South Korea’s Monetary Companies Fee (FSC) has ordered exchanges to droop new crypto lending merchandise till formal pointers are in place, citing mounting dangers to customers and market stability.

Regulators pointed to a latest incident at Bithumb the place greater than 27,000 prospects tapped lending companies in June, with 13% compelled into liquidation after collateral values swung in opposition to them.

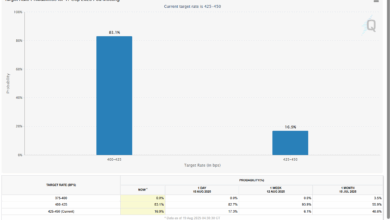

The transfer by the FSC comes days after analysts at Galaxy Digital revealed a report the place they flagged the rising quantity of leverage in crypto markets as a priority.

The executive steerage, from the FSC permits current loans to run their course however bars the rollout of latest lending companies. Officers stated that if platforms ignore the directive, on-site inspections and different supervisory actions will comply with. Formal lending pointers are anticipated within the coming months.

Korea’s crackdown lands as crypto leverage globally surges again towards bull-market ranges. Galaxy’s report exhibits crypto-collateralized loans jumped 27% in Q2 to $53.1 billion, the very best since early 2022.

Final week’s $1 billion liquidation wave, sparked by bitcoin’s retreat from $124,000 to $118,000, highlighted how rapidly overstretched bets can unwind.

Analysts warn that stress factors are already displaying throughout the system: DeFi liquidity crunches, ETH staking exit queues, and widening spreads between on-chain and over-the-counter greenback lending charges.

Nonetheless, not everybody agrees with the method the Korean authorities are taking. DNTV Analysis’s Bradley Park argues that higher safeguards are wanted, and never a shutdown.

“The rational method is to improve UI/UX, danger disclosures, and LTV controls to handle publicity safely,” Park advised CoinDesk in a word, noting that the majority change lending is in stablecoins used to construct quick positions.

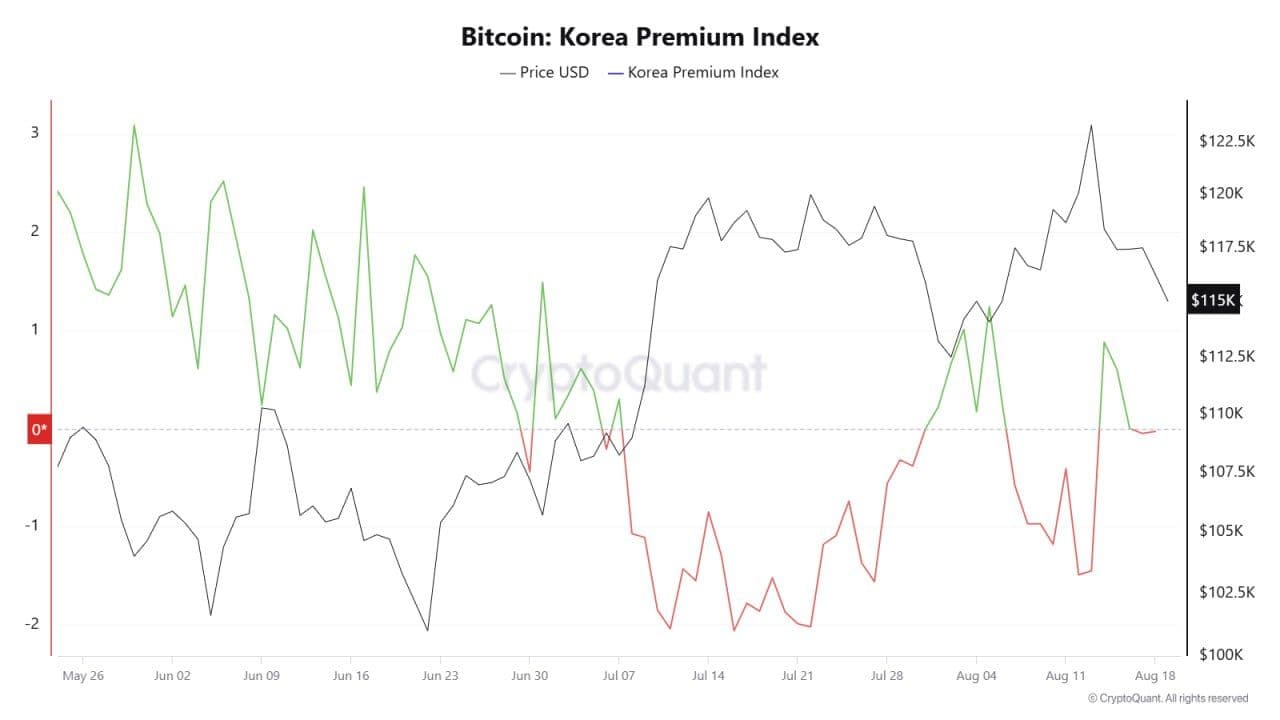

He added that the regulator’s actual concern could also be market-structure distortions, such because the unfavourable kimchi premium, fairly than the service itself.

Park stated that transparency gaps additionally complicate oversight: Bithumb discloses the size of its lending exercise, however Upbit, the nation’s largest change, doesn’t. That opacity might make it more durable for regulators to guage systemic dangers and could also be a key issue behind the blanket suspension.

“Till these structural points are addressed, reopening could take time; precedence ought to be understanding the mechanism and adopting a data-driven design, fairly than blanket restrictions,” he concluded.

Learn extra: Crypto for Advisors: Asian Stablecoin Adoption