Key takeaways

-

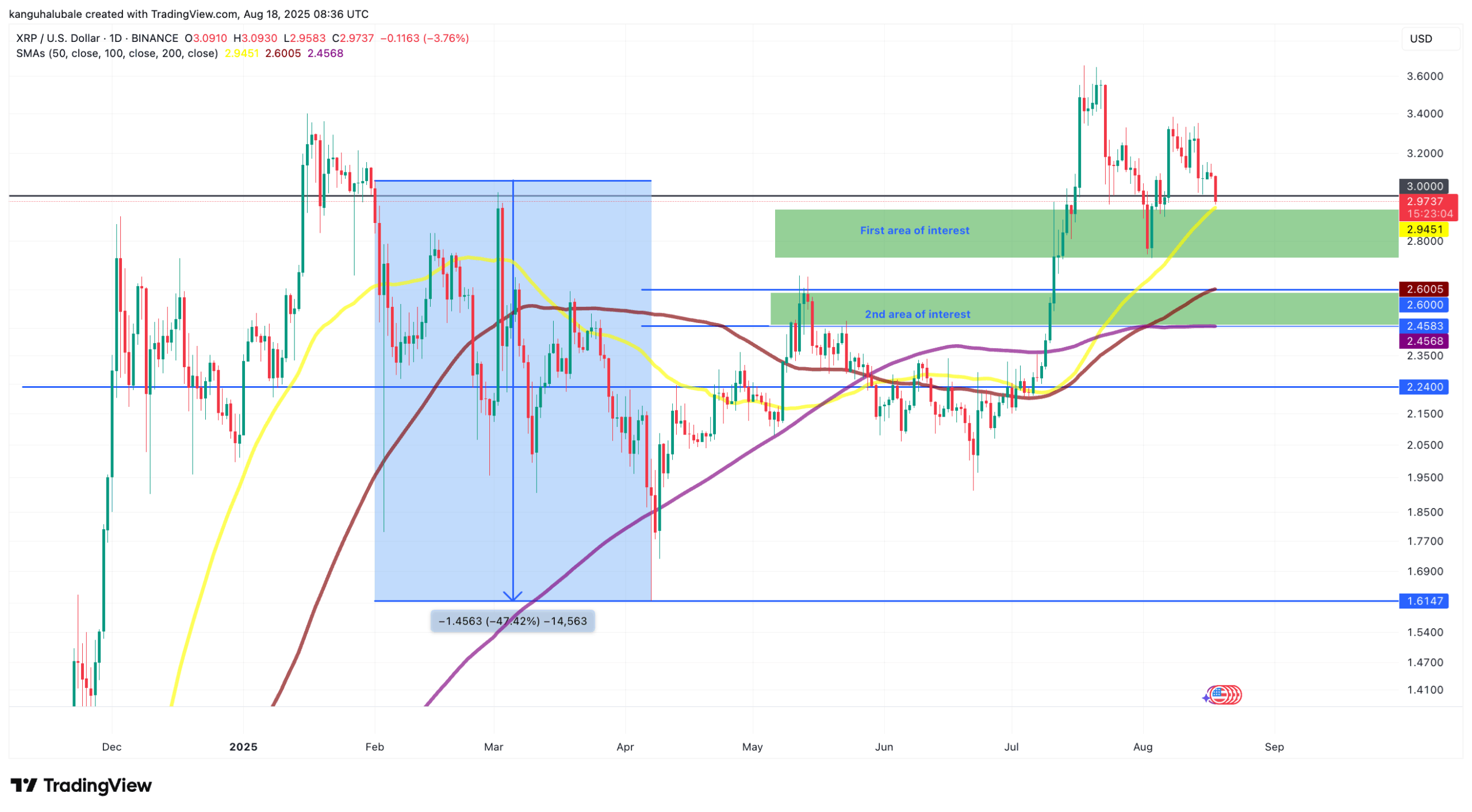

XRP worth should reclaim $3 help to keep away from a deeper correction to $2.24.

