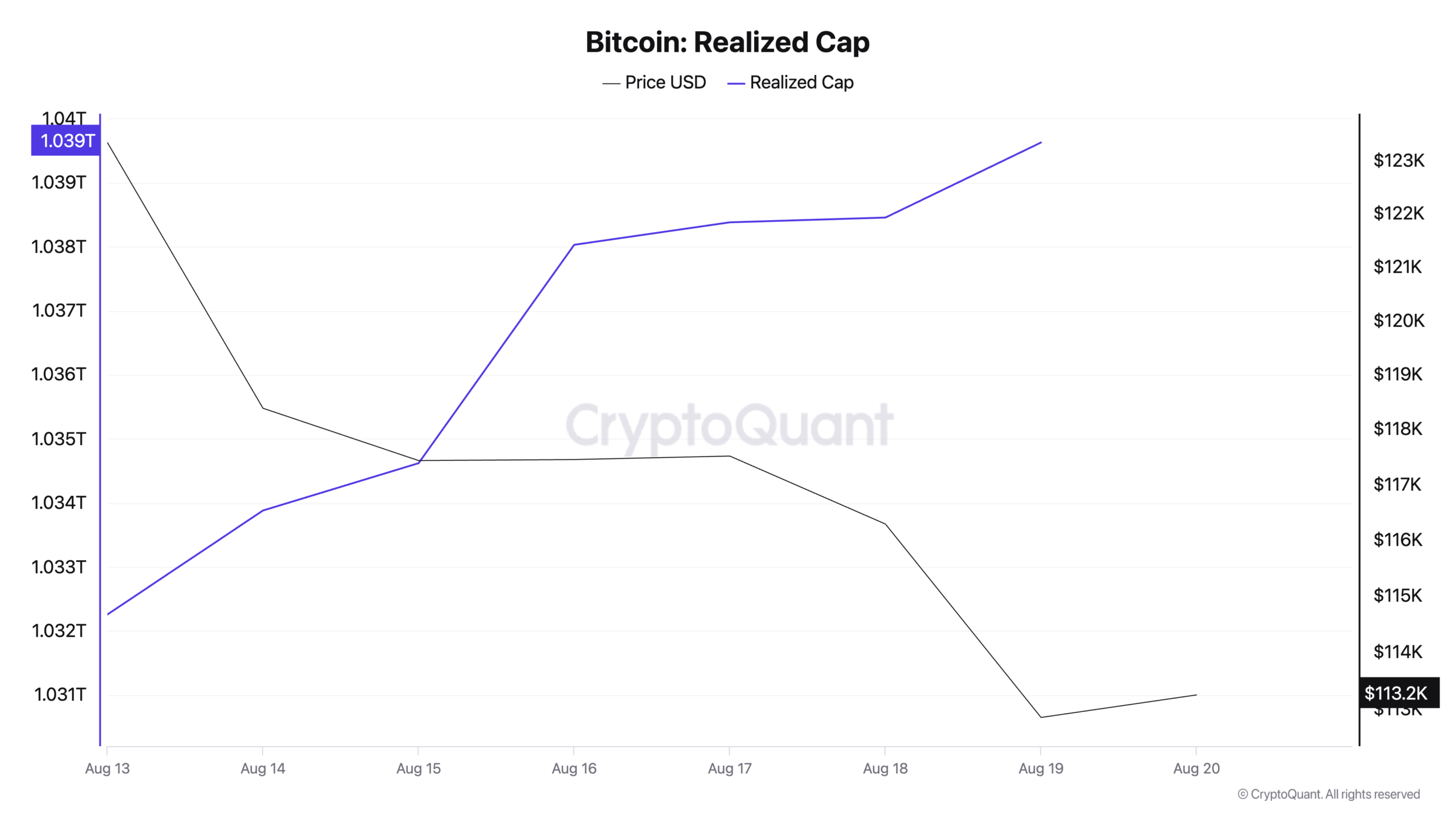

Bitcoin’s spot value fell on Aug. 19 whereas realized cap climbed, a textbook case of how on-chain price foundation can advance even on a purple day.

The day by day shut dropped 2.94% from $116,284 on Aug. 18 to $112,861 on Aug. 19. The realized cap rose by $1.172 billion over the identical window, from $1.038456 trillion to $1.039628 trillion.

The transfer seems odd provided that you deal with realized cap as a mark-to-market gauge. It isn’t. It revalues cash solely after they transfer on-chain and assigns every shifting coin the value on the time of that transfer. Cash that sit nonetheless retain their prior foundation, so many of the provide stays anchored whereas a skinny slice of transacting provide reshapes the mixture.

Mechanically, every UTXO that strikes contributes the distinction between the value at transfer time and its earlier foundation. If a coin final moved years in the past at $8,000 and transacts close to $113,000, its realized worth jumps by about $105,000.

Repeat that impact throughout sufficient low-basis provide, and the sum can rise even because the day by day shut is decrease than the day earlier than. The worth drop solely drags realized cap if many cash transfer at costs under their outdated foundation, which might register as vital realized losses.

Issuance provides a gradual tailwind. With a 3.125 BTC block subsidy and roughly 144 blocks per day, about 450 new BTC enter the ledger day by day.

Valued on the day’s low, roughly $50.8 million was inserted into the realized cap on Aug. 19. That covers about 4.3% of the $1.172 billion enhance. The remainder, roughly $1.121 billion, got here from repricing present cash above their historic bases as they moved.

This sample tells you that turnover on Aug. 19 skewed towards older, cheaper provide being spent at present costs, whereas current high-basis cash largely stayed put.

As a result of realized cap solely strikes when cash do, it usually drifts larger throughout uptrends and may maintain agency throughout shallow pullbacks if spending is dominated by long-dormant cash realizing features.

The mirror picture reveals up in true stress occasions, when a big slice of current patrons strikes cash at losses, pulling the realized cap decrease alongside the value.

The put up Why Bitcoin’s realized cap spiked as value fell to $112k appeared first on CryptoSlate.