- Canadian inflation is anticipated to tick increased on a month-to-month foundation in July.

- The headline Shopper Worth Index is seen declining to 1.7% YoY.

- The Canadian Greenback stays mired inside a consolidation vary.

Statistics Canada will challenge the Shopper Worth Index (CPI) for July on Tuesday. This may entice the market’s consideration since it should present the Financial institution of Canada (BoC) with recent data on how inflation is altering, which they use to set rates of interest.

Economists anticipate that the headline inflation charge will fall to 1.7% in July, beneath June’s 1.9%. On a month-to-month foundation, the inflation is seen gaining 0.4%.

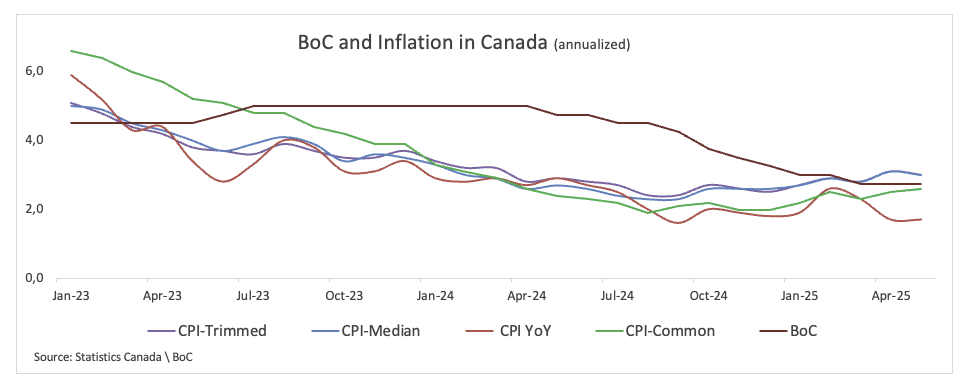

The BoC may also launch its core inflation measure, which excludes meals and power prices. In June, this main indicator was 2.7% increased than in the identical month the earlier 12 months and up 0.1% from a month earlier.

Even whereas there are indications that pricing strain is lowering, analysts are nonetheless fairly apprehensive about the potential of US tariffs inflicting home inflation to rise. Each markets and policymakers are anticipated to be circumspect within the coming weeks for the reason that inflation forecast is now much less clear.

What can we count on from Canada’s inflation charge?

The Financial institution of Canada left its benchmark charge unchanged at 2.75% on July 30, a transfer that broadly matched market expectations.

In his press convention, Governor Tiff Macklem stated the financial institution’s resolution to carry charges regular was influenced by recent indicators of stickiness in underlying inflation. He identified that the BoC’s most well-liked core measures — the trim imply and trim median — have been hovering round 3%, whereas a broader set of indicators has additionally edged increased. That shift, he acknowledged, has caught policymakers’ consideration and shall be watched carefully within the months forward.

On the similar time, Macklem sought to reassure that not the entire current power in inflation is prone to persist. He argued that a number of forces ought to assist ease worth strain: the Canadian Greenback (CAD) has regained floor after a bout of weak spot, wage development has slowed, and the economic system stays in extra provide, with output thought to have contracted within the second quarter. In his view, these dynamics ought to mix to place downward strain on inflation because the 12 months progresses.

Markets will react to the headline quantity, however policymakers shall be wanting underneath the hood on the trim, median and customary measures. In line with the most recent releases, the trim and median gauges have picked up tempo, elevating considerations amongst policymakers. The frequent gauge, nevertheless, has been extra subdued.

When is the Canada CPI information due, and the way may it have an effect on USD/CAD?

Statistics Canada will launch its July inflation information on Tuesday at 12:30 GMT, and markets are bracing for indicators that worth strain may re-emerge.

A stronger-than-expected print would help the view that tariff-related prices are starting to feed into shopper costs. That might push the BoC to tread extra cautiously, lending short-term help to the Canadian Greenback (CAD) whereas additionally protecting an in depth eye on developments on the commerce entrance.

FXStreet’s senior analyst, Pablo Piovano, notes that the CAD has settled right into a range-bound sample to date in August, with USD/CAD holding near the 1.3800 space. He argues that renewed promoting strain may initially drive the pair again towards its provisional 55-day Easy Shifting Common (SMA) at 1.3699, forward of the month-to-month ground at 1.3721 (August 7). South from right here emerge minor help ranges at 1.3575 (weekly trough on July 23) after which the July valley at 1.3556 (July 3), all previous the 2025 backside of 1.3538 set on June 16.

On the topside, Piovano sees resistance on the August ceiling at 1.3879 (August 1), previous to the Could peak at 1.4015 (Could 13), which is bolstered by the important 200-day SMA at 1.4031.

From a broader view, he means that the bearish bias will persist so long as spot trades beneath its 200-day SMA.

He additionally argues that momentum indicators stay inconclusive: the Relative Energy Index (RSI) has retreated to almost the 56 mark, suggesting some lack of upside impulse as of late, whereas the Common Directional Index (ADX) close to 20 is indicative that the prevailing development is slowly gaining steam.

Financial Indicator

Shopper Worth Index (MoM)

The Shopper Worth Index (CPI), launched by Statistics Canada on a month-to-month foundation, represents modifications in costs for Canadian customers by evaluating the price of a hard and fast basket of products and companies. The MoM determine compares the costs of products within the reference month to the earlier month. Usually, a excessive studying is seen as bullish for the Canadian Greenback (CAD), whereas a low studying is seen as bearish.

Learn extra.

Final launch:

Tue Jul 15, 2025 12:30

Frequency:

Month-to-month

Precise:

0.1%

Consensus:

0.1%

Earlier:

0.6%

Supply:

Statistics Canada