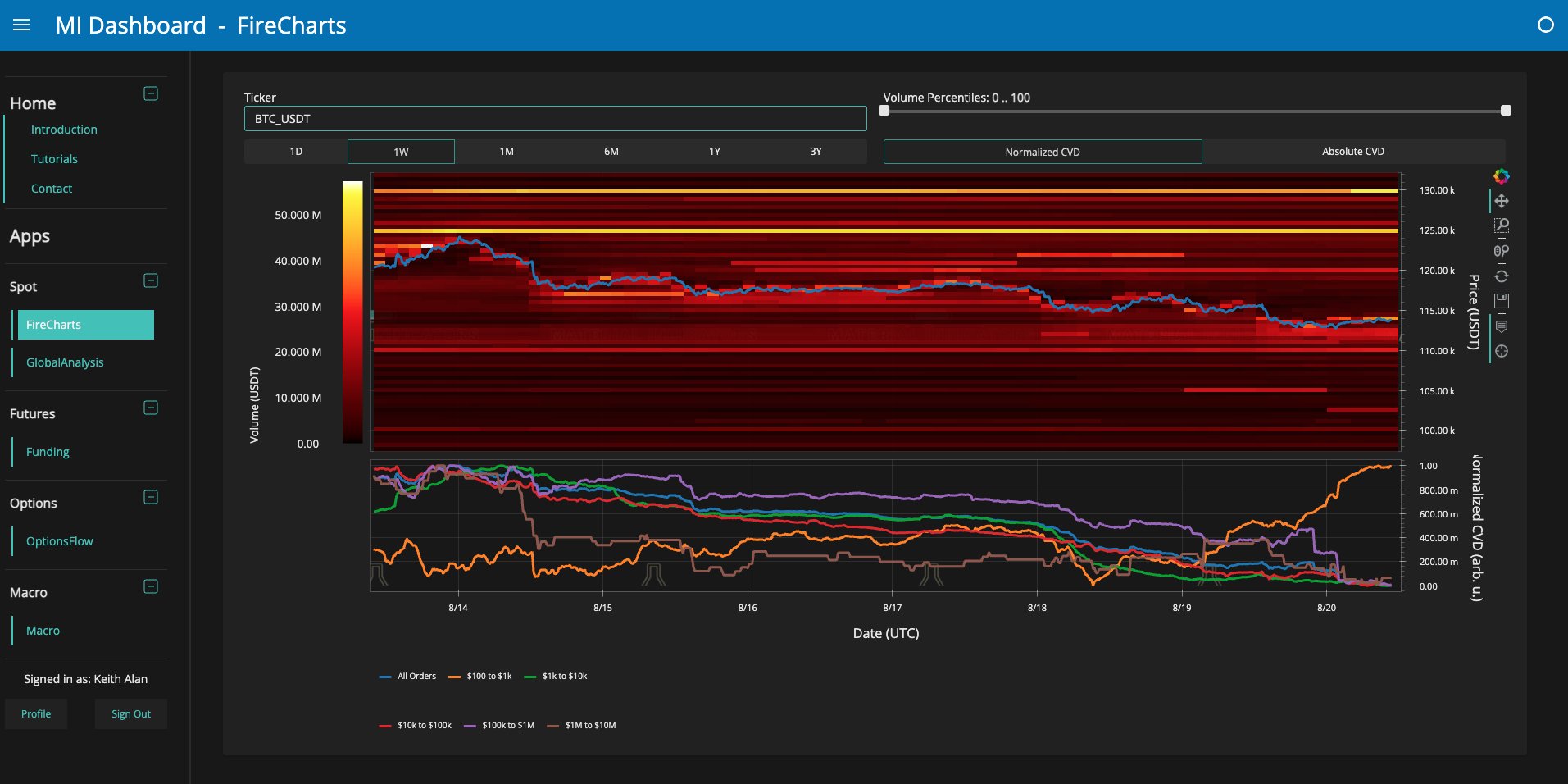

Keith Alan, co-founder of buying and selling useful resource Materials Indicators, urged that extra bid liquidity showing decrease down the order e book — together with “plunge safety” at $105,000 — could possibly be a type of worth manipulation.

Alan referred to entities for whom he coined the phrases “Spoofy the Whale” and the “Infamous B.I.D.” — each apt to artificially affect worth motion in current months.

“Too quickly to make any assumptions, however the affect on worth course would be the similar,” he concluded.

“Bids shifting decrease invitations worth to maneuver decrease.”

Persevering with, fashionable commentator TheKingfisher warned that Bitcoin might “bleed” additional, which might have vital penalties for altcoins.