-

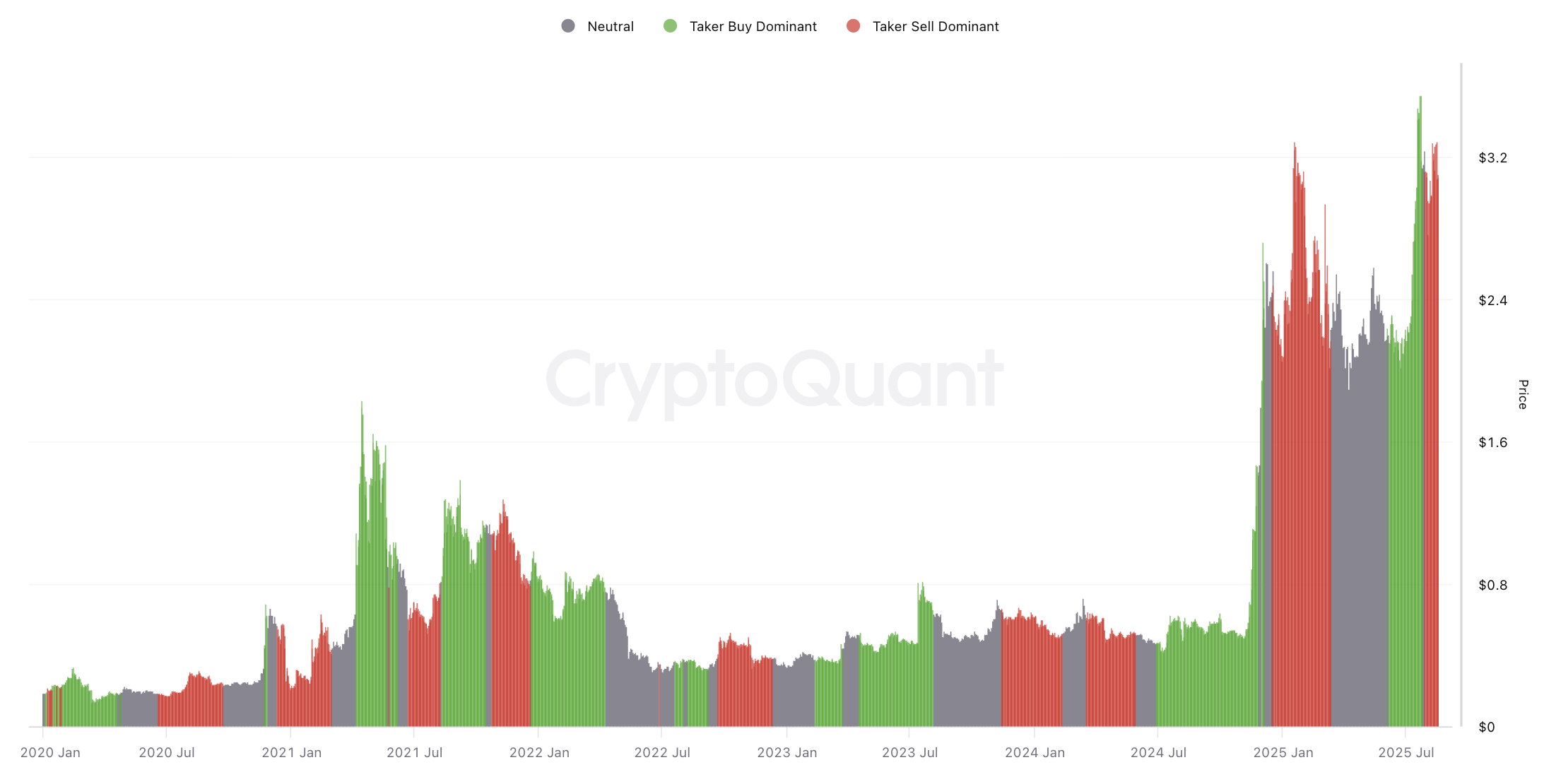

Spot taker CVD stays adverse, suggesting waning demand.

XRP (XRP) confirmed weak point on Monday, down 5% during the last 24 hours, and traded at $2.97. A number of technical and onchain indicators counsel that the second-biggest altcoin should reclaim $3 help to keep away from a deeper correction towards $2.24.

XRP worth bulls should maintain $3

The newest sell-off has seen XRP worth drop beneath the psychological $3 stage.

The final time XRP noticed a excessive quantity shut beneath it was in January, previous a 50% drop to $1.61 in April.

Associated: XRP futures OI jumps 20% as worth charts goal $6 in August

A every day shut beneath $3 might set off an identical drawdown in worth, with the primary space of curiosity between the 50-day easy shifting common at $2.94 and the native low at $2.72 (reached on Aug. 2).

The second space of curiosity sits between the 100-day SMA at $2.60 and the 200-day SMA at $2.45. Shedding this help would carry $2.24 into the image, the place the July rally began.

Information from Cointelegraph Markets Professional and TradingView exhibits XRP buying and selling breaking beneath a symmetrical triangle on the every day candle chart, as proven beneath.

Failure to shut above the triangle’s help line at $3.00 places the worth prone to falling additional to as little as $2.25, or down 25% from the present stage.

The relative power index is headed downward, dropping to 45 from 61 during the last week, suggesting that the bulls have misplaced momentum.

XRP spot taker CVD alerts excessive vendor volumes

Analyzing the 90-day spot taker cumulative quantity delta (CVD) reveals that sell-orders (taker promote) have change into dominant once more. CVD measures the distinction between purchase and promote quantity over a three-month interval.

Since July 28, sell-side strain dominated the order e-book, after the XRP/USD pair hit multi-year highs above $3.66 on July 18.

Adverse CVD (crimson bars within the chart beneath) signifies profit-taking amongst merchants, which alerts waning demand as sellers take management.

If the CVD stays crimson, it means sellers will not be backing down, which might set the stage for an additional leg down, as seen in historic corrections.

As Cointelegraph reported, 94% of the XRP provide is in revenue at present costs, a stage that has traditionally aligned with worth tops.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.