Key takeaways:

-

Quick-term Bitcoin holders bought 20,000 BTC at a loss since Sunday.

-

Technicals recommend pushing Bitcoin’s value under $100,000 might be a tricky activity for the bears.

Bitcoin (BTC) value has pulled again under $116,000, as uncertainty forward of Jerome Powell’s Jackson Gap speech led buyers and merchants to reevaluate dangers and keep cautious.

Bitcoin “weak palms” again to realizing losses

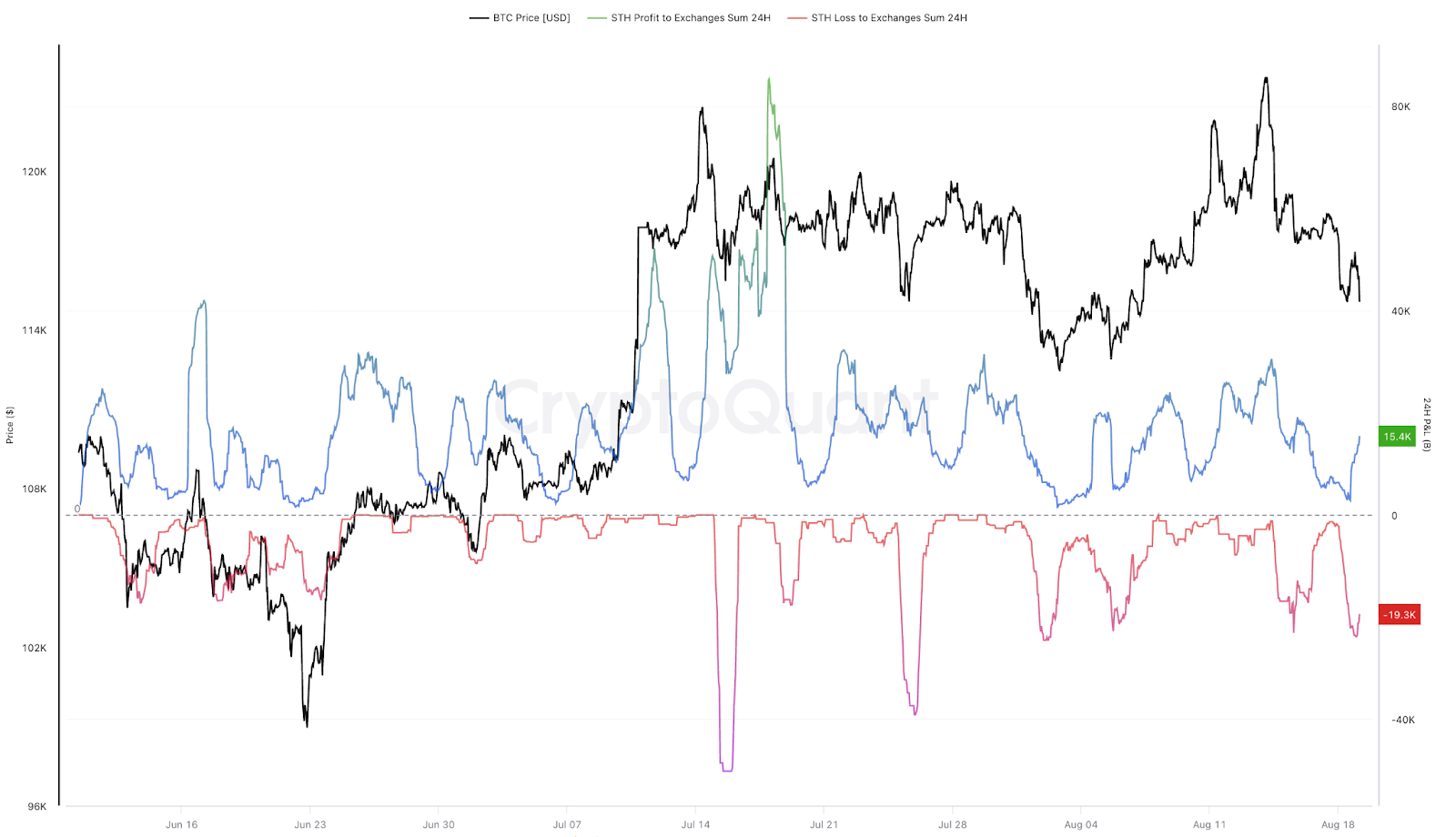

Bitcoin has retraced 7.6% from its new all-time excessive of $24,500 set final week. Following this value motion, onchain information from CryptoQuant present that over 20,000 BTC held by short-term holders (STHs) — buyers who’ve held the asset for lower than 155 days — moved to exchanges at a loss over the past three days.

