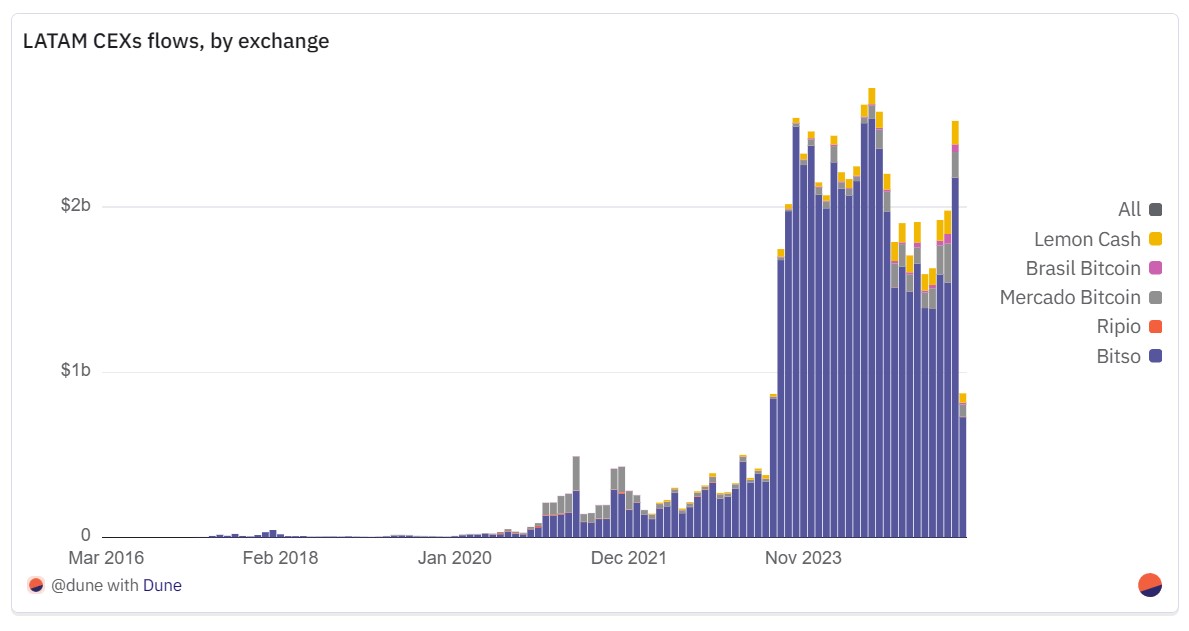

Latin America’s (LATAM) centralized crypto exchanges have grown from area of interest platforms into crucial monetary infrastructure in simply three years, with flows rising ninefold, in response to new analysis.

Dune Analysis’s LATAM Report revealed that 2021 annual alternate flows within the area totalled $3 billion. In 2024, the entire alternate flows for LATAM reached $27 billion, up by 800% in simply three years, signaling digital asset development within the area.

In its early years, LATAM crypto exercise was modest by international requirements. Nevertheless, a fragmented ecosystem of small brokers and over-the-counter (OTC) desks grew into bigger, built-in exchanges serving retail and institutional purchasers.

In line with Dune Analytics, flows from early 2021 to mid-2025 by means of LATAM-based centralized alternate platforms confirmed a transparent arc of “development maturity and consolidation.”

Bitso stays essentially the most dominant LATAM alternate by flows

Since 2021, crypto alternate Bitso has dominated the Latin American market. On the time, the alternate processed over $2 billion in flows, over 66% of all of the flows within the area.

In 2024, the alternate processed over $25.2 billion in flows, a 1,160% development in three years. Its share of alternate flows grew to 93% throughout the identical time interval.

Other than Bitso, gamers like Mercado Bitcoin and Lemon Money additionally noticed elevated alternate flows. The Dune report additionally highlighted that the circulation enhance occurred and not using a sustained bull run.

“Crucially, this development got here and not using a sustained bull market, reflecting a shift towards real-world utility reminiscent of cross-border commerce, remittance settlements, and foreign money hedging,” Dune mentioned.

Associated: Brazil’s central financial institution service supplier hacked, $140M stolen

Ethereum accounted for over $45.5 billion in total flows since 2021

The report additionally revealed that Ethereum-based transfers dominated the market. From January 2021 to July 2025, community transfers have reached over $45.5 billion. This quantity is roughly 75% of all recorded flows all through the interval.

The report mentioned that Tron ranked second by way of transfers, with over $12.5 billion. The report mentioned this was largely pushed by low-cost Tether (USDT) transfers within the community.

As of Tuesday, Tron holds the most important quantity of USDT, with $81.8 billion in tokens circulating on the community, in response to Tether. Ethereum follows with $80.3 billion.

Solana ranks third in LATAM with $1.45 billion in complete flows, whereas Polygon follows with $1.17 billion.

Journal: Animoca’s Tower crypto surges 214%, gaming exercise up in July: Web3 Gamer