Key factors:

-

Revenue-taking close to Bitcoin’s vary highs aligns with merchants’ earlier response to new all-time highs.

-

Dip-buying close to key liquidation zones and constant institutional investor demand recommend the sell-pressure gained’t final lengthy.

Bitcoin’s (BTC) abrupt sell-off from its $124,474 all-time excessive appeared like a routine end result at first, particularly contemplating {that a} portion of merchants will all the time take revenue at new highs, and a separate group will select to open shorts on the identical time.

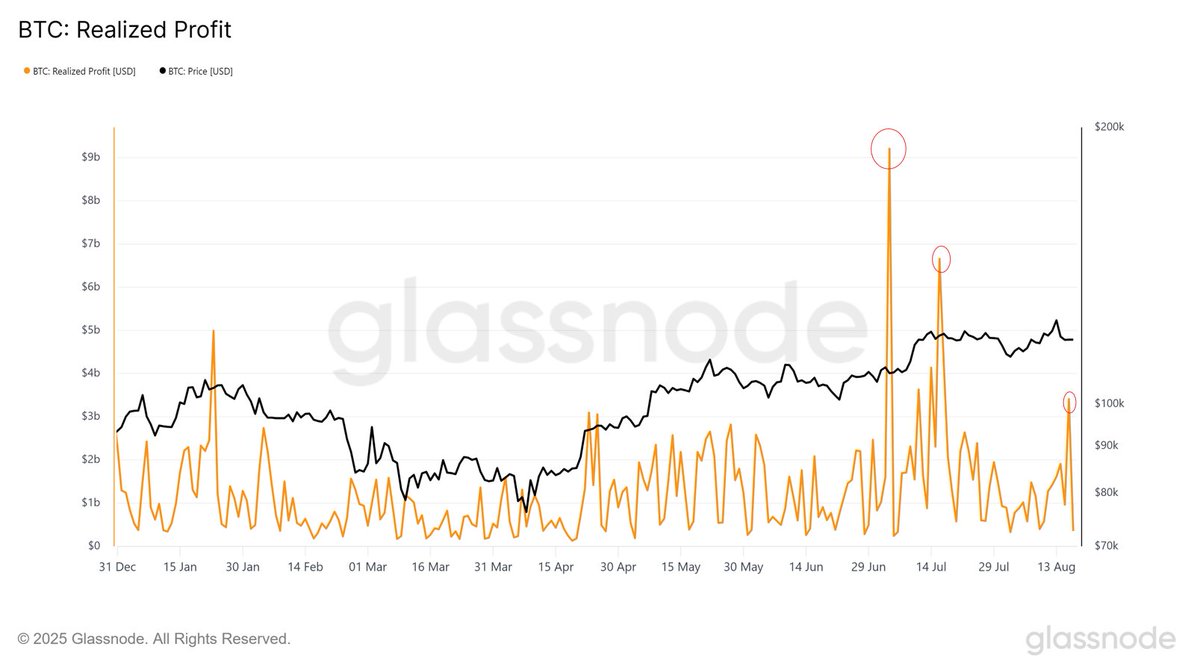

Addressing the current sell-off, Bitwise European Head of Analysis, Andre Dragosch, posted the above chart and mentioned,

“NOTE: Sure – we have now seen elevated profit-taking (by short-term holders) currently. However they’ve turn into smaller over time, too.”

That mentioned, the 6.72% correction under $115,000 is maybe a bit deeper than most anticipated, main some analysts to foretell additional decline to $110,000 and under.

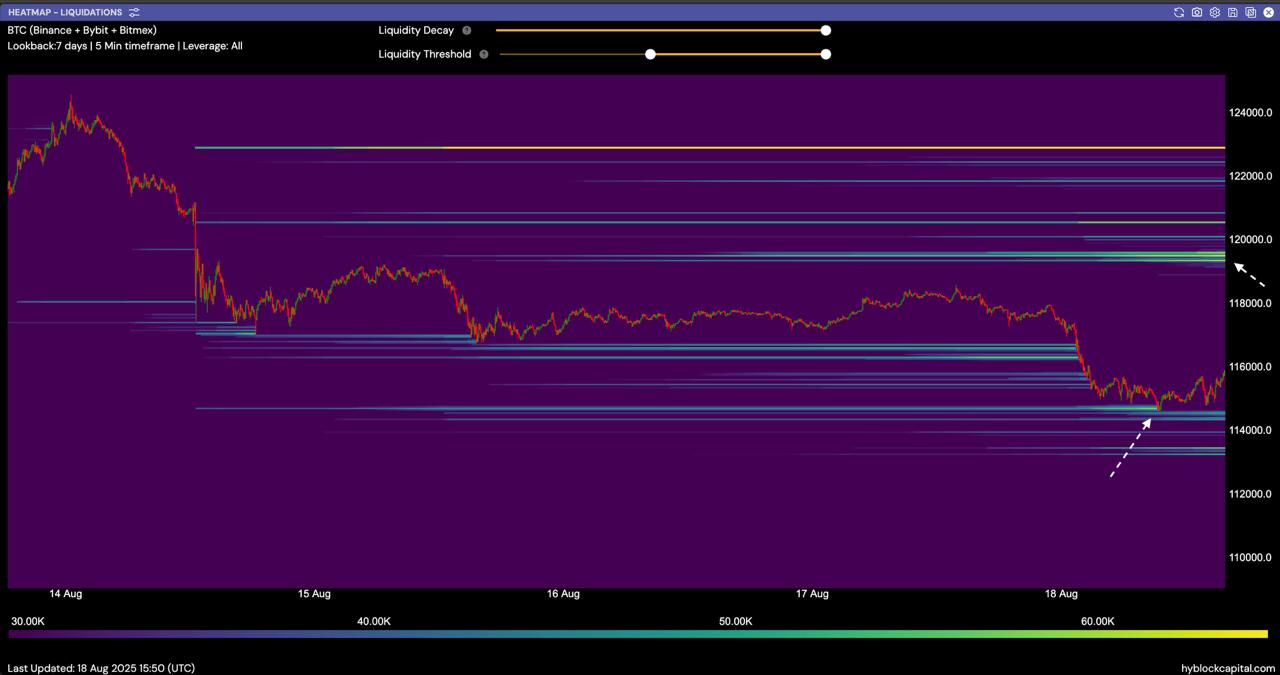

In feedback to Cointelegraph, Hyblock co-founder and CEO Shubh Varma defined that:

“Over the previous week, we’ve seen a transparent sample of liquidity dynamics driving Bitcoin’s weekend value motion. Going into the weekend, liquidity constructed up on the draw back (Picture 1), creating seen swimming pools of potential liquidation targets. Because the weekend wrapped up, that liquidity was swept (Picture 2), reinforcing the recurring theme of skinny weekend markets being extra susceptible to liquidity grabs.”

Varma mentioned that on the identical time that these “liquidity grabs” occurred, “provide began to emerge within the orderbook and onchain.”

“Giant ETH unstaking occasions have added to obtainable provide. But, throughout the weekdays, demand from digital asset treasuries (DATs) has remained robust. A number of establishments introduced main BTC and ETH purchases final week, with demand not solely assembly this provide however far exceeding it, serving to gasoline the upside transfer.”

The catch is Wall Avenue closes store for the weekend, and in line with Varma, “institutional demand appeared to dry up, leaving orderflow imbalances uncovered.”

“We noticed this in each the orderbook and slippage metrics (Picture 3). Liquidity sat under, slippage spiked, and each 1% and a couple of% bid-ask depth flipped bearish. This mixture triggered a cascade that swept the highlighted liquidation zones.”

When requested how Bitcoin fared throughout Monday’s shock drop under $115,000 and whether or not the prospect of extra draw back was excessive, Varma shared the next chart and mentioned,

“Huge quantities of open curiosity opened up round that very same time as the place liquidity was swept. It should function good assist, as a result of each longs and shorts opened there, and shorts are presently trapped.”

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.