Greater than 1,670 BTC have been transferred to exchanges at a loss on Sunday, which surged to 23,520 BTC by Tuesday, coinciding with a 3.5% drop in BTC’s value to $114,400 from $118,600, per Glassnode information.

Associated: Bitcoin ‘liquidity zones swept’ however uptick in open curiosity hints at BTC restoration

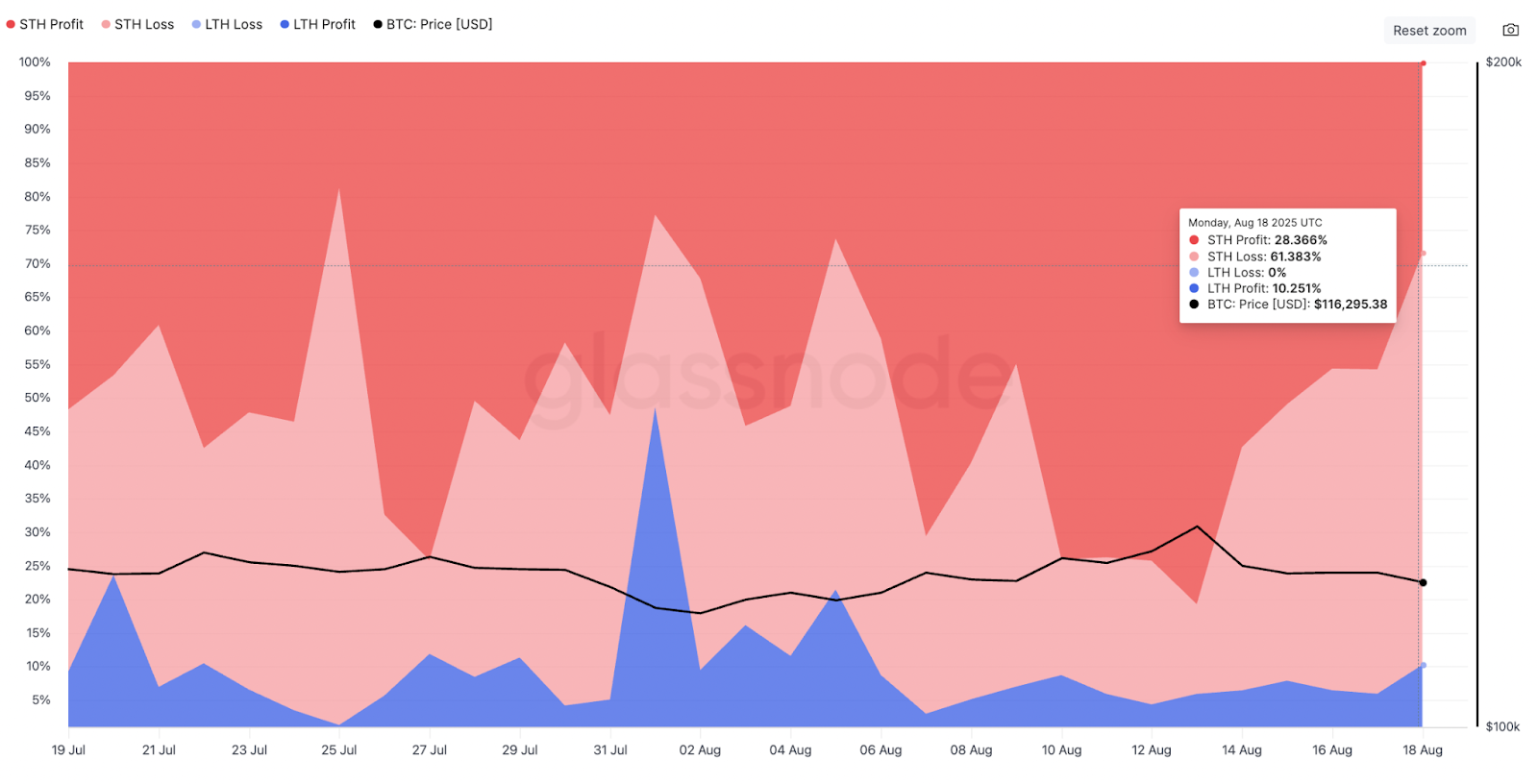

The chart under reveals that the majority Bitcoin despatched to exchanges at a loss are from STHs, whereas LTHs—each in revenue and loss—comprise simply 10% of the entire quantity to exchanges.

