In a pointy reversal from final week’s euphoric report highs and $300,000 bitcoin value targets, a few of crypto’s most adopted merchants at the moment are warning of looming draw back dangers for each bitcoin

and ether (ETH).

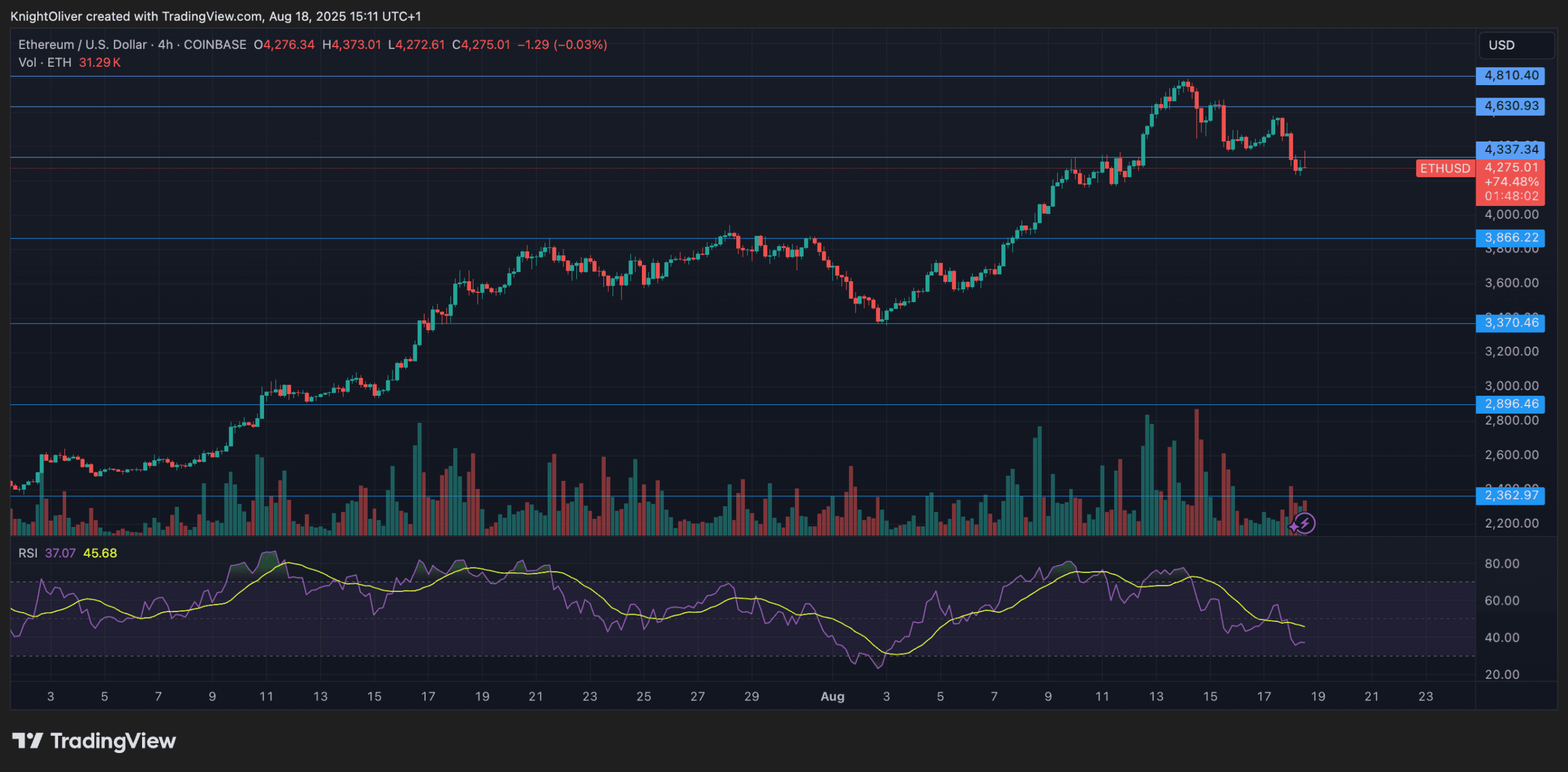

Bitcoin is at the moment buying and selling at $115,000, down almost 3% in a single day, however comparatively comfy inside its current $112,000 to $124,000 vary. ETH, in the meantime, is down by 5% over the previous 24 hours at $4,317, although nonetheless 21% from a month earlier.

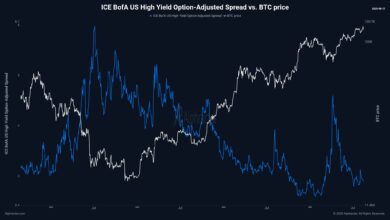

Among the many potential causes for Monday’s decline are jitters across the Federal Reserve’s potential price reduce in September, which might profit danger belongings liks crypto.

Whereas price markets proceed to level to a excessive chance of a Fed reduce subsequent month, the percentages per CME FedWatch have slipped to 83% from almost 100% at one level final week.

Andrew Kang, co-founder of Mechanism Capital, was one of many loudest voices predicting crypto draw back on Monday, suggesting ETH may very well be observing billions in liquidations as leveraged positions unwind.

“Would estimate we’re about to hit $5 billion in ETH liquidations throughout exchanges,” Kang posted on X.

He forecast a potential slide in ether’s value to between $3,200 and $3,600, warning the market was “not prepared to search out out what occurs when that purchasing dissipates.” His feedback observe the launch of ETH DATs (Deposit Entry Tokens), which drove short-term demand however could now face a vacuum of momentum.

The bearish tone comes towards the backdrop of a record-breaking validator exit queue, with 885,000 ETH ($3.8 billion) awaiting withdrawal from Ethereum’s staking mechanism, as CoinDesk reported final week.

A lot of the motion displays profit-taking, the unwinding of dangerous leveraged staking methods, and preparations for the launch of potential ETH staking ETFs. Massive liquid staking gamers like Lido have seen lots of of hundreds of ETH withdrawn, including to market jitters about potential compelled liquidations.

Pseudonymous dealer Flood additionally grew to become more and more vocal in regards to the draw back danger on Monday, telling followers: “Again to $2k you go Ethereum, the place you belong.”

The feedback replicate a stark shift in sentiment, demonstrating the delicate psychology that drives crypto markets the place bullish and bearish narratives can shortly unravel.

For astute merchants, nonetheless, the shift in sentiment may be seen as alternative; as Wall Avenue veteran Warren Buffett as soon as mentioned: “Purchase when there’s blood within the streets, even when the blood is your personal.”