South Korea is reportedly making ready to introduce a regulatory framework for a won-backed stablecoin, with its monetary regulator set to introduce a authorities invoice in October.

On Monday, South Korean information portal MoneyToday reported that the Monetary Companies Fee (FSC) will unveil a invoice as a part of the second section of the nation’s Digital Asset Person Safety Act.

Democratic Occasion of Korea (DPK) Consultant Park Min-kyu mentioned throughout a coverage debate that he acquired a briefing from the FSC on the coverage course on stablecoins. “The federal government invoice is anticipated to be submitted to the Nationwide Meeting round October,” Park mentioned.

The invoice is anticipated to stipulate necessities for issuance, collateral administration and inner management programs for stablecoins. The FSC has been engaged on the framework since 2023 by its digital asset committee, aiming to set clearer guidelines for crypto service suppliers within the nation.

Lowering reliance on dollar-pegged stablecoins

With the US ramping up its efforts on stablecoin laws, South Korea is taking part in catch-up.

Cash In the present day mentioned that institutionalizing won-pegged stablecoins gained traction since President Lee Jae-myung pledged it throughout his marketing campaign.

A number of lawmakers have since submitted associated proposals, together with the Digital Asset Primary Act from Consultant Min Byung-deok of the Democratic Occasion, the Act on the Issuance and Circulation of Worth-Steady Digital Property from Rep. Ahn Do-gul of the Planning and Finance Committee and the Act on Fee Innovation Utilizing Worth-Pegged Digital Property from Rep. Kim Eun-hye of the Individuals Energy Occasion.

The report additionally mentioned that native trade stakeholders have referred to as for the pressing have to introduce a won-pegged stablecoin to cut back reliance on dollar-based stablecoin tokens.

In June, main South Korean banks teamed as much as work on a won-pegged stablecoin to guard the forex towards the rising greenback dominance. The banks mentioned the upcoming token is ready to materialize in late 2025 or early 2026.

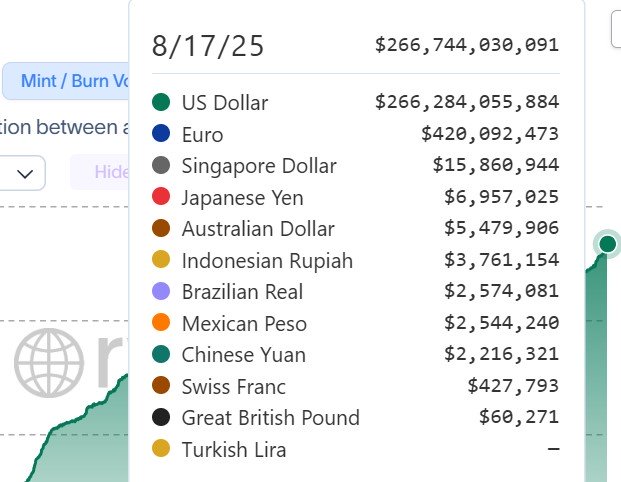

Actual-world asset (RWA) tokenization tracker RWA.xyz reveals that as of Aug. 17, the whole market worth for stablecoins is $266.7 billion. The info reveals that dollar-pegged stablecoins proceed to dominate 99.8% of the market with $266.2 billion.

Associated: Vietnam state-run Army Financial institution companions with Dunamu to launch crypto alternate

South Korea clamps down on tax evaders

Along with clarifying stablecoin guidelines, authorities in South Korea have additionally been clamping down on residents utilizing crypto to keep away from paying taxes.

On Monday, tax officers in Jeju Metropolis, the capital of Jeju Province, began freezing and seizing digital property of customers suspected of dodging tax necessities utilizing crypto.

Authorities began investigating practically 3,000 people in arrears for a complete of about $14.2 million to verify if that they had holdings that could possibly be seized to settle their tax balances.

Journal: South Koreans dump Tesla for Ethereum treasury BitMine: Asia Categorical