This exercise underscores a well-recognized behavioral sample the place short-term speculators panic-sell throughout market dips, incessantly realizing losses.

The final time Bitcoin STHs moved into sustained loss realization was in January, “a interval that marked the deepest correction of this cycle,” in line with CryptoQuant analyst Kripto Mevsimi.

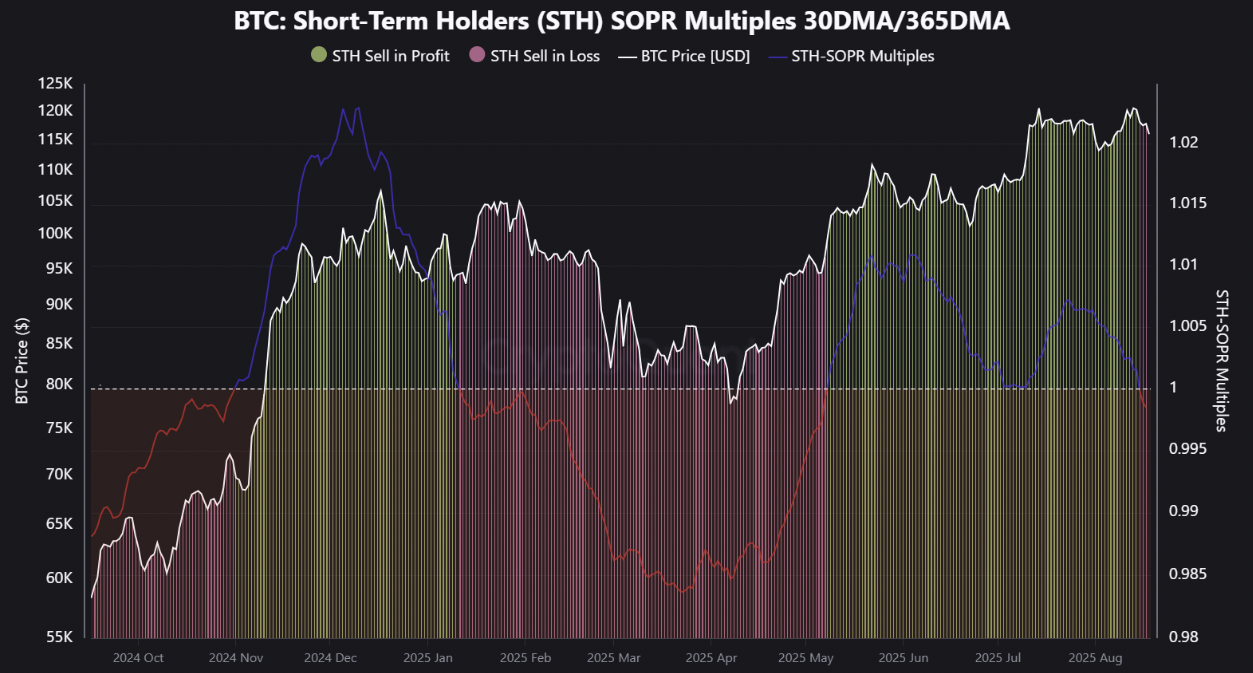

“For the primary time since that January drawdown, STH-SOPR multiples have slipped again under 1, indicating that short-term buyers are as soon as once more realizing losses,” the analyst mentioned in an Aug. 18 Quicktake word.

Traditionally, this has carried two implications: A weakening momentum the place prolonged loss realization usually precedes deeper corrective phases, or a wholesome reset the place “transient dips under 1 can flush out weak palms, clearing the trail for extra sustainable rallies,” Kripto Mevsimi defined, including:

“This loss-selling occasion turns into a vital barometer of market well being. If absorbed rapidly, it may mirror previous resets that fueled robust rebounds. If not, it dangers signaling a momentum breakdown.”

Bitcoin’s drop under $100,000 “robust combat for bears”

BTC’s newest drop under $115,000 has a number of merchants and analysts calling for deeper value corrections to sub-$100,000 ranges.

