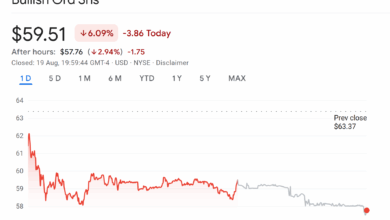

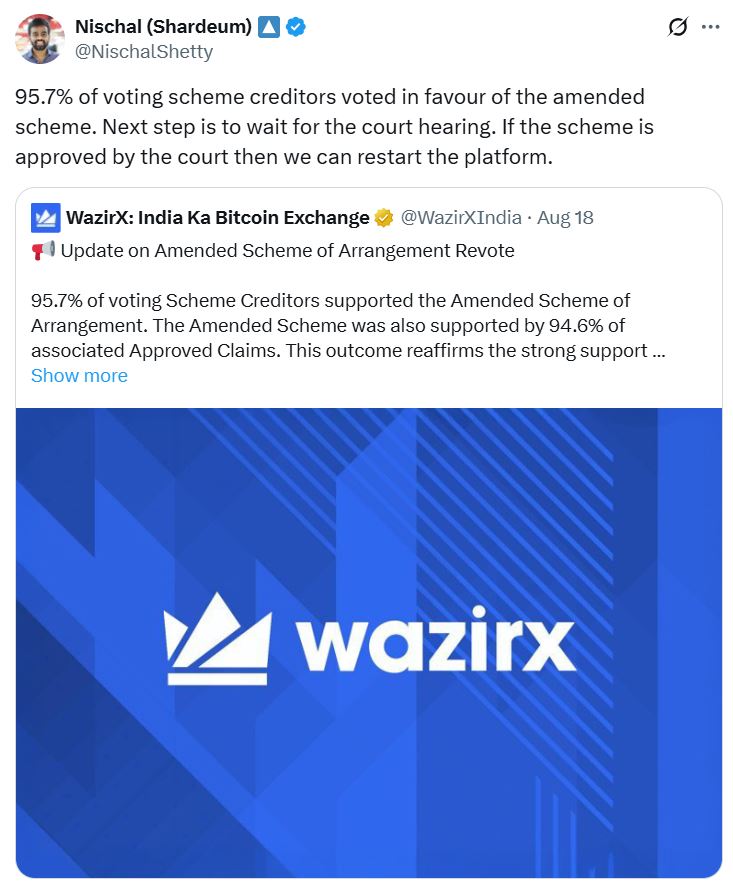

Crypto trade WazirX customers are doubtlessly one step nearer to recovering funds greater than a yr after a $234 million hack of the trade — with 95% of voting collectors greenlighting a brand new restructuring plan that had been shot down by the Singapore Excessive Courtroom earlier this yr.

WazirX misplaced $234 million of crypto from a Protected Multisig pockets mid-July 2024 in an assault since attributed to North Korean hackers, forcing them to quickly pause all crypto and Indian rupee withdrawals on the platform.

On Monday, WazirX founder Nischal Shetty stated that if the Singapore Excessive Courtroom approves the most recent restructuring proposal, the trade would restart and start compensating customers inside 10 days of “the scheme taking impact.”

The remark contrasts with a city corridor on July 30, the place George Gwee, a director at restructuring agency Kroll working with WazirX, estimated customers must wait between two and three months after Excessive Courtroom approval earlier than they may obtain any funds again.

