Key takeaways:

-

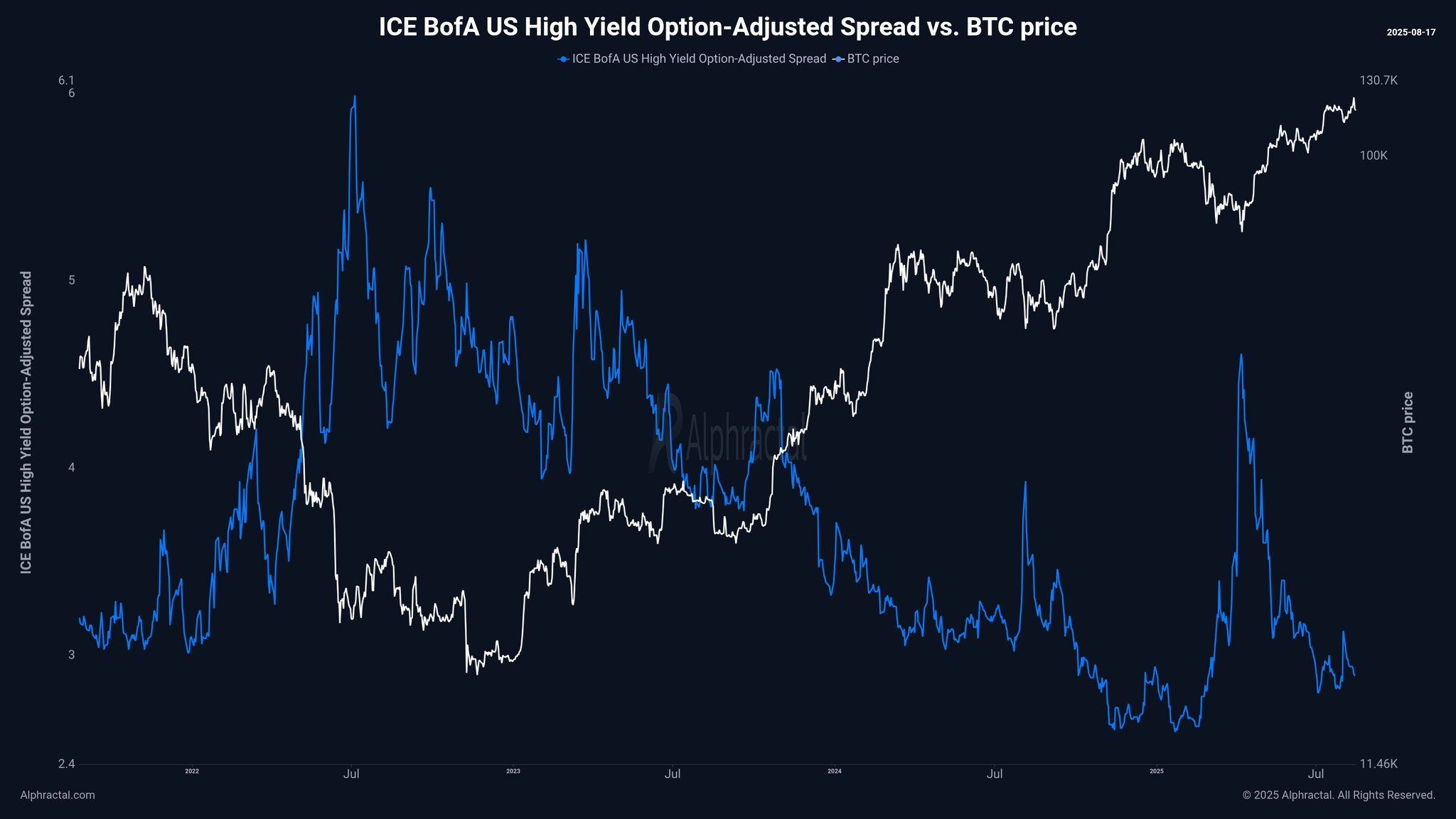

Bond market stress has traditionally aligned with Bitcoin cycle bottoms and will sign new purchase alternatives.

-

US debt surpassing $37 trillion and elevated 10-year yields level to macroeconomic pressures which will favor Bitcoin in This autumn.

A shopping for alternative in Bitcoin (BTC) might emerge earlier than a powerful rally in This autumn, and the bond markets might play a key function.

In response to Alphractal founder Joao Wedson, some of the dependable indicators to look at is the ICE BofA Choice-Adjusted Unfold (OAS). This measures the additional yield buyers demand to carry dangerous company bonds over protected US Treasurys. When OAS spikes, it indicators concern in credit score markets. Traditionally, these stress factors have usually marked native bottoms for Bitcoin.

Presently, OAS stays comparatively calm, suggesting markets haven’t totally priced within the subsequent wave of stress. But when credit score spreads widen within the coming quarter, a typical end result when liquidity tightens, it might set the stage for one more Bitcoin accumulation section.

The broader macro backdrop reinforces this view. The US nationwide debt has surged previous $37 trillion, requiring greater than $2.6 billion in every day curiosity funds. A latest US credit score downgrade displays concern over this fiscal path. In the meantime, the 10-year Treasury yield is at 4.3%, up from 3.9% a yr in the past, elevating borrowing prices throughout the economic system.

Wedson believes this mix of fiscal stress and rising yields might ultimately shake conventional markets, with Bitcoin benefiting instead asset. “An aggressive bear market will occur ultimately,” Wedson mentioned. “However earlier than it happens, euphoria is the most definitely situation. I consider a lot of 2026 and onward can be very dangerous for the US economic system.”

Associated: Bitcoin worth rising wedge breakdown: How low can BTC go?

Technique buys $54 million in Bitcoin, however whales trace at deeper dips

Institutional demand for Bitcoin stays regular, highlighted by Technique’s newest buy on Aug. 17. The agency acquired 430 BTC for about $51.4 million at a mean worth of $119,666 per coin. This brings its complete holdings to 629,376 BTC.

Nonetheless, onchain information factors to rising promoting stress amongst Bitcoin’s largest holders. Cointelegraph reported that the variety of mega whale addresses holding over 10,000 BTC has dropped to its lowest stage in 2025, with a constant adverse 30-day pattern since mid-July. Equally, whale wallets within the 1,000–10,000 BTC vary have declined, suggesting profit-taking after latest highs.

Including to market volatility, practically 32,000 dormant BTC (3–5 years previous), value about $3.78 billion, was moved in a single switch, the most important shift from this age band in over a yr.

📊MARKET UPDATE: Practically 32K dormant BTC (3–5y previous) value ~$3.78B was moved, the most important switch from this age band in over a yr. 👀

(h/t: @JA_Maartun) pic.twitter.com/DfQLabFRKR

— Cointelegraph Markets & Analysis (@CointelegraphMT) August 17, 2025

Collectively, these indicators counsel that whereas institutional patrons proceed to build up, broader whale exercise and revived dormant provide might gas short-term corrections, retaining volatility elevated.

Associated: Dip patrons ‘stopped the practice,’ 5 issues to know in Bitcoin this week

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.