Key takeaways:

-

President Donald Trump’s push for aggressive rate of interest cuts might set off a surge in inflation, weaken the greenback, and destabilize long-term bond markets.

-

Even with out charge cuts, commerce coverage and financial enlargement are more likely to push costs larger.

-

Bitcoin stands to profit both method—whether or not as an inflation hedge in a rapid-cut surroundings, or as a slow-burn retailer of worth as US macro credibility quietly erodes.

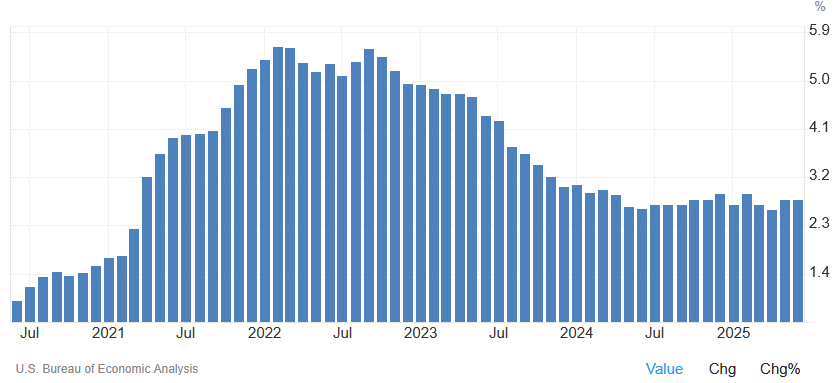

The US financial system could also be rising on paper, however the underlying stress is more and more troublesome to disregard — a pressure now in sharp focus on the Federal Reserve’s Jackson Gap symposium. The US greenback is down over 10% since January, core PCE inflation is caught at 2.8% and the July PPI surged 0.9%, tripling expectations.

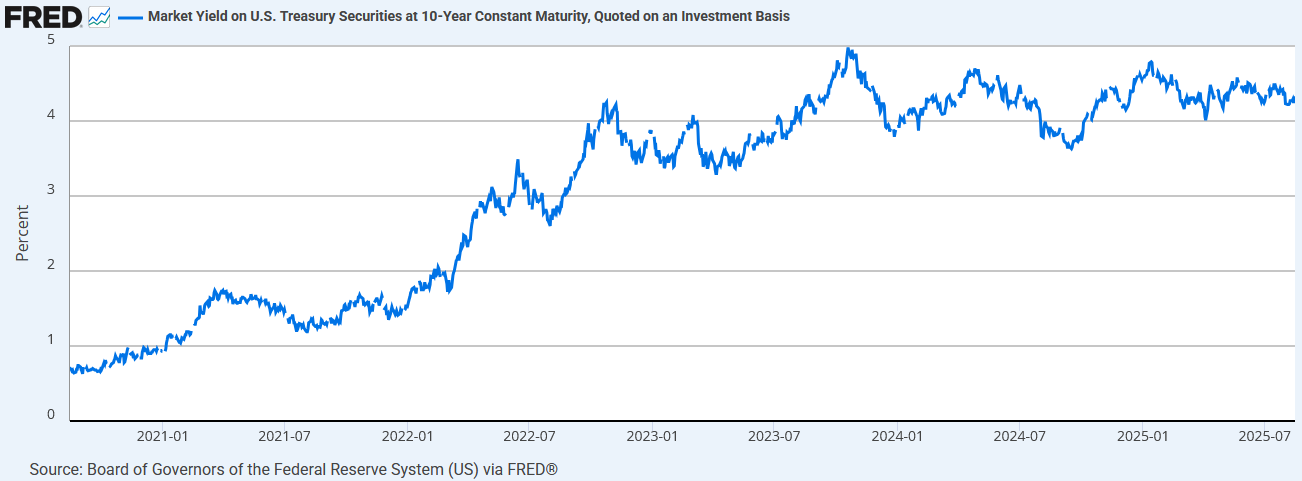

Towards this backdrop, 10-year Treasury yields holding at 4.33% look more and more uneasy in opposition to a $37 trillion debt load. The query of rates of interest has moved to the middle of nationwide financial debate.

President Donald Trump is now overtly pressuring Federal Reserve Chair Jerome Powell to chop rates of interest by as a lot as 300 foundation factors, pushing them all the way down to 1.25-1.5%. If the Fed complies, the financial system might be flooded with low cost cash, danger property will surge, and inflation will speed up. If the Fed resists, the consequences of rising tariffs and the fiscal shock from Trump’s newly handed Large Stunning Invoice might nonetheless push inflation larger.