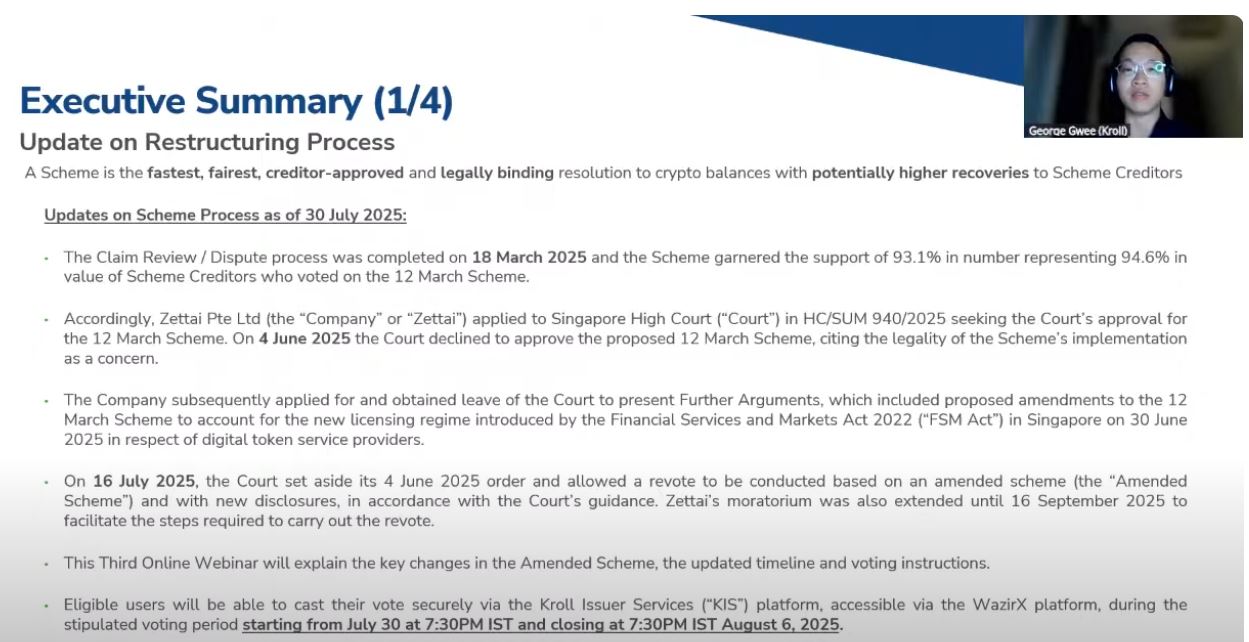

New vote compelled after earlier plan was shot down

Almost 150,000 collectors solid a vote between July 30 and Aug. 6, representing over $206 million of the misplaced funds, in response to WazirX.

Customers accredited the same scheme in April; nevertheless, it fell by the wayside after the Singapore Excessive Courtroom didn’t approve it due to considerations about how the restoration tokens used to compensate customers could be affected by the proposed regulatory framework for Digital Token Service Suppliers.

WazirX has stated the restoration tokens characterize the remaining claims not coated by the preliminary distribution and monitor a person’s excellent stability. Holders are anticipated to periodically obtain further distributions by way of holding the tokens funded by WazirX earnings and recovered property.

Singapore’s central financial institution set a deadline of June 30 for native crypto service suppliers to cease providing digital token providers to abroad markets.

New firm will deal with compensation

A big change between the previous proposal and the one simply accredited by collectors concerned which firm would compensate customers.

Underneath the amended scheme, WazirX stated the restoration tokens will nonetheless be repurchased utilizing web earnings from the trade, however the distribution can be managed by way of Zanmai India, a reporting entity below the jurisdiction of India’s Monetary Intelligence Unit.

WazirX mother or father firm Zettai was primarily based in Singapore, however after the Excessive Courtroom ruling, it took steps in June to include a subsidiary, Zensui Company, within the Republic of Panama and switch the operations of the platform’s cryptocurrency-related providers.

Associated: BtcTurk halts withdrawals amid suspected $48M crypto hack

Some customers pissed off at delays

WazirX has repeatedly warned that repayments might be delayed for years, even up till 2030, if collectors didn’t approve its proposed restructuring plan as a result of the choice — liquidating the trade’s property — would take far longer.

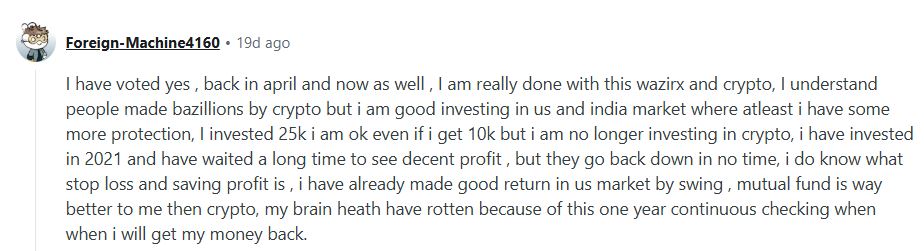

Customers on X and Reddit who indicated they deliberate to vote sure previous to the vote stated they needed the entire saga to be over, and the restructuring plan meant they might no less than hope to get a few of their funds again.

In the meantime, these extra skeptical had considerations over the delays, the regulatory points raised by the Excessive Courtroom and the switch of firm operations.

Some additionally argued that particular person holders of unhacked cash would lose out as a result of the tokens had risen considerably in worth for the reason that safety breach.

Others are pushing for some type of authorized motion in opposition to WazirX. Though a separate April 16 court docket judgment from the Supreme Courtroom of India dismissed a petition filed by 54 victims of the hack as a result of it couldn’t rule on a matter of crypto coverage, which the court docket stated it doesn’t have the authority to rule on.

WazirX didn’t instantly reply to a request for remark.

Journal: Coinbase requires ‘full-scale’ alt season, Ether eyes $6K: Hodler’s Digest, Aug. 10 – 16