Nasdaq-listed healthcare service supplier and Bitcoin treasury agency KindlyMD has acquired $679 million value of Bitcoin for its company reserve.

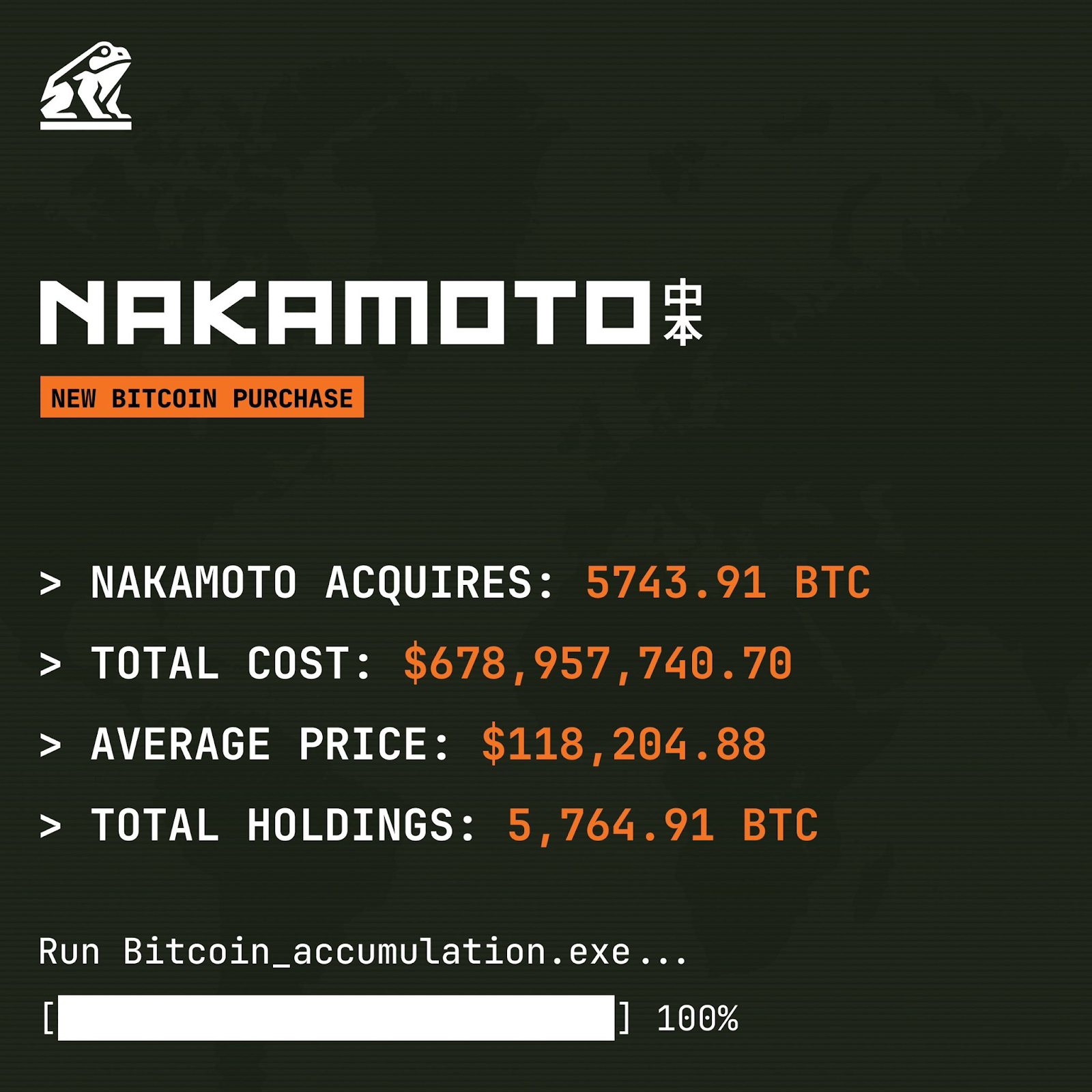

KindlyMD acquired 5,744 Bitcoin (BTC) for roughly $679 million at a weighted common worth of $118,204 per Bitcoin, the corporate introduced Tuesday.

The acquisition was made utilizing personal funding in public fairness (PIPE) proceeds and displays KindlyMD’s “disciplined Bitcoin treasury technique,” the corporate stated.

The $679 million purchase marks the corporate’s first Bitcoin investments since finishing its merger with David Bailey’s Bitcoin agency, Nakamoto Holdings, final Friday.

KindlyMD’s buy is greater than 13 occasions bigger than the newest acquisition by Michael Saylor’s Technique, which stated Monday it had purchased $51.4 million value of Bitcoin at a mean worth of $119,666. Technique stays the biggest public Bitcoin holder.

Nonetheless, the 5,769 Bitcoin represents a small fraction of KindlyMD’s plan to accumulate 1 million BTC.

Is Bitcoin Headed for a 2025 Peak? Or is the 4-12 months Cycle Useless? https://t.co/DckFjvkJIx

— Cointelegraph (@Cointelegraph) August 18, 2025

Associated: Document $37T US debt and M2 cash development set stage for $132K Bitcoin

Bitcoin is the “final reserve asset” for companies and establishments: David Bailey

The brand new firm’s long-term mission to accumulate 1 million Bitcoin displays a “perception that Bitcoin will anchor the following period of worldwide finance,” stated David Bailey, CEO and chairman of KindlyMD.

“This acquisition reinforces our conviction in Bitcoin as the last word reserve asset for companies and establishments alike.”

Bailey additionally served as a key crypto adviser throughout US President Donald Trump’s marketing campaign and was largely credited with the president’s favorable Bitcoin shift.

Earlier this month, he stated he needs to lift $200 million for a political motion committee (PAC) to advance Bitcoin’s pursuits within the US.

Associated: Bitcoin’s company growth raises ‘Fort Knox’ nationalization issues

KindlyMD’s inventory, nevertheless, fell greater than 12% because the merger was first introduced on Could 12, in line with Google Finance information.

The corporate’s transfer comes as different companies speed up Bitcoin treasury methods. Japanese funding agency Metaplanet just lately stated it plans to lift $3.7 billion to gasoline its personal company technique of shopping for 210,000 BTC by 2027.

Developments equivalent to company Bitcoin adoption and potential inclusion of digital belongings in US 401(okay) retirement plans might assist push Bitcoin to $200,000 by the tip of 2025, in line with André Dragosch, head of European analysis at crypto asset supervisor Bitwise.

“This “bullish” growth could also be even “greater than the US Bitcoin ETF approval itself,” signaling one other $122 billion value of latest capital, assuming a modest 1% portfolio allocation, Dragosch informed Cointelegraph throughout the Chain Response X areas present on Monday.

Journal: Bitcoin OG Willy Woo has offered most of his Bitcoin — Right here’s why