In both case, the US seems locked into an inflationary path. The one distinction is the velocity and violence of the adjustment, and what it could imply for Bitcoin worth.

What if Trump forces the Fed to chop?

Ought to the Fed bow to political strain beginning as early as September or October, the implications would possible unfold quickly.

Core PCE inflation might climb from the present 2.8% to above 4% in 2026 (for context, post-COVID charge cuts and stimulus pushed core PCE to a peak of 5.3% in February 2022). A renewed inflation surge would possible drag the greenback down even additional, presumably sending the DXY beneath 90.

Financial easing would briefly decrease Treasury yields to round 4%, however as inflation expectations rise and international consumers retreat, yields might surge past 5.5%. In accordance with the Monetary Instances, many strategists warn that such a spike might break the bull market altogether.

Increased yields would have rapid fiscal penalties. Curiosity funds on US debt might rise from round $1.4 trillion to as a lot as $2 trillion—roughly 6% of GDP—by 2026, triggering a debt servicing disaster and placing additional strain on the greenback.

Extra harmful nonetheless is the potential politicization of the Fed. If Trump finds a solution to drive Powell out and appoint a extra compliant chair, markets might lose religion within the independence of US financial coverage. As FT columnist Rana Foroohar wrote:

“There’s an enormous physique of analysis to point out that once you undermine the rule of regulation the way in which the president is doing with these unwarranted threats to Powell, you finally increase, not decrease, the price of borrowing and curb funding into your financial system.”

She cited Turkey as a cautionary story, the place a central financial institution purge led to market collapse and 35% inflation.

If the Fed holds regular

Sustaining coverage charges might appear to be the accountable choice, and it could assist protect the Fed’s institutional credibility. However it received’t spare the financial system from inflation.

Certainly, two forces are already pushing costs larger: the tariffs and the Large Stunning Invoice.

Tariff results are already seen in key financial indicators. The S&P International flash US Composite PMI rose to 54.6 in July, the best since December, whereas enter costs for providers jumped from 59.7 to 61.4. Almost two-thirds of producers within the S&P International survey attributed larger prices to tariffs. As Chris Williamson, chief enterprise economist at S&P International, stated:

“The rise in promoting costs for items and providers in July, which was one of many largest seen over the previous three years, means that shopper worth inflation will rise additional above the Fed’s 2% goal.”

The results of the Large Stunning Invoice are but to be felt, however warnings are already mounting over its mixture of elevated spending and sweeping tax cuts. At first of July, the IMF acknowledged that the invoice “runs counter to decreasing federal debt over the medium time period” and its deficit‑growing measures danger destabilizing public funds.

On this state of affairs, even with out rapid charge cuts, core PCE inflation might drift as much as 3.0–3.2%. Yields on 10-year Treasurys would possible rise extra progressively, reaching 4.7% by subsequent summer season. Debt servicing prices would nonetheless climb to an estimated $1.6 trillion, or 4.5% of GDP, elevated however not but catastrophic. DXY might proceed plummeting, with Morgan Stanley predicting that it might go as little as 91 by mid‑2026.

Even on this extra measured final result, the Fed doesn’t emerge unscathed. The controversy over tariffs is dividing policymakers. As an illustration, Governor Chris Waller, seen as a doable new Fed Chair, helps charge cuts. Macquarie strategist Thierry Wizman not too long ago warned that such splits throughout the FOMC might devolve into politically motivated blocs, weakening the Fed’s inflation-fighting resolve and ultimately steepening the yield curve.

Associated: Bitcoin received’t go beneath $100K ‘this cycle’ as $145K goal stays: Analyst

The affect of macro on Bitcoin

Within the first state of affairs—sharp cuts, excessive inflation, and a collapsing greenback—Bitcoin would possible surge instantly alongside shares and gold. With actual rates of interest destructive and Fed independence in query, crypto might turn into a most popular retailer of worth.

Within the second state of affairs, the rally could be slower. Bitcoin would possibly commerce sideways till the tip of 2025, till inflation expectations meet up with actuality subsequent 12 months. Nonetheless, because the greenback continues to weaken and deficits accumulate, non-sovereign property will progressively achieve enchantment. Bitcoin’s worth proposition would solidify not as a tech guess, however as a hedge in opposition to systemic danger.

Expectations for a charge lower proceed to rise, however whether or not or not the Fed complies within the fall or stands agency, the US is on a collision course with inflation. Trump’s aggressive fiscal stimulus and commerce coverage make sure that upward worth strain is already baked into the system. Whether or not the Fed cuts charges quickly or not, the trail forward could also be tough for the greenback and long-term debt, and Bitcoin isn’t simply alongside for the journey—it might be the one automobile constructed for this street.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.