“Altcoins presently present a balanced skew. We would see a minor retrace geared toward liquidating high-leverage shorts. Momentum stays regular,” a part of an X put up learn on the day.

“Nonetheless, we might see a gradual bleed, cascading block by block. Whereas majors stay secure, a 5% BTC transfer might set off 10–30% drops in alts.”

A silver lining got here from fashionable dealer and analyst Rekt Capital, who in contrast present worth motion to earlier bull-market corrections.

“Some of the constructive issues about this present pullback is that this similar kind of retrace happened at this similar second within the cycle in each 2017 and 2021,” he advised X followers.

“In each 2017 and 2021, every of these retraces preceded upside to new All Time Highs.”

All eyes on Fed’s Powell at Jackson Gap

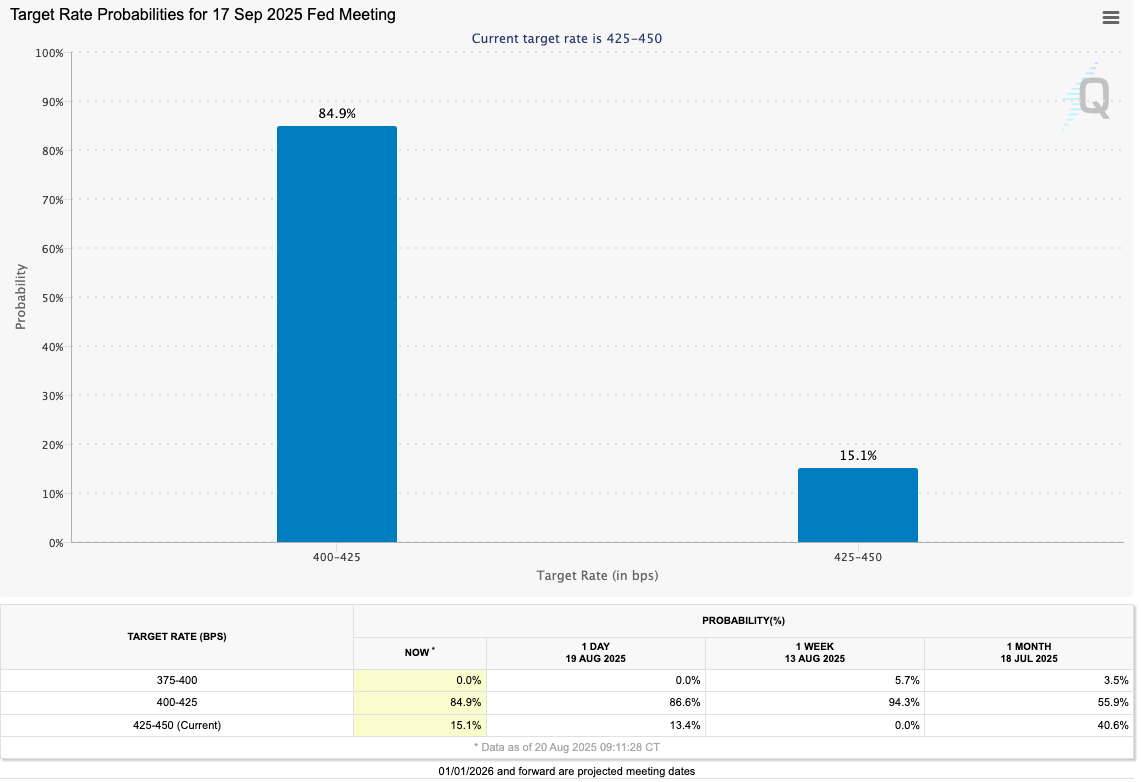

With the minutes of the US Federal Reserve’s July Federal Open Market Committee (FOMC) assembly due, buying and selling agency QCP Capital seemed to Friday’s speech by Chair Jerome Powell.

Associated: Dip patrons ‘stopped the prepare,’ 5 issues to know in Bitcoin this week

Below heavy stress to chop rates of interest, Powell will take to the stage on the Fed’s annual Jackson Gap financial symposium.

As Cointelegraph reported, final yr noticed Powell channel particulars about forthcoming charge cuts. His language can be watched by markets searching for affirmation that September’s assembly will yield that consequence.

“The stakes are excessive: setting the trail of financial coverage as markets stability easing inflation towards rising labour dangers,” QCP wrote in its newest “Asia Colour” replace on Wednesday.

“Markets are presently pricing an 80–95 % chance of a 25‑foundation‑level minimize on the 17 Sep FOMC, but incoming information might shift expectations rapidly.”

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.