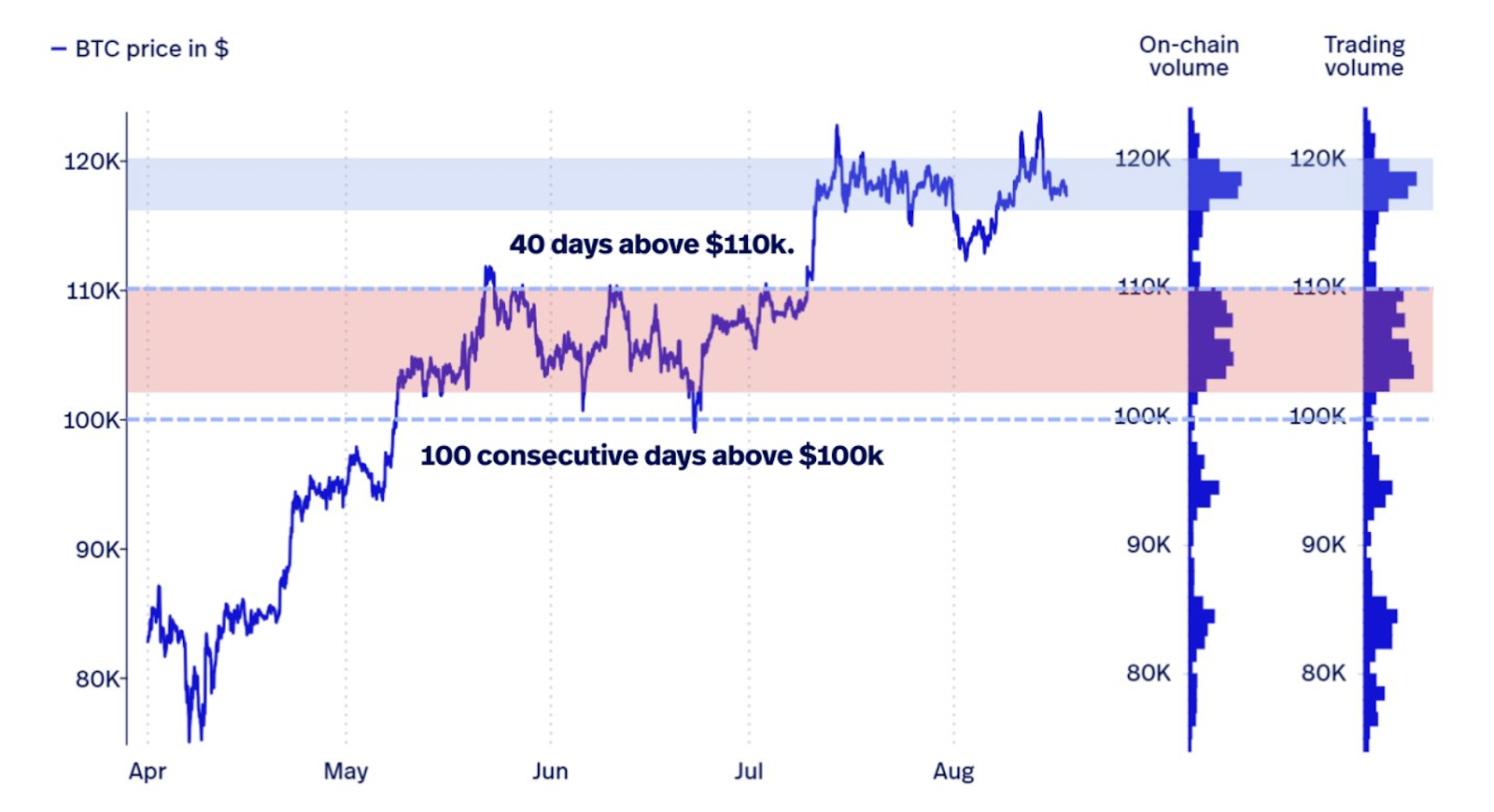

For this to occur, “$BTC would want to interrupt the $100K–$110K wall” constructed for over 100 days since breaking above the $100,000 mark on Might 8, buying and selling agency Swissblock mentioned in an X submit on Monday, including:

“Not indestructible, however a tricky combat for bears.”

For widespread Bitcoin analyst AlphaBTC, an in depth under Monday’s low at $114,700 may see the value drop towards the $110,000-$112,000 demand zone.

In the meantime, prediction market platform Polymarket expects extra value weak spot for the remainder of the week. The most definitely end result for BTC is now $114,000 at 73%, whereas an in depth under $112,000 is at 39% likelihood, and 18% and 16% odds for a drop towards $110,000 and $108,000, respectively.

As Cointelegraph reported, Bitcoin may proceed consolidating within the present vary as many BTC buyers could proceed taking revenue under all-time highs.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.