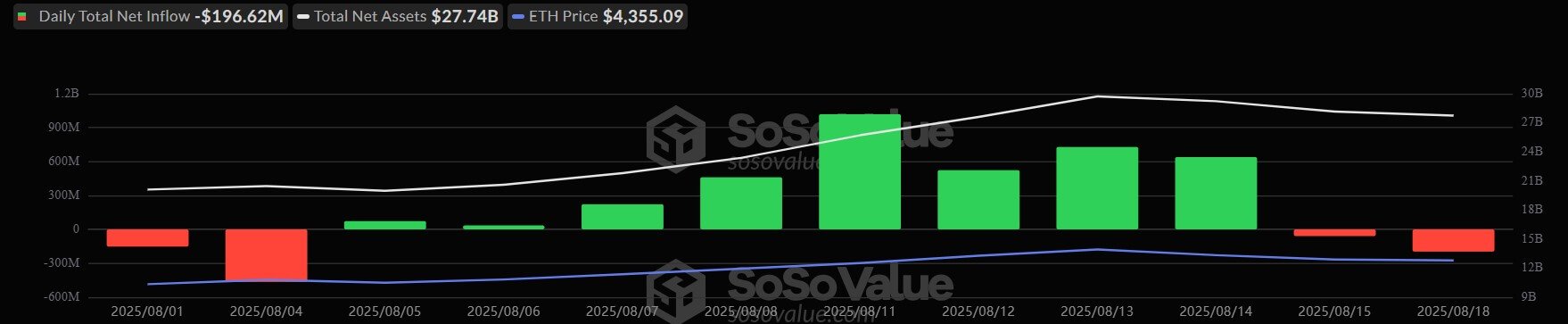

US spot Ethereum exchange-traded funds (ETFs) noticed heavy redemptions on Aug. 18, with traders pulling $196.6 million in a single day.

Information from SoSoValue confirmed that this was the second-largest day by day outflow because the merchandise debuted and the fourth outflow this month.

Based on the information, many of the day’s losses got here from the 2 largest issuers. BlackRock’s ETHA accounted for the largest drop, with round 20,000 ETH, or $86.9 million, leaving the product. Constancy’s FETH trailed carefully, seeing redemptions price $78.4 million.

In the meantime, different issuers additionally recorded outflows, although on a smaller scale.

Grayscale’s Ethereum fund misplaced $18.7 million, Franklin Templeton’s EZET shed $6.6 million, VanEck’s ETHV noticed $4.8 million in withdrawals, and Bitwise’s ETHW dropped by about $1 million.

The setback comes after an eight-day influx streak throughout which traders added greater than $3.7 billion to Ethereum ETFs.

Nevertheless, regardless of the most recent reversal, total market momentum stays firmly optimistic.

Based on SoSoValue information, cumulative internet inflows into US Ethereum ETFs now exceed $12 billion, most of which have arrived over the previous two months as institutional adoption has accelerated.

Collectively, the funds maintain about $27.7 billion in belongings underneath administration, representing 5.34% of Ethereum’s whole market capitalization.