Anthony Scaramucci’s SkyBridge Capital, a worldwide funding firm recognized for different investments, is bringing belongings price $300 million to tokenize on the Avalanche blockchain — a transfer that may enhance Avalanche’s tokenized belongings by practically 160%.

Based on a report from Fortune, SkyBridge Capital will tokenize two funds: one solely composed of cryptocurrencies like Bitcoin (BTC) and a “fund of funds” that features each enterprise and crypto belongings. SkyBridge is partnering with Tokeny, an organization specializing in tokenizing institutional holdings.

On the Wyoming Blockchain Symposium on Tuesday, Scaramucci stated the important thing query round tokenization is whether or not it could outperform present programs by enabling sooner, cheaper and safer transactions.

And I believe the reply to these questions [is] ‘Sure,’ and I believe all through historical past, any time that the know-how is best, we usually undertake it, even when there’s some resistance.”

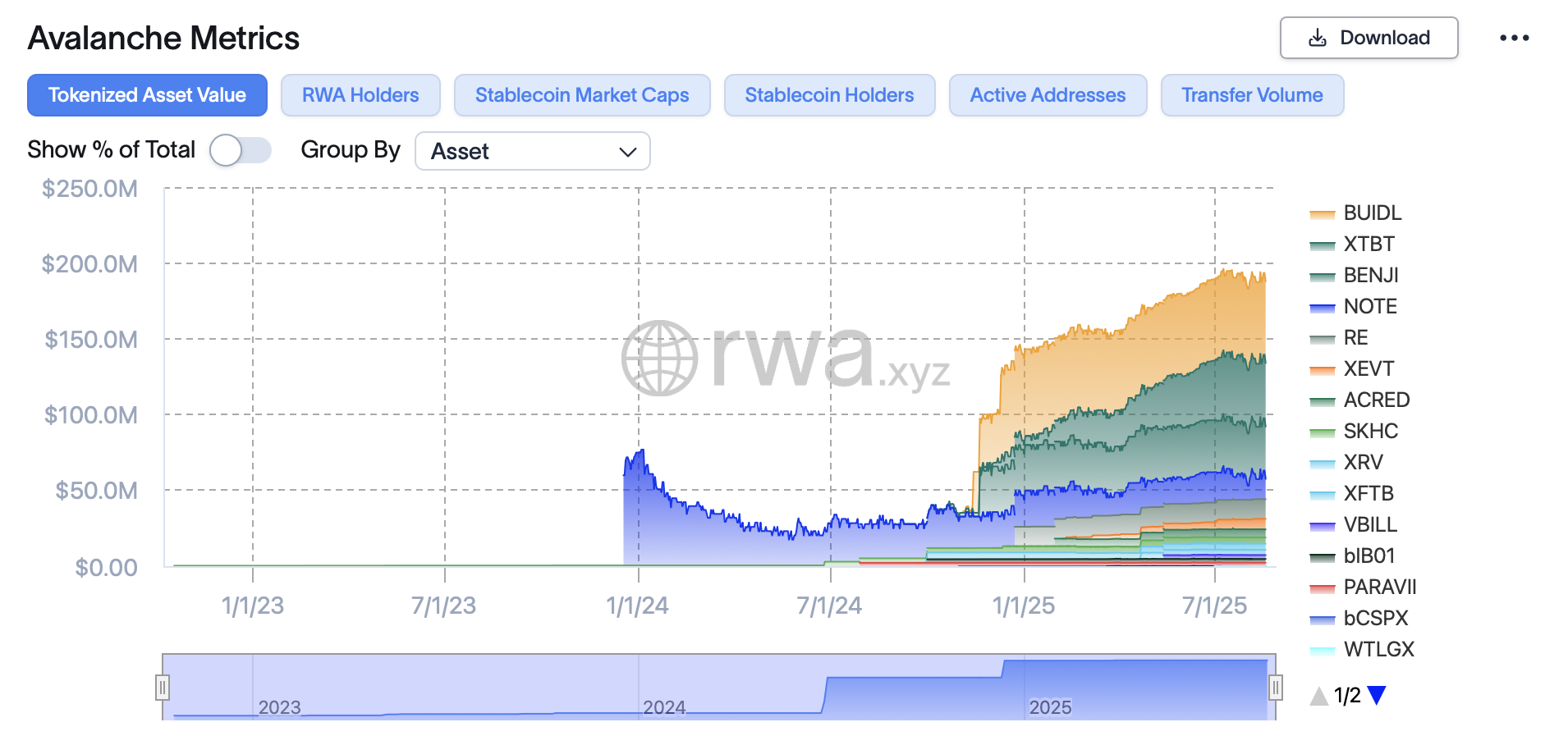

Avalanche, a layer-1 blockchain that homes the native Avalanche (AVAX) token, has $1.9 billion in whole worth locked at this writing, based on DefiLlama. The blockchain has $188 million in real-world asset (RWA) tokenization worth, based on RWA.xyz, rating twelfth amongst all blockchains.

Scaramucci based SkyBridge Capital in 2005 and briefly served as director of communications for the primary Trump administration. The agency has $2 billion in belongings below administration, based on AUM13F.

Associated: The true tokenization revolution is in personal markets, not public shares

Conventional asset managers enter RWA tokenization fray

RWA tokenization is the method of turning real-world belongings, equivalent to bonds, actual property or funds, into digital tokens that may be traded on a blockchain.

The sector has develop into a pattern within the crypto house this 12 months. Conventional asset managers like BlackRock and Franklin Templeton have taken to this innovation, pushed by the guarantees of decreased intermediaries, elevated transparency and better accessibility for buyers.

Based on RWA.xyz, the 2 most important blocks of tokenized real-world belongings are personal credit score and US Treasurys. On Monday, the tokenized personal credit score market was valued at $15.5 billion, and the tokenized US Treasurys market was price $7.3 billion. All instructed, tokenized personal credit score accounts for 58.8% of the $26.4 billion RWA tokenization market, whereas tokenized US Treasurys accounts for 27.7%.

Whereas nonetheless small in comparison with the general crypto market, the RWA tokenization market has grown considerably in 2025. On Dec. 30, 2024, the market was valued at $15.8 billion. With its soar to $26.4 billion on Monday, the market has grown 64.7%.

BlackRock’s BUIDL fund, Franklin Templeton’s BENJI, Ondo’s numerous funds, and WisdomTree’s WTGXX point out the normal finance urge for food for this crypto sector.

Journal: TradFi is constructing Ethereum L2s to tokenize trillions in RWAs — Inside story