Key takeaways:

-

President Donald Trump’s push for aggressive rate of interest cuts may set off a surge in inflation, weaken the greenback, and destabilize long-term bond markets.

-

Even with out fee cuts, commerce coverage and monetary enlargement are more likely to push costs larger.

-

Bitcoin stands to profit both approach—whether or not as an inflation hedge in a rapid-cut setting, or as a slow-burn retailer of worth as US macro credibility quietly erodes.

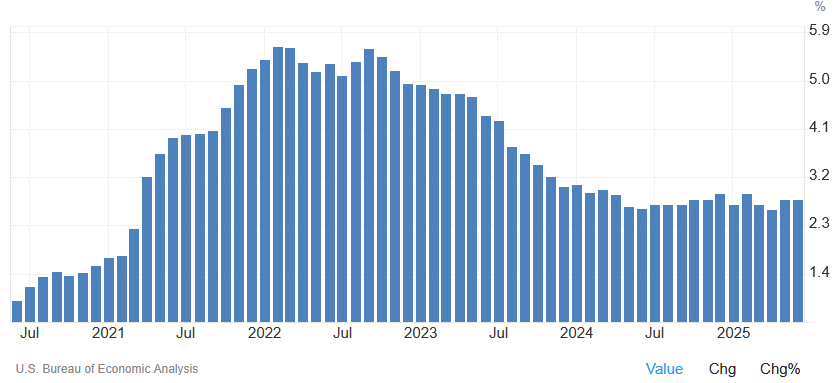

The US economic system could also be rising on paper, however the underlying stress is more and more troublesome to disregard — a pressure now in sharp focus on the Federal Reserve’s Jackson Gap symposium. The US greenback is down over 10% since January, core PCE inflation is caught at 2.8% and the July PPI surged 0.9%, tripling expectations.

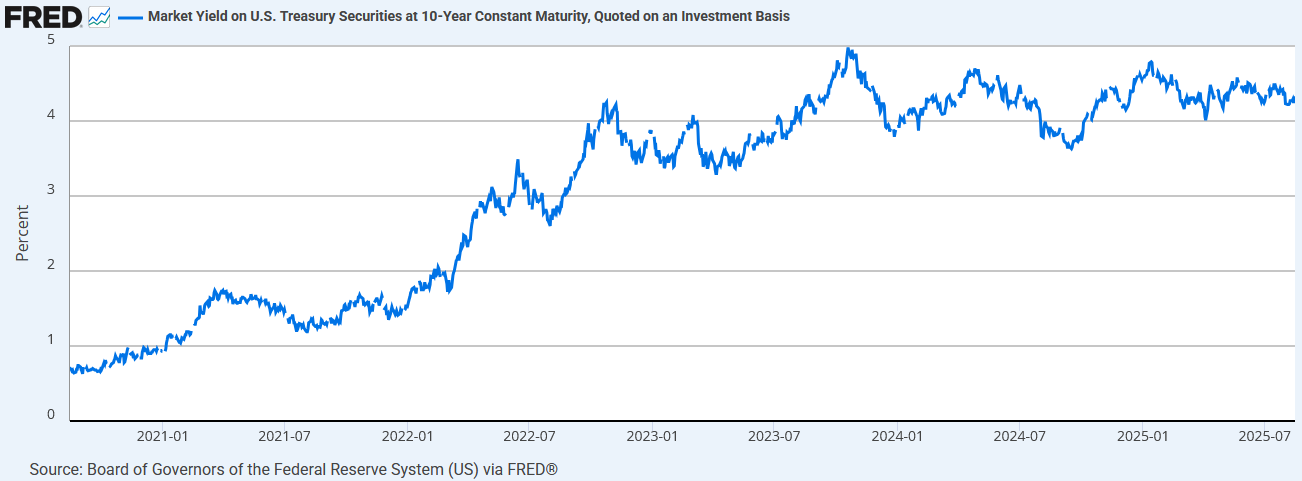

Towards this backdrop, 10-year Treasury yields holding at 4.33% look more and more uneasy towards a $37 trillion debt load. The query of rates of interest has moved to the middle of nationwide financial debate.

President Donald Trump is now overtly pressuring Federal Reserve Chair Jerome Powell to chop rates of interest by as a lot as 300 foundation factors, pushing them right down to 1.25-1.5%. If the Fed complies, the economic system will probably be flooded with low cost cash, threat property will surge, and inflation will speed up. If the Fed resists, the consequences of rising tariffs and the fiscal shock from Trump’s newly handed Massive Stunning Invoice may nonetheless push inflation larger.

In both case, the US seems locked into an inflationary path. The one distinction is the velocity and violence of the adjustment, and what it might imply for Bitcoin value.

What if Trump forces the Fed to chop?

Ought to the Fed bow to political strain beginning as early as September or October, the results would doubtless unfold quickly.

Core PCE inflation may climb from the present 2.8% to above 4% in 2026 (for context, post-COVID fee cuts and stimulus pushed core PCE to a peak of 5.3% in February 2022). A renewed inflation surge would doubtless drag the greenback down even additional, presumably sending the DXY beneath 90.

Financial easing would briefly decrease Treasury yields to round 4%, however as inflation expectations rise and overseas consumers retreat, yields may surge past 5.5%. In response to the Monetary Occasions, many strategists warn that such a spike may break the bull market altogether.

Larger yields would have rapid fiscal penalties. Curiosity funds on US debt may rise from round $1.4 trillion to as a lot as $2 trillion—roughly 6% of GDP—by 2026, triggering a debt servicing disaster and placing additional strain on the greenback.

Extra harmful nonetheless is the potential politicization of the Fed. If Trump finds a strategy to pressure Powell out and appoint a extra compliant chair, markets may lose religion within the independence of US financial coverage. As FT columnist Rana Foroohar wrote:

“There’s an enormous physique of analysis to indicate that whenever you undermine the rule of regulation the way in which the president is doing with these unwarranted threats to Powell, you finally increase, not decrease, the price of borrowing and curb funding into your economic system.”

She cited Turkey as a cautionary story, the place a central financial institution purge led to market collapse and 35% inflation.

If the Fed holds regular

Sustaining coverage charges might look like the accountable choice, and it might assist protect the Fed’s institutional credibility. However it gained’t spare the economic system from inflation.

Certainly, two forces are already pushing costs larger: the tariffs and the Massive Stunning Invoice.

Tariff results are already seen in key financial indicators. The S&P International flash US Composite PMI rose to 54.6 in July, the very best since December, whereas enter costs for companies jumped from 59.7 to 61.4. Practically two-thirds of producers within the S&P International survey attributed larger prices to tariffs. As Chris Williamson, chief enterprise economist at S&P International, stated:

“The rise in promoting costs for items and companies in July, which was one of many largest seen over the previous three years, means that client value inflation will rise additional above the Fed’s 2% goal.”

The results of the Massive Stunning Invoice are but to be felt, however warnings are already mounting over its mixture of elevated spending and sweeping tax cuts. At the start of July, the IMF said that the invoice “runs counter to lowering federal debt over the medium time period” and its deficit‑growing measures threat destabilizing public funds.

On this state of affairs, even with out rapid fee cuts, core PCE inflation might drift as much as 3.0–3.2%. Yields on 10-year Treasurys would doubtless rise extra regularly, reaching 4.7% by subsequent summer time. Debt servicing prices would nonetheless climb to an estimated $1.6 trillion, or 4.5% of GDP, elevated however not but catastrophic. DXY may proceed plummeting, with Morgan Stanley predicting that it may go as little as 91 by mid‑2026.

Even on this extra measured end result, the Fed doesn’t emerge unscathed. The talk over tariffs is dividing policymakers. For example, Governor Chris Waller, seen as a potential new Fed Chair, helps fee cuts. Macquarie strategist Thierry Wizman lately warned that such splits throughout the FOMC may devolve into politically motivated blocs, weakening the Fed’s inflation-fighting resolve and finally steepening the yield curve.

Associated: Bitcoin gained’t go beneath $100K ‘this cycle’ as $145K goal stays: Analyst

The affect of macro on Bitcoin

Within the first state of affairs—sharp cuts, excessive inflation, and a collapsing greenback—Bitcoin would doubtless surge instantly alongside shares and gold. With actual rates of interest destructive and Fed independence in query, crypto may turn into a most popular retailer of worth.

Within the second state of affairs, the rally can be slower. Bitcoin may commerce sideways till the tip of 2025, till inflation expectations meet up with actuality subsequent yr. Nonetheless, because the greenback continues to weaken and deficits accumulate, non-sovereign property will regularly achieve attraction. Bitcoin’s worth proposition would solidify not as a tech guess, however as a hedge towards systemic threat.

Expectations for a fee minimize proceed to rise, however whether or not or not the Fed complies within the fall or stands agency, the US is on a collision course with inflation. Trump’s aggressive fiscal stimulus and commerce coverage make sure that upward value strain is already baked into the system. Whether or not the Fed cuts charges quickly or not, the trail forward could also be tough for the greenback and long-term debt, and Bitcoin isn’t simply alongside for the journey—it could be the one car constructed for this highway.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.