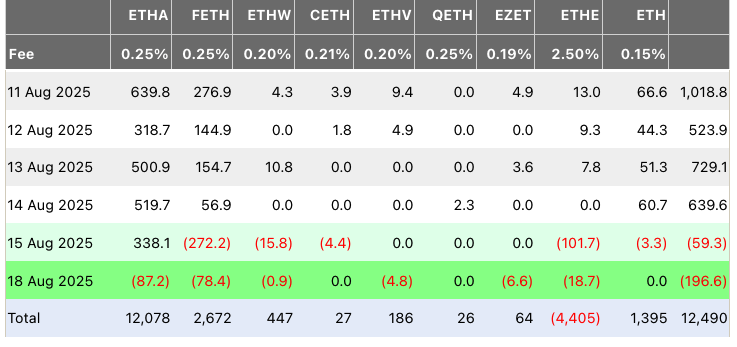

Spot Ether funds began a brand new week with a serious sell-off, posting almost $200 million in outflows on Monday and increasing a development that began final week.

Spot Ether (ETH) exchange-traded funds (ETFs) noticed $196.7 million of outflows on Monday, marking their second-largest each day outflows since launching. Monday’s outflows had been solely topped by $465 million in outflows on Aug. 4, in accordance with SoSoValue.

The newest outflows adopted Friday’s $59 million in losses, bringing the two-day whole to $256 million.

The outflows stay modest in comparison with the document $3.7 billion influx streak over the earlier eight buying and selling days, when some single-day inflows topped $1 billion.

BlackRock’s ETHA sees $87 million in outflows

In keeping with Farside knowledge, BlackRock and Constancy noticed the biggest ETH ETF outflows amongst issuers on Monday, totaling $87 million and $79 million, respectively.

Final Friday, Constancy’s Ethereum Fund (FETH) alone posted $272 million in outflows, considerably contributing to the full $59 million in each day outflows.

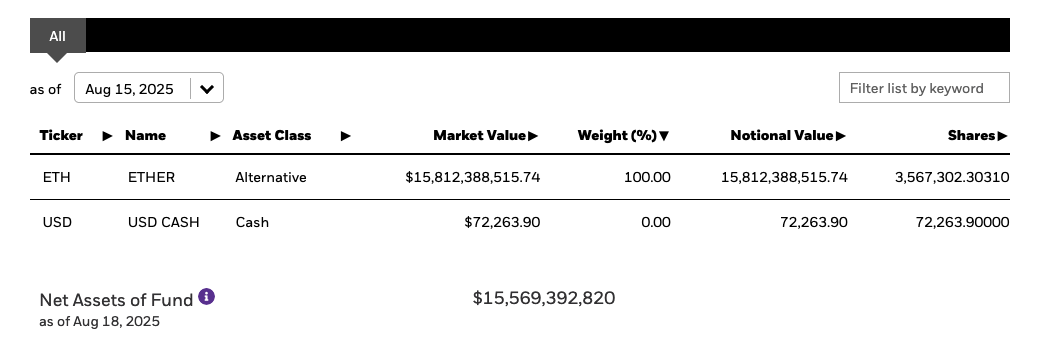

BlackRock has change into one of many largest institutional holders of Ether. In keeping with official knowledge for the iShares Ethereum Belief ETF (ETHA), the fund held roughly 3.6 million ETH — valued at $15.8 billion — as of final Friday.

Since then, the greenback worth of ETHA’s holdings has declined by 1.5% to $15.6 billion reported on Monday.

On this interval, the ETH value has tumbled round 6.5%, in accordance with CoinGecko.

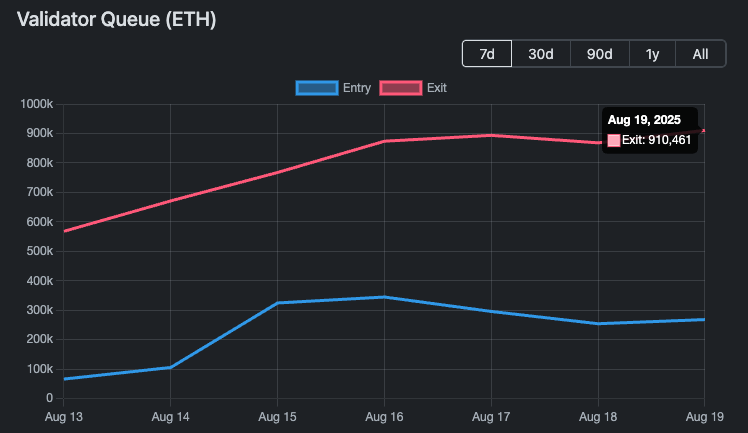

Ether unstaking queue repeatedly hits new highs

The document Ether ETF outflows and turbulent ETH costs come amid the continued surge in Ether unstaking queue, or the quantity of Ether being awaited to be withdrawn from staking swimming pools by Ethereum validators.

In keeping with ValidatorQueue, a third-party web site monitoring the validator queues on the Ethereum proof-of-stake (PoS) community, the validator’s exit line broke an all-time excessive of 910,000 ETH price roughly $3.9 billion on Tuesday.

The information additionally means that validators now have to attend at the least 15 days and 14 hours to unstake their ETH.

Some crypto market observers have highlighted the possibly detrimental outcomes of the continued ETH unstaking queue development, warning of a looming “unstakening.”

“The flippening won’t ever occur however the unstakening is coming,” Bitcoin (BTC) advocate Samson Mow wrote on X final Thursday.

Associated: Ether dealer turns $125K into $43M, locks in $7M after market downturn

He additionally recommended that the value of ETH associated to BTC might probably revert to “0.03 or decrease.” On the time of writing, Ether traded at 0.036 BTC, in accordance with TradingView.

Ether ETFs acquire floor versus Bitcoin ETFs

Spot Ether ETFs have been flipping Bitcoin ETFs when it comes to inflows the previous few weeks, reflecting a rising investor urge for food for ETH over BTC.

In keeping with knowledge by Hildobby, an information analyst at Dragonfly, the ratio of BTC provide versus BTC held in ETFs was at 6.4% as of Monday, in comparison with a 5% ratio for ETH and Ether ETFs.

“If the present development charge continues, the ETH-ETF will surpass the BTC-ETF when it comes to the share of whole provide contained by September,” the analyst forecasted on Monday.

Journal: Coinbase requires ‘full-scale’ alt season, Ether eyes $6K: Hodler’s Digest, Aug. 10 – 16