Cryptocurrency traders have been bracing for the US Federal Reserve’s annual gathering in Jackson Gap on Friday, the place Chair Jerome Powell’s remarks might present key alerts on rate of interest coverage heading into September’s Federal Open Market Committee assembly.

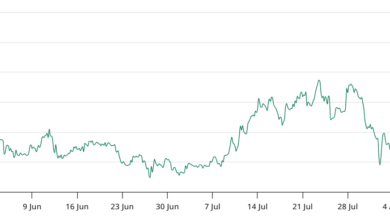

Bitcoin (BTC) briefly fell to $112,565 on Wednesday, a two-week low final seen on Aug. 3, Cointelegraph information confirmed.

Bitcoin’s dip beneath $113,000 was a snapshot of “rising nerves out there” as macroeconomic tensions surrounding Powell’s speech have been inflicting “concern spikes” amongst digital asset merchants, in response to Ryan Lee, chief analyst at Bitget trade.

“Now, letting the narratives settle and liquidity return may pave the way in which for a rebound,” the analyst advised Cointelegraph, including that if the $112,000 help degree holds till the speech, it might present the “setup for the subsequent leg of the bull run relatively than a reset.”

Associated: Crypto in US 401(ok) retirement plans might drive Bitcoin to $200K in 2025

Firms hold accumulating Bitcoin

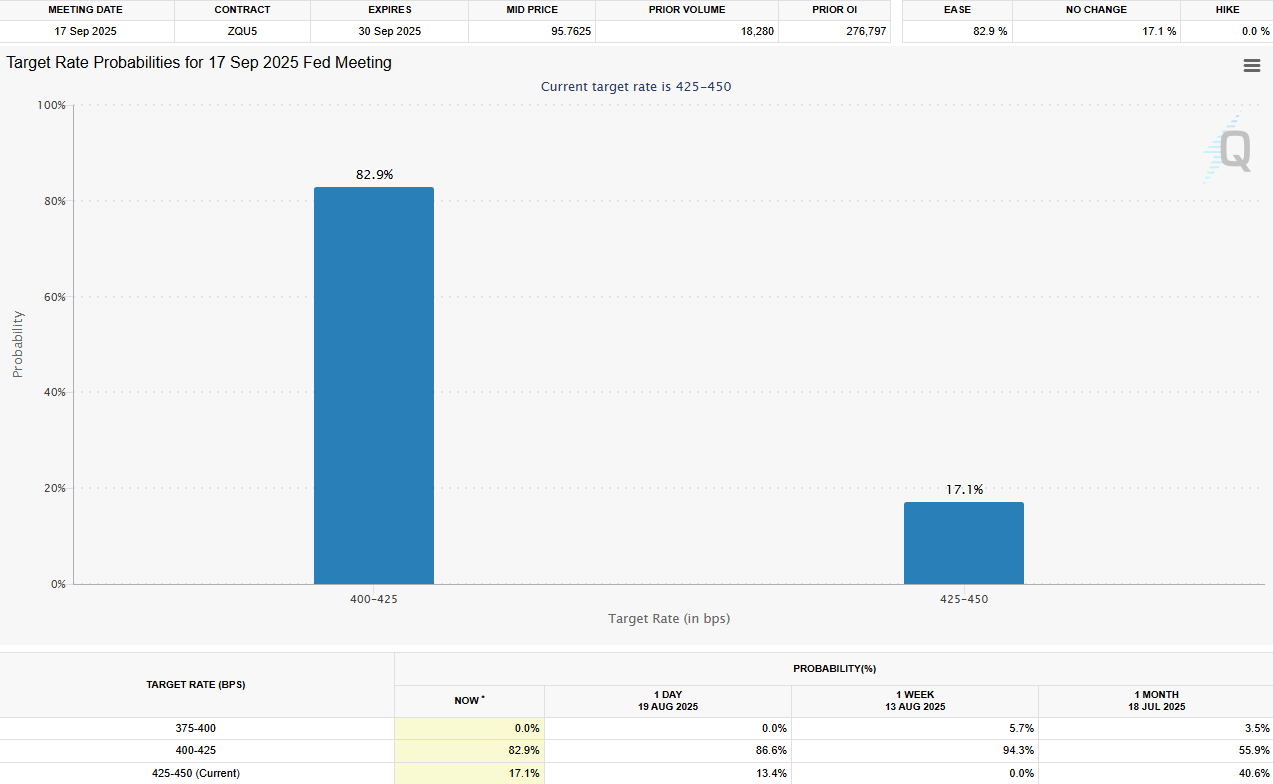

Investor considerations over a possible rate of interest minimize delay have been exacerbated on Aug. 12, after the US Client Worth Index (CPI) confirmed client costs rising 2.7% year-over-year, which remained unchanged from June, however properly above the Fed’s 2% goal.

Following the CPI information, expectations for an rate of interest minimize fell by over 12%, to 82% on Wednesday, down from over 94% every week in the past, in response to the newest estimates of the CME Group’s FedWatch instrument.

The primary rate of interest minimize of 2025 might develop into a big market catalyst, triggering expectations of two or three whole rate of interest reductions earlier than the tip of the 12 months, in response to André Dragosch, head of European analysis at crypto asset supervisor Bitwise.

“The second you see additional charge cuts by the Fed, the curve will steepen, which means much more acceleration and US cash provide progress,” Dragosch advised Cointelegraph, including that the speed cuts often is the most important macro improvement to “help” the continuation of Bitcoin’s rally “not less than till the tip of the 12 months.”

Associated: Ether dealer turns $125K into $43M, locks in $7M after market downturn

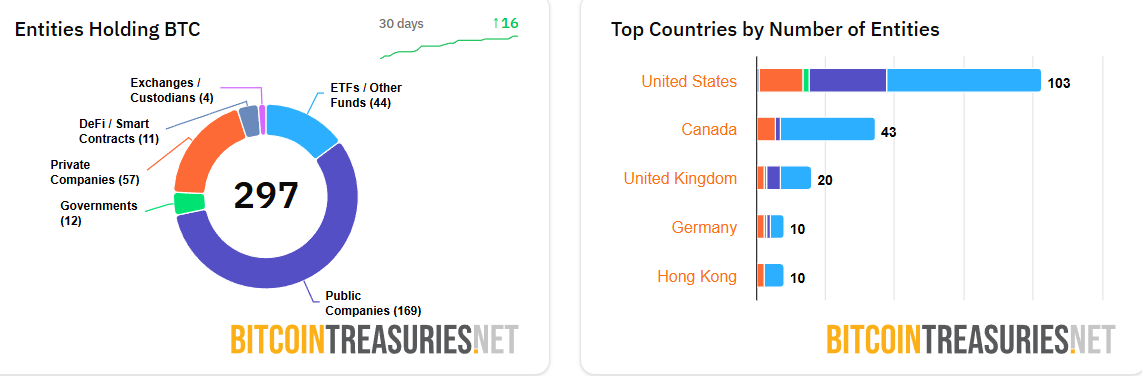

Regardless of a big sentiment shift amongst retail traders, companies continued buying the world’s two main cryptocurrencies.

No less than 297 public entities have been holding Bitcoin, up from 124 firstly of June.

These included 169 public corporations, 57 non-public corporations, 44 funding and exchange-traded funds, and 12 governments that scooped up 3.67 million BTC, representing over 17% of the overall provide, in response to BitcoinTreasuries.NET.

Journal: Bitcoin OG Willy Woo has offered most of his Bitcoin — Right here’s why