Ethereum treasury agency BTCS Inc. will subject a one-time Ether dividend cost and a loyalty cost, totaling $0.40 per share in ETH, to reward shareholders and restrict “predatory short-selling.”

“These funds are designed to reward our long-term shareholders and empower them to take management of their funding by lowering the flexibility of their shares to be lent to predatory short-sellers,” the Bitcoin mining-turned Ethereum agency mentioned on Monday.

BTCS says it could be the primary publicly traded firm to subject a dividend in ETH — a transfer seemingly acquired nicely by buyers as BTCS shares rose 10.4% on the day.

ETH “Bividend” to be paid in September

The ETH dividend — dubbed the “Bividend” — of $0.05 per share shall be paid on Sept. 26, whereas the $0.35 per share “Loyalty Fee” shall be paid in ETH to these holding the shares till Jan. 26, 2026. The loyalty cost shall be supplied to all shareholders besides officers, administrators and workers, the corporate famous.

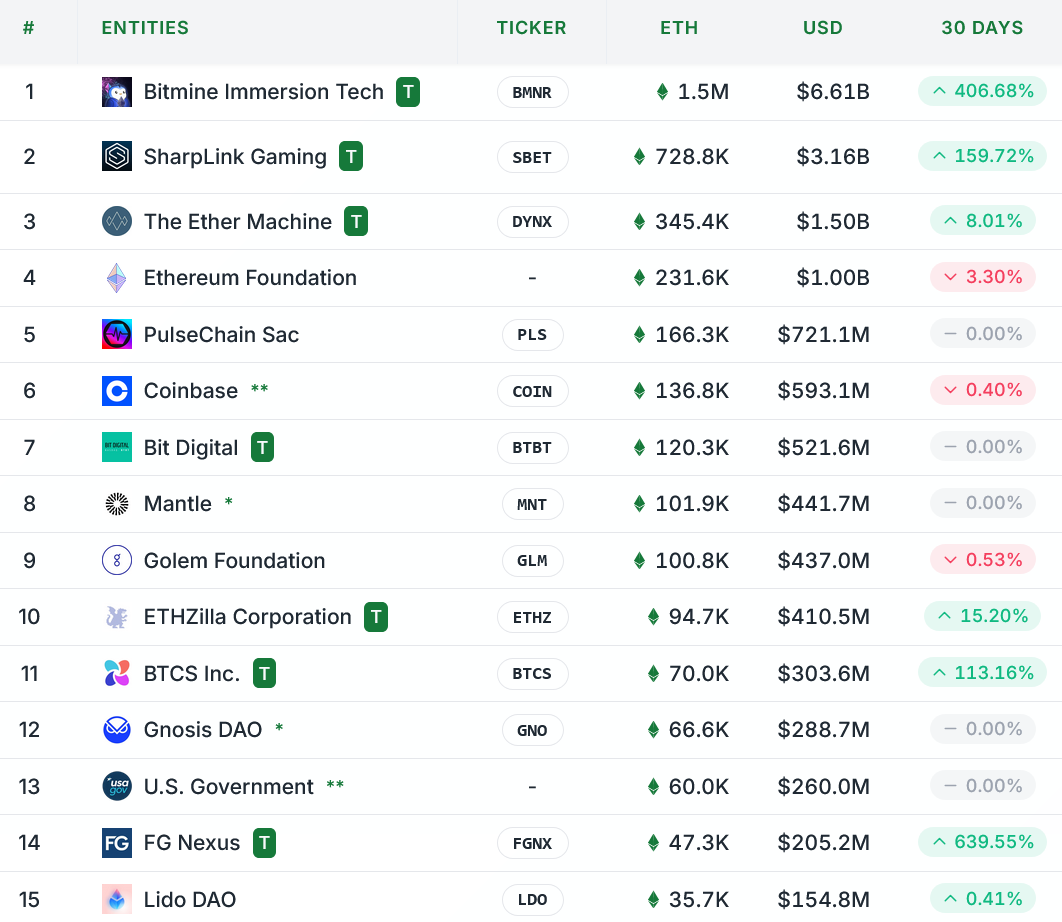

The previous Bitcoin mining agency is seeking to stand out amid a crowded area of 69 ETH treasury entities competing to amass the most important ETH holdings.

Ether treasury companies have been a key catalyst behind Ether’s value rally from round $1,465 to $4,775 over the previous 4 months.

BTCS eyes prime 10 in ETH treasury race

Bitmine Immersion Tech and SharpLink Gaming lead the race, with 1.5 million ETH and 728,800 ETH, respectively, whereas BTCS sits eleventh at 70,000 ETH value over $303 million, StrategicETHReserve knowledge exhibits.

BTCS has been leveraging decentralized finance — comparable to borrowing on Aave — and staking since at the very least 2022, however solely began aggressively accumulating ETH over the previous couple of months.

Associated: Ether ETFs smash information as crypto merchandise see $3.75B inflows

It has funded purchases by at-the-market fairness choices and issuing convertible notes, much like methods adopted by its rivals.

BTCS partially recovers after tumbling from July excessive

BTCS shares rose 10.4% on the information to $4.87 on Monday, clawing again some misplaced floor since reaching a 2025 excessive of $6.57 on July 18, Google Finance knowledge exhibits.

The Nasdaq-listed agency now boasts a market cap of $233 million.

Journal: How Ethereum treasury corporations may spark ‘DeFi Summer time